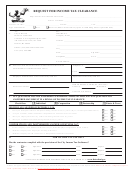

Request For Income Tax Withholding - Arlingtonva Page 2

ADVERTISEMENT

Completing Part B. Federal Income Tax Withholding

For detailed information about federal income tax withholding, refer to the Internal Revenue Service (IRS) web site at

to review the IRS Form W-4P. The “Personal Allowances Worksheet” from the W-4P is provided below for

calculating exemptions for federal income tax purposes. Review the IRS Form W-4P for additional information about other

worksheets that might apply.

A

Enter “1” for yourself if no one else can claim you as a dependent.

A_______

B

Enter “1” if: a) You are single and have only one pension; or

B_______

b) You are married, have only one pension and your spouse has no income subject to

withholding; or

c) Your income from a second pension or a job, or your spouse’s pension or wages (or the

total of all), is $1,000 or less.

C

Enter “1” for your spouse. But, you may choose to enter “0” if you are married and have either a

C_______

spouse who has income subject to withholding or you have more than one source of income subject to

withholding. (Entering “0” may help you avoid having too little tax withheld.)

D

Enter the number of dependents (other than your spouse or yourself) you will claim on your tax return.

D_______

E

Enter “1” if you will file as head of household on your tax return.

E_______

F

Child Tax Credit (including additional child tax credit): If your total income will be less than $52,000

F_______

($77,000 if married), enter “2” for each eligible child. If your total income will be between $52,000 and

$84,000 ($77,000 and $119,000 if married), enter “1” for each eligible child, plus “1” additional if you

have for or more eligible children.

G

Add lines A through F for total Personal Exemptions. Enter this number in Part B if you choose to have

G_______

federal income tax withheld. Note: This may be different than the number of exemptions you claim on

your tax return.

Completing Part C. State Income Tax Withholding

For detailed information about state income tax withholding, refer to the Virginia Department of Taxation web site at

to review the Virginia Form VA-4P. The “Personal Exemption Worksheet” from the VA-4P is provided

below for calculating exemptions for state income tax purposes.

Calculate Personal Exemptions

1

Enter “1” for yourself.

1_______

2

If you are married and your spouse is not claimed on his or her own certificate, enter “1”.

2_______

3

Enter the number of dependents you will claim on your state income tax return. (Do not include your

3_______

spouse.)

4

Add lines 1, 2, and 3 for total Personal Exemptions. Enter this number in Part C if you choose to have

4_______

state income tax withheld.

Calculate Exemptions for Age and Blindness

5

Age:

a) If you will be 65 or older on January 1, enter “1”.

5a_______

b) If you claimed an exemption on line 2 above and your spouse will be 65 or older on

5b_______

January 1, enter“1”.

6

Blindness: a) If you are legally blind, enter “1”.

6a_______

b) If you claimed an exemption on line 2 above and your spouse is legally blind, enter “1”.

6b_______

7

Add lines 5a through 6b for total Age and Blindness Exemptions. Enter this number in Part C if you

7________

choose to have state income tax withheld.

C:\Documents and Settings\bgrowd\Local Settings\Temporary Internet Files\OLK11F\Form - REQUEST FOR INCOME TAX WITHHOLDING.doc

Rev. 05/09

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2