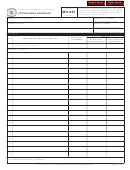

Form 851 (1992) - Affiliations Schedule Page 3

ADVERTISEMENT

3

Form 851 (Rev. 1-92)

Page

Part IV

Additional Information (See instructions.)

1

During the tax year, did the corporation have more than one class of stock outstanding?

Answer to

Question 1

No.

Name

If yes, list and describe each class of stock.

Yes

No

During the tax year, was there any member of the consolidated group that reaffiliated within 60 months of disaffiliation, or was

2

there any member of the affiliated group that was deconsolidated under Rev. Proc. 91-11, 1991-1 C.B. 470 (as modified by

Rev. Proc. 91-39, 1991-27 IRB 11)?

Answer to

If yes for any part of question 2, list and explain the

Question 2

No.

Name

circumstances.

Yes

No

3a

During the tax year, was there any arrangement in existence by which one or more persons that were not members of the

affiliated group could acquire any stock, or acquire any voting power without acquiring stock, in the corporation, other than a

de minimis amount, from the corporation or another member of the affiliated group?

Answer to

Item 3b

Item 3c

Item 3d

Question 3a

No.

Name

(see instructions)

(see instructions)

(see instructions)

Yes

No

%

%

%

%

%

%

%

%

%

%

%

%

No.

Item 3e—Description of arrangements.

Under penalties of perjury, I declare that I have examined this form, including accompanying statements, and to the best of my knowledge and belief,

Please

it is true, correct, and complete for the tax year as stated.

Sign

Here

Signature of officer

Date

Title

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4