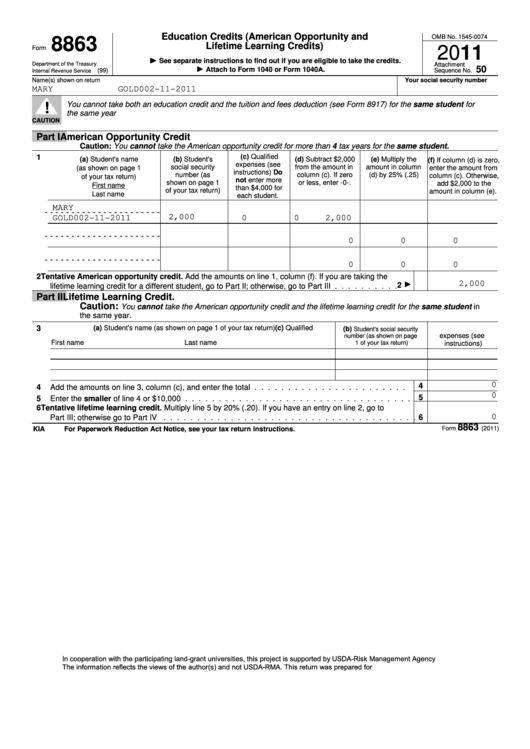

Sample Form 8863 - Education Credits (American Opportunity And Lifetime Learning Credits) - 2011

ADVERTISEMENT

Education Credits (American Opportunity and

OMB No. 1545-0074

8863

Lifetime Learning Credits)

2011

Form

See separate instructions to find out if you are eligible to take the credits.

Department of the Treasury

Attachment

50

Attach to Form 1040 or Form 1040A.

(99)

Sequence No.

Internal Revenue Service

Name(s) shown on return

Your social security number

MARY

GOLD

002-11-2011

You cannot take both an education credit and the tuition and fees deduction (see Form 8917) for the same student for

!

the same year

CAUTION

Part I

American Opportunity Credit

Caution: You cannot take the American opportunity credit for more than 4 tax years for the same student.

(c) Qualified

1

(a) Student's name

(b) Student's

(d) Subtract $2,000

(e) Multiply the

(f) If column (d) is zero,

expenses (see

social security

from the amount in

amount in column

(as shown on page 1

enter the amount from

instructions) Do

number (as

column (c). If zero

(d) by 25% (.25)

column (c). Otherwise,

of your tax return)

not enter more

shown on page 1

or less, enter -0-.

add $2,000 to the

First name

than $4,000 for

of your tax return)

amount in column (e).

Last name

each student.

MARY

- - - - - - - - - - - - - - - - - - - - - -

2,000

GOLD

002-11-2011

0

0

2,000

- - - - - - - - - - - - - - - - - - - - - -

0

0

0

- - - - - - - - - - - - - - - - - - - - - -

0

0

0

2

Tentative American opportunity credit. Add the amounts on line 1, column (f). If you are taking the

2,000

2

lifetime learning credit for a different student, go to Part II; otherwise, go to Part III . . . . . . . . . .

Part II

Lifetime Learning Credit.

Caution:

You cannot take the American opportunity credit and the lifetime learning credit for the same student in

the same year.

(a) Student's name (as shown on page 1 of your tax return)

(c) Qualified

3

(b)

Student's social security

expenses (see

number (as shown on page

First name

Last name

1 of your tax return)

instructions)

0

4

Add the amounts on line 3, column (c), and enter the total

. . . . . . . . . . . . . . . . . . . . . . .

4

0

5

5

Enter the smaller of line 4 or $10,000

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Tentative lifetime learning credit. Multiply line 5 by 20% (.20). If you have an entry on line 2, go to

6

0

Part III; otherwise go to Part IV . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

8863

Form

(2011)

KIA

For Paperwork Reduction Act Notice, see your tax return instructions.

In cooperation with the participating land-grant universities, this project is supported by USDA-Risk Management Agency.

The information reflects the views of the author(s) and not USDA-RMA. This return was prepared for .

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2