Table C Life Insurance Policy Comparison Chart - Life Health Page 2

ADVERTISEMENT

INTRODUCTION TO LIFE INSURANCE

ChApTER 1

Figure 1.3 (cont’d)

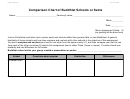

Table C

LIFE INSURANCE POLICY COMPARISON CHART

PARTIAL

DIRECT

ADVANTAGES

DISADVANTAGES

SURRENDERS

POLICY

BORROWING

TO

TO

RISKS

PERMITTED?

ELEMENTS

RECOGNITION

BUYER

BUYER

TO BUYER

N/A

Bundled.

N/A

Low outlay for

Increasing

Increasing premium.

large face amounts;

outlay; buyer may

Failure to earn more

develop outside

not invest differ-

aftertax on investments

investment

ence or may realize

than insurer.

program.

lower return.

Yes, but

Bundled.

Yes, with many

Familiar product;

Costly if lapsed

Failure to meet premium

through paid

policies.

predictable; helps

early.

commitment.

up additions

buyer discipline;

only.

share in favorable

interest, mortality

and expense

experience.

Yes.

Unbundled.

Yes.

Take advantage of

Premiums can be

If assumptions change

high current interest

higher or cash

adversely, premiums can

rates and improved

value lower than

be higher or cash value

mortality.

projected; policy

can be lower than with

can lose paid-up

traditional products.

status.

No.

Bundled, but

No.

Take advantage of

Must decide on

Investment risk is great.

to some degree

growth in economy.

underlying invest-

Typically higher expenses

shown in

ments and monitor

than traditional products.

prospectus.

them for change;

few guarantees.

Yes.

Bundled.

Yes.

Flexibility to adjust

If needs are known

Changes made by buyer

to changing needs;

and not likely to

to satisfy short-term

only one policy

change, other

needs may have an

needed.

products may be

impact on the satisfac-

less costly per unit

tion of long-term goals.

of protection.

Yes.

Unbundled.

Yes.

Greater transparency

Flexibility places

Adverse change in

and more flexibility

greater responsibil-

assumptions can affect

than Adj. Life.

ity on buyer; buyer

satisfaction of long-term

assumes greater

goals and drop cash

investment and

value below that of

mortality risks.

ordinary life.

Yes.

Unbundled.

No.

Epitome of flexibility

Equity performance

Combined risks of

in all respects.

unpredictable; rela-

universal and variable

tively high expenses;

life products.

few guarantees.

Yes.

Partially

Yes,

Cannot outlive

Expenses can be

Under life options, pay-

unbundled.

if permitted.

benefits if life

higher than alter-

outs cease at death: if

option elected.

native investments.

death occurs early, total

benefits less than with

alternative investments.

15

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2