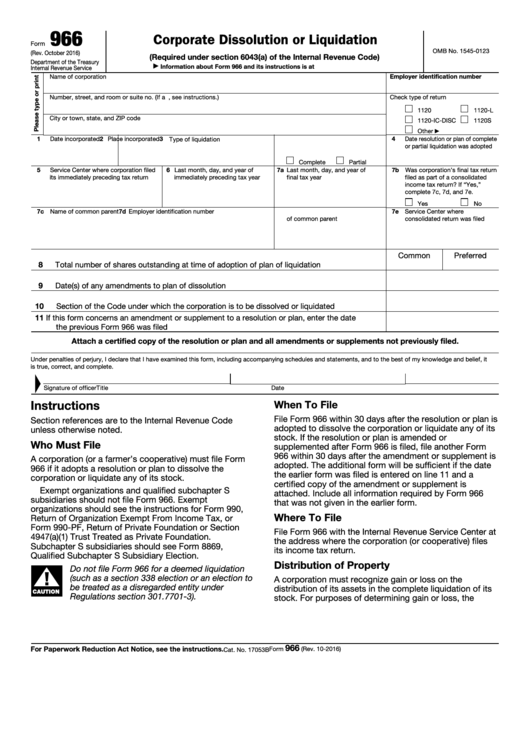

966

Corporate Dissolution or Liquidation

Form

OMB No. 1545-0123

(Rev. October 2016)

(Required under section 6043(a) of the Internal Revenue Code)

Department of the Treasury

Information about Form 966 and its instructions is at

▶

Internal Revenue Service

Name of corporation

Employer identification number

Number, street, and room or suite no. (If a P.O. box number, see instructions.)

Check type of return

1120

1120-L

City or town, state, and ZIP code

1120-IC-DISC

1120S

Other

▶

1

Date incorporated

2 Place incorporated

3 Type of liquidation

4

Date resolution or plan of complete

or partial liquidation was adopted

Complete

Partial

5

Service Center where corporation filed

6 Last month, day, and year of

7a Last month, day, and year of

7b Was corporation’s final tax return

its immediately preceding tax return

immediately preceding tax year

final tax year

filed as part of a consolidated

income tax return? If “Yes,”

complete 7c, 7d, and 7e.

Yes

No

7c Name of common parent

7d Employer identification number

7e Service Center where

of common parent

consolidated return was filed

Common

Preferred

8

Total number of shares outstanding at time of adoption of plan of liquidation

.

.

.

.

.

9

Date(s) of any amendments to plan of dissolution

.

.

.

.

.

.

.

.

.

.

.

.

.

.

10

Section of the Code under which the corporation is to be dissolved or liquidated . . . . .

11

If this form concerns an amendment or supplement to a resolution or plan, enter the date

the previous Form 966 was filed

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Attach a certified copy of the resolution or plan and all amendments or supplements not previously filed.

Under penalties of perjury, I declare that I have examined this form, including accompanying schedules and statements, and to the best of my knowledge and belief, it

is true, correct, and complete.

Signature of officer

Title

Date

Instructions

When To File

File Form 966 within 30 days after the resolution or plan is

Section references are to the Internal Revenue Code

adopted to dissolve the corporation or liquidate any of its

unless otherwise noted.

stock. If the resolution or plan is amended or

Who Must File

supplemented after Form 966 is filed, file another Form

966 within 30 days after the amendment or supplement is

A corporation (or a farmer’s cooperative) must file Form

adopted. The additional form will be sufficient if the date

966 if it adopts a resolution or plan to dissolve the

the earlier form was filed is entered on line 11 and a

corporation or liquidate any of its stock.

certified copy of the amendment or supplement is

Exempt organizations and qualified subchapter S

attached. Include all information required by Form 966

subsidiaries should not file Form 966. Exempt

that was not given in the earlier form.

organizations should see the instructions for Form 990,

Where To File

Return of Organization Exempt From Income Tax, or

Form 990-PF, Return of Private Foundation or Section

File Form 966 with the Internal Revenue Service Center at

4947(a)(1) Trust Treated as Private Foundation.

the address where the corporation (or cooperative) files

Subchapter S subsidiaries should see Form 8869,

its income tax return.

Qualified Subchapter S Subsidiary Election.

Distribution of Property

Do not file Form 966 for a deemed liquidation

▲

!

(such as a section 338 election or an election to

A corporation must recognize gain or loss on the

be treated as a disregarded entity under

distribution of its assets in the complete liquidation of its

CAUTION

Regulations section 301.7701-3).

stock. For purposes of determining gain or loss, the

966

For Paperwork Reduction Act Notice, see the instructions.

Form

(Rev. 10-2016)

Cat. No. 17053B

1

1 2

2