Ffel Consolidation Loan Rebate Fee Report And Remittance Form Page 3

ADVERTISEMENT

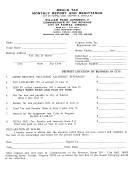

5. Number of Loans: Enter the number of loans subject to the 1.05% fee used to calculate the

Consolidation Loan Rebate Fee. To determine this number, review all Federal Consolidation Loans held by

you at the end of the month and identify the loans that were disbursed on or after October 1, 1993, except for

loans based on applications received during the period from October 1, 1998 through January 31, 1999,

inclusive which are subject to the 0.62% fee. Include a loan even if you were not the originating lender, you

only purchased it at a later date. Include all loans eligible for insurance, even if an insurance claim has been

filed, but not paid, as of close of business on the last day of the month.

6. End-of-Month Principal Balance: Enter the Principal Balance used to determine the Consolidation

Loan Rebate Fee. For all Federal Consolidation Loans meeting the requirements in item 5, Number of Loans,

determine the unpaid principal balance at the end of the day on the last day of the month. Payments received

from borrowers on the last day of the month should be credited prior to determining the unpaid principal

balance. Add the unpaid principal balances for all loans to determine the End-of-Month Principal Balance.

You may round this total to the nearest dollar if desired.

7. End-of-Month Accrued Unpaid Interest Balance: Enter the End-of-Month Accrued Unpaid Interest

Balance used to determine the Consolidation Loan Rebate Fee. For each loan for which an End-of-Month

Principal Balance (see item 6) was determined, determine its accrued unpaid interest balance at the end of the

day on the last day of the month. Payments received from borrowers or ED on the last day of the month

should be credited prior to determining the accrued unpaid interest balance. Add the accrued unpaid interest

balances for all loans to determine the End-of-Month Accrued Unpaid Interest Balance. You may round this

total to the nearest dollar if desired.

(Items 8 through 11 – Repeat the instructions for Items 4 through 7, as they apply to Consolidation loans

based on applications received during the period from October 1, 1998 through January 31,1999, inclusive,

which are subject to the 0.62% fee.)

12. Consolidation Loan Rebate Fee: Enter the amount of the Federal Consolidation Loan Interest

Payment Rebate Fee being paid at the time this report is submitted. To determine the amount of the Fee for

the month, add the End-of-Month Principal Balance (see item 6) to the End-of-Month Accrued Interest

Balance (see item 7). Multiply this sum by 0.0875 percent (that is, .0008750). To this amount, add the End-

of-Month Principal Balance (see item 10) to the End-of-Month Accrued Interest Balance (see item 11) and

then multiplied by .05167 percent (that is, .0005167). Round the resulting product to the nearest dollar if

desired. Prepare a check for this amount made out to the "U.S. Department of Education," and with the

notation "Consolidation Loan Rebate Fee." (Refer to the "Where to Submit" paragraph at the beginning of the

second page of this form for mailing instructions.) Please make sure that the amount reported in this item is

the same as the amount of the check being submitted.

13. Lender’s Check Number: Enter the number of your check.

14. Lender Name: Enter the name of the lender that holds the Federal Consolidation Loans reported in

the Consolidation Loan Rebate Fee Report.

15. Signature: Read the certification statement and sign the form in ink. Forms signed with signature

stamps and unsigned forms will be returned for a valid signature.

16. Date: Enter the date the form is signed.

17. Typed Name & Title: Type or print (do not write) the name and title of the official signing the form.

18. Contact Name & Phone #: Print the name and the telephone number (including area code) of the

person who can answer questions from ED about the holder's Federal Consolidation Loan portfolio and about

this Consolidation Loan Rebate Fee Report. This person may be a representative of the servicer, or

representative of the lending institution holding the loans.

Reporting Burden: According to the Paperwork Reduction Act of 1995, no persons are required to respond to a collection of information

unless such collection displays a valid OMB control number. The valid OMB control number for this information collection is 1845-xxxx.

The time required to complete this information collection is estimated to average 1 hour per response, including the time to review

instructions, search existing data resources, gather the data needed, and complete and review the information collection. If you have any

comments concerning the accuracy of the time estimate(s) or suggestions for improving this form, please write to: U.S. Department

of Education, Washington, D.C. 20202-4651. If you have comments or concerns regarding the status of your individual submission of

Floor – Lender Reporting, Washington, D.C. 20202.

th

this form, write directly to U.S. Dept. of Education, 830 First Street, N.E., 5

Warning: Although the law does not explicitly state that this information be reported, such reporting is necessary to implement the required

monthly payments of the Consolidation Loan Rebate Fee (CLRF). Failure to report would be the basis for the initiation of an action to limit, suspend

or terminate the lender's participation in the Federal Family Education Loan Programs pursuant to 20 U.S.C. Sections 1080, 1082, 1085 and 1094.

3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4