Instructions For Form 843 - Claim For Refund And Request For Abatement - Internal Revenue Service - 2011

ADVERTISEMENT

Instructions for Form 843

Department of the Treasury

Internal Revenue Service

(Rev. August 2011)

Claim for Refund and Request for Abatement

Section references are to the Internal Revenue Code unless

previously adjusted by the IRS, or to make certain elections

after the prescribed deadline (see Regulations sections

otherwise noted.

301.9100-1 through -3).

What’s New

•

Use Form 8379, Injured Spouse Allocation, to claim your

portion of a joint refund used to offset your spouse’s past due

Claim for refund of branded prescription drug fee. A

obligations.

covered entity that paid the branded prescription drug fee must

•

Individuals, estates, and trusts filing within 1 year after the

file Form 843 to claim a refund. See Where To File and

end of the year in which a claim of right adjustment under

Branded prescription drug fee.

section 1341(b)(1), a net operating loss (NOL), a general

General Instructions

business credit, or net section 1256 contracts loss arose, can

use Form 1045, Application for Tentative Refund, to apply for a

refund resulting from any overpayment of tax due to the claim of

Purpose of Form

right adjustment or the carryback of the loss or unused credit.

Individuals also can get a refund by filing Form 1040X instead

Use Form 843 to claim a refund or request an abatement of

of Form 1045. An estate or trust can file an amended Form

certain taxes, interest, penalties, fees, and additions to tax.

1041, U.S. Income Tax Return for Estates and Trusts.

Do not use Form 843 to request a refund of income tax.

•

Use Form 940, Employer’s Annual Federal Unemployment

Employers cannot use Form 843 to request a refund of Federal

(FUTA) Tax Return, to amend a previously filed Form 940. See

Insurance Contributions Act (FICA) tax, Railroad Retirement

the Instructions for Form 940.

Tax Act (RRTA) tax, or income tax withholding. Also do not use

•

Employers must use the tax form that corresponds to the tax

Form 843 to amend a previously filed income or employment

return previously filed to make an adjustment or claim a refund

tax return. Do not use Form 843 to claim a refund of agreement

or abatement of FICA tax, RRTA tax, or income tax withholding.

fees, offer-in-compromise fees, or lien fees.

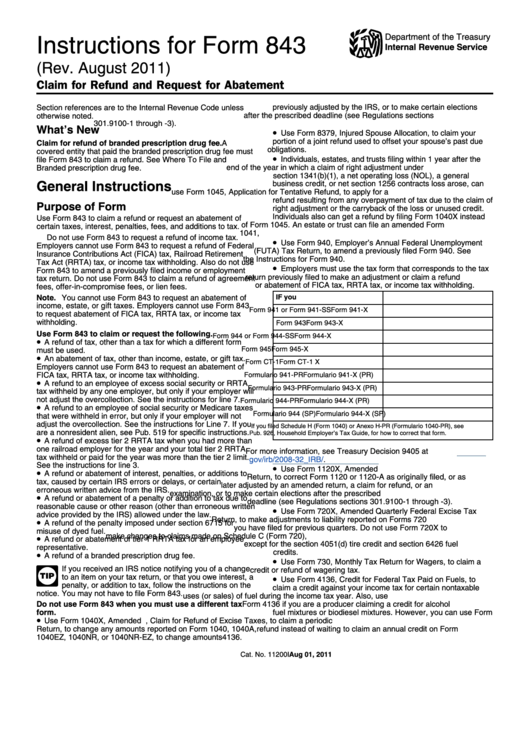

Note. You cannot use Form 843 to request an abatement of

IF you filed...

CORRECT using...

income, estate, or gift taxes. Employers cannot use Form 843

Form 941 or Form 941-SS

Form 941-X

to request abatement of FICA tax, RRTA tax, or income tax

withholding.

Form 943

Form 943-X

Use Form 843 to claim or request the following.

Form 944 or Form 944-SS

Form 944-X

•

A refund of tax, other than a tax for which a different form

Form 945

Form 945-X

must be used.

•

An abatement of tax, other than income, estate, or gift tax.

Form CT-1

Form CT-1 X

Employers cannot use Form 843 to request an abatement of

FICA tax, RRTA tax, or income tax withholding.

Formulario 941-PR

Formulario 941-X (PR)

•

A refund to an employee of excess social security or RRTA

Formulario 943-PR

Formulario 943-X (PR)

tax withheld by any one employer, but only if your employer will

not adjust the overcollection. See the instructions for line 7.

Formulario 944-PR

Formulario 944-X (PR)

•

A refund to an employee of social security or Medicare taxes

Formulario 944 (SP)

Formulario 944-X (SP)

that were withheld in error, but only if your employer will not

adjust the overcollection. See the instructions for Line 7. If you

If you filed Schedule H (Form 1040) or Anexo H-PR (Formulario 1040-PR), see

are a nonresident alien, see Pub. 519 for specific instructions.

Pub. 926, Household Employer’s Tax Guide, for how to correct that form.

•

A refund of excess tier 2 RRTA tax when you had more than

one railroad employer for the year and your total tier 2 RRTA

For more information, see Treasury Decision 9405 at

tax withheld or paid for the year was more than the tier 2 limit.

gov/irb/2008-32_IRB/ar13.html.

See the instructions for line 3.

•

Use Form 1120X, Amended U.S. Corporation Income Tax

•

A refund or abatement of interest, penalties, or additions to

Return, to correct Form 1120 or 1120-A as originally filed, or as

tax, caused by certain IRS errors or delays, or certain

later adjusted by an amended return, a claim for refund, or an

erroneous written advice from the IRS.

examination, or to make certain elections after the prescribed

•

A refund or abatement of a penalty or addition to tax due to

deadline (see Regulations sections 301.9100-1 through -3).

reasonable cause or other reason (other than erroneous written

•

Use Form 720X, Amended Quarterly Federal Excise Tax

advice provided by the IRS) allowed under the law.

Return, to make adjustments to liability reported on Forms 720

•

A refund of the penalty imposed under section 6715 for

you have filed for previous quarters. Do not use Form 720X to

misuse of dyed fuel.

make changes to claims made on Schedule C (Form 720),

•

A refund or abatement of tier 1 RRTA tax for an employee

except for the section 4051(d) tire credit and section 6426 fuel

representative.

credits.

•

A refund of a branded prescription drug fee.

•

Use Form 730, Monthly Tax Return for Wagers, to claim a

If you received an IRS notice notifying you of a change

credit or refund of wagering tax.

to an item on your tax return, or that you owe interest, a

•

TIP

Use Form 4136, Credit for Federal Tax Paid on Fuels, to

penalty, or addition to tax, follow the instructions on the

claim a credit against your income tax for certain nontaxable

notice. You may not have to file Form 843.

uses (or sales) of fuel during the income tax year. Also, use

Do not use Form 843 when you must use a different tax

Form 4136 if you are a producer claiming a credit for alcohol

form.

fuel mixtures or biodiesel mixtures. However, you can use Form

•

Use Form 1040X, Amended U.S. Individual Income Tax

8849, Claim for Refund of Excise Taxes, to claim a periodic

Return, to change any amounts reported on Form 1040, 1040A,

refund instead of waiting to claim an annual credit on Form

1040EZ, 1040NR, or 1040NR-EZ, to change amounts

4136.

Aug 01, 2011

Cat. No. 11200I

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4