Application For Refund - Cca

Download a blank fillable Application For Refund - Cca in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Application For Refund - Cca with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

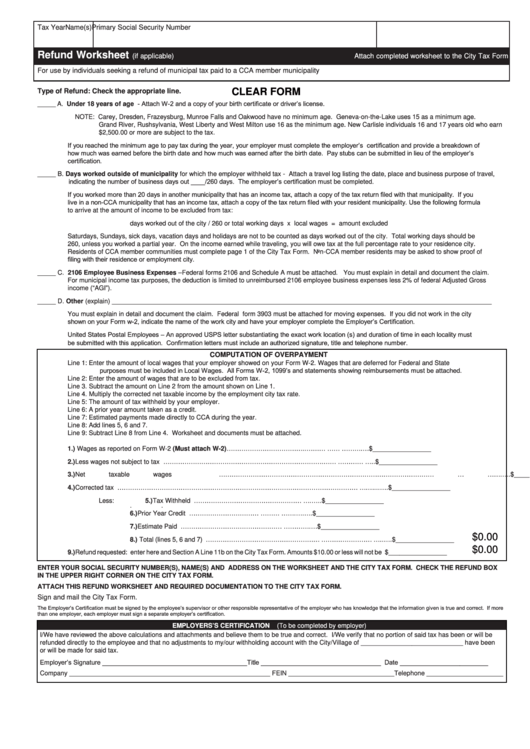

Tax Year

Name(s)

Primary Social Security Number

Refund Worksheet

(if applicable)

Attach completed worksheet to the City Tax Form

For use by individuals seeking a refund of municipal tax paid to a CCA member municipality

CLEAR FORM

Type of Refund: Check the appropriate line.

_____ A. Under 18 years of age

NOTE: Carey, Dresden, Frazeysburg, Munroe Falls and Oakwood have no minimum age. Geneva-on-the-Lake uses 15 as a minimum age.

Grand River, Rushsylvania, West Liberty and West Milton use 16 as the minimum age. New Carlisle individuals 16 and 17 years old who earn

$2,500.00 or more are subject to the tax.

_____ B. Days worked outside of municipality for which the employer withheld tax - Attach a travel log listing the date, place and business purpose of travel,

to arrive at the amount of income to be excluded from tax:

days worked out of the city / 260 or total working days x local wages = amount excluded

Saturdays, Sundays, sick days, vacation days and holidays are not to be counted as days worked out of the city. Total working days should be

260, unless you worked a partial year. On the income earned while traveling, you will owe tax at the full percentage rate to your residence city.

Residents of CCA member communities must complete page 1 of the City Tax Form. Non-CCA member residents may be asked to show proof of

_____ C. 2106 Employee Business Expenses –Federal forms 2106 and Schedule A must be attached. You must explain in detail and document the claim.

For municipal income tax purposes, the deduction is limited to unreimbursed 2106 employee business expenses less 2% of federal Adjusted Gross

income (“AGI”).

_____ D. Other (explain) ________________________________________________________________________________________________________

You must explain in detail and document the claim. Federal form 3903 must be attached for moving expenses. If you did not work in the city

COMPUTATION OF OVERPAYMENT

Line 1:

Enter the amount of local wages that your employer showed on your Form W-2. Wages that are deferred for Federal and State

Line 2:

Enter the amount of wages that are to be excluded from tax.

Line 3.

Subtract the amount on Line 2 from the amount shown on Line 1.

Line 4.

Multiply the corrected net taxable income by the employment city tax rate.

Line 5:

The amount of tax withheld by your employer.

Line 6:

A prior year amount taken as a credit.

Line 7:

Estimated payments made directly to CCA during the year.

Line 8:

Add lines 5, 6 and 7.

Line 9:

Subtract Line 8 from Line 4. Worksheet and documents must be attached.

1.)

Wages as reported on Form W-2 (Must attach W-2) ………………………………..……….............……............……….…$________________

2.)

Less wages not subject to tax ………………………………………………………………….……........…………............…..$________________

3.)

Net taxable wages ………………………………………………………………………………………….....….............…….….$________________

4.)

Corrected tax ……………………………………………………………………………………………………............….…...….$________________

Less:

5.) Tax Withheld ……………………………………………........................................................................….…..$________________

..

6.) Prior Year Credit ……………………………............................................................……….........…….….….$________________

7.) Estimate Paid …………………………………………................................................................………….…$________________

$0.00

8.) Total (lines 5, 6 and 7) ……………………………………………….............……………………............…..….$________________

$0.00

9.)

Refund requested: enter here and Section A Line 11b on the City Tax Form. Amounts $10.00 or less will not be refunded....$________________

ENTER YOUR SOCIAL SECURITY NUMBER(S), NAME(S) AND ADDRESS ON THE WORKSHEET AND THE CITY TAX FORM. CHECK THE REFUND BOX

IN THE UPPER RIGHT CORNER ON THE CITY TAX FORM.

ATTACH THIS REFUND WORKSHEET AND REQUIRED DOCUMENTATION TO THE CITY TAX FORM.

Sign and mail the City Tax Form.

than

EMPLOYERS’S CERTIFICATION

(To be completed by employer)

I/We have reviewed the above calculations and attachments and believe them to be true and correct. I/We verify that no portion of said tax has been or will be

refunded directly to the employee and that no adjustments to my/our withholding account with the City/Village of ____________________________ have been

or will be made for said tax.

Company _______________________________________________________ FEIN _____________________________Telephone _____________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1