Instructions For Form 843

ADVERTISEMENT

Department of the Treasury

Internal Revenue Service

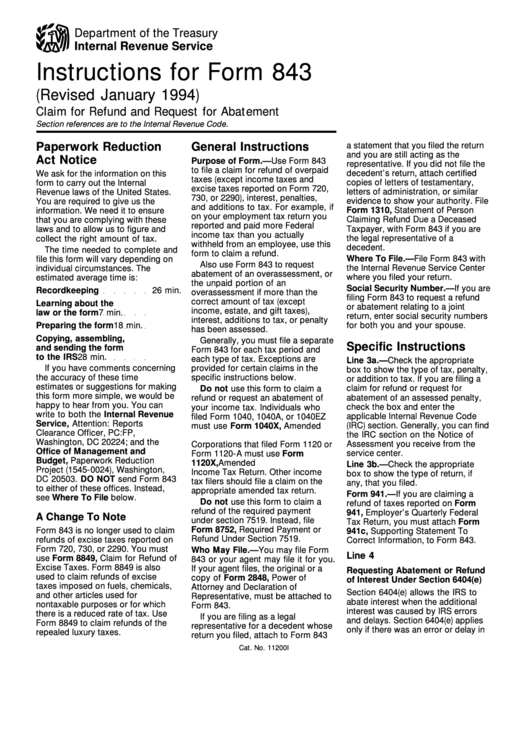

Instructions for Form 843

(Revised January 1994)

Claim for Refund and Request for Abatement

Section references are to the Internal Revenue Code.

Paperwork Reduction

General Instructions

a statement that you filed the return

and you are still acting as the

Act Notice

Purpose of Form.—Use Form 843

representative. If you did not file the

to file a claim for refund of overpaid

decedent’s return, attach certified

We ask for the information on this

taxes (except income taxes and

copies of letters of testamentary,

form to carry out the Internal

excise taxes reported on Form 720,

letters of administration, or similar

Revenue laws of the United States.

730, or 2290), interest, penalties,

You are required to give us the

evidence to show your authority. File

and additions to tax. For example, if

Form 1310, Statement of Person

information. We need it to ensure

on your employment tax return you

Claiming Refund Due a Deceased

that you are complying with these

reported and paid more Federal

Taxpayer, with Form 843 if you are

laws and to allow us to figure and

income tax than you actually

the legal representative of a

collect the right amount of tax.

withheld from an employee, use this

decedent.

The time needed to complete and

form to claim a refund.

Where To File.—File Form 843 with

file this form will vary depending on

Also use Form 843 to request

the Internal Revenue Service Center

individual circumstances. The

abatement of an overassessment, or

where you filed your return.

estimated average time is:

the unpaid portion of an

Social Security Number.—If you are

Recordkeeping

26 min.

overassessment if more than the

filing Form 843 to request a refund

correct amount of tax (except

Learning about the

or abatement relating to a joint

income, estate, and gift taxes),

law or the form

7 min.

return, enter social security numbers

interest, additions to tax, or penalty

Preparing the form

18 min.

for both you and your spouse.

has been assessed.

Copying, assembling,

Generally, you must file a separate

Specific Instructions

and sending the form

Form 843 for each tax period and

to the IRS

28 min.

each type of tax. Exceptions are

Line 3a.—Check the appropriate

If you have comments concerning

provided for certain claims in the

box to show the type of tax, penalty,

the accuracy of these time

specific instructions below.

or addition to tax. If you are filing a

estimates or suggestions for making

claim for refund or request for

Do not use this form to claim a

this form more simple, we would be

abatement of an assessed penalty,

refund or request an abatement of

happy to hear from you. You can

check the box and enter the

your income tax. Individuals who

write to both the Internal Revenue

applicable Internal Revenue Code

filed Form 1040, 1040A, or 1040EZ

Service, Attention: Reports

(IRC) section. Generally, you can find

must use Form 1040X, Amended

Clearance Officer, PC:FP,

the IRC section on the Notice of

U.S. Individual Income Tax Return.

Washington, DC 20224; and the

Assessment you receive from the

Corporations that filed Form 1120 or

Office of Management and

service center.

Form 1120-A must use Form

Budget, Paperwork Reduction

1120X, Amended U.S. Corporation

Line 3b.—Check the appropriate

Project (1545-0024), Washington,

Income Tax Return. Other income

box to show the type of return, if

DC 20503. DO NOT send Form 843

tax filers should file a claim on the

any, that you filed.

to either of these offices. Instead,

appropriate amended tax return.

Form 941.—If you are claiming a

see Where To File below.

Do not use this form to claim a

refund of taxes reported on Form

refund of the required payment

941, Employer’s Quarterly Federal

A Change To Note

under section 7519. Instead, file

Tax Return, you must attach Form

Form 8752, Required Payment or

Form 843 is no longer used to claim

941c, Supporting Statement To

Refund Under Section 7519.

refunds of excise taxes reported on

Correct Information, to Form 843.

Form 720, 730, or 2290. You must

Who May File.—You may file Form

Line 4

use Form 8849, Claim for Refund of

843 or your agent may file it for you.

Excise Taxes. Form 8849 is also

If your agent files, the original or a

Requesting Abatement or Refund

used to claim refunds of excise

copy of Form 2848, Power of

of Interest Under Section 6404(e)

taxes imposed on fuels, chemicals,

Attorney and Declaration of

Section 6404(e) allows the IRS to

and other articles used for

Representative, must be attached to

abate interest when the additional

nontaxable purposes or for which

Form 843.

interest was caused by IRS errors

there is a reduced rate of tax. Use

If you are filing as a legal

and delays. Section 6404(e) applies

Form 8849 to claim refunds of the

representative for a decedent whose

only if there was an error or delay in

repealed luxury taxes.

return you filed, attach to Form 843

Cat. No. 11200I

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2