Information About Form 1099-R - Trs - 2016

ADVERTISEMENT

Are you a retiree, beneficiary or a former member who received payments from TRS in 2016, such as annuity

payments, death benefits, or a refund? If so, TRS will begin mailing 1099R forms for tax year 2016 in January

2017.

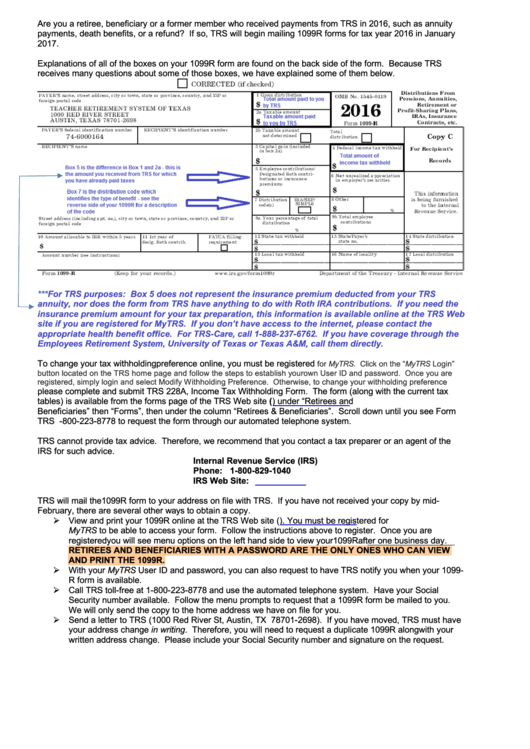

Explanations of all of the boxes on your 1099R form are found on the back side of the form. Because TRS

receives many questions about some of those boxes, we have explained some of them below.

***For TRS purposes: Box 5 does not represent the insurance premium deducted from your TRS

annuity, nor does the form from TRS have anything to do with Roth IRA contributions. If you need the

insurance premium amount for your tax preparation, this information is available online at the TRS Web

site if you are registered for MyTRS. If you don’t have access to the internet, please contact the

appropriate health benefit office. For TRS-Care, call 1-888-237-6762. If you have coverage through the

Employees Retirement System, University of Texas or Texas A&M, call them directly.

To change your tax withholding preference online, you must be registered

for MyTRS. Click on the “MyTRS Login”

button located on the TRS home page and follow the steps to establish your own User ID and password. Once you are

registered, simply login and select Modify Withholding Preference. Otherwise, to change your withholding preference

please complete and submit TRS 228A, Income Tax Withholding Form. The form (along with the current tax

tables) is available from the forms page of the TRS Web site ( ) under “Retirees and

Beneficiaries” then “Forms”, then under the column “Retirees & Beneficiaries”. Scroll down until you see Form

TRS 228A. You may also call 1-800-223-8778 to request the form through our automated telephone system.

TRS cannot provide tax advice. Therefore, we recommend that you contact a tax preparer or an agent of the

IRS for such advice.

Internal Revenue Service (IRS)

Phone: 1-800-829-1040

IRS Web Site:

TRS will mail the1099R form to your address on file with TRS. If you have not received your copy by mid-

February, there are several other ways to obtain a copy.

View and print your 1099R online at the TRS Web site ( ). You must be registered for

MyTRS to be able to access your form. Follow the instructions above to register. Once you are

registered you will see menu options on the left hand side to view your 1099R after one business day.

RETIREES AND BENEFICIARIES WITH A PASSWORD ARE THE ONLY ONES WHO CAN VIEW

AND PRINT THE 1099R.

With your MyTRS User ID and password, you can also request to have TRS notify you when your 1099-

R form is available.

Call TRS toll-free at 1-800-223-8778 and use the automated telephone system. Have your Social

Security number available. Follow the menu prompts to request that a 1099R form be mailed to you.

We will only send the copy to the home address we have on file for you.

Send a letter to TRS (1000 Red River St, Austin, TX 78701-2698). If you have moved, TRS must have

your address change in writing. Therefore, you will need to request a duplicate 1099R along with your

written address change. Please include your Social Security number and signature on the request.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1