2014

4 of 4

Name

SSN

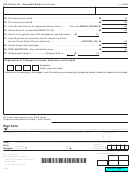

Form 1X

Page

Schedule 1

– Itemized Deduction Credit

(Fill in completely if any item is changed. If this credit was not claimed on your original return, enclose federal Schedule A.)

.00

1 Medical and dental expenses from line 4 of federal Schedule A . . . . . . . . . . . . . . . . . . . . . . . .

1

2 Interest paid from lines 10-12 and 14 of federal Schedule A. Do not include interest paid

to purchase a second home located outside Wisconsin or a residence which is a boat .

Also, do not include interest paid to purchase or hold U .S . government securities, or

.00

interest passed through from a tax‑option (S) corporation that is claimed as a subtraction . . . .

2

.00

3 Gifts to charity from line 19 of federal Schedule A . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4 Casualty losses from line 20 of federal Schedule A, only if the loss is directly related to

.00

a federally‑declared disaster . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

.00

5 Add lines 1 through 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

.00

6 Wisconsin standard deduction from line 2 of Form 1X . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7 Subtract line 6 from line 5. If line 6 is more than line 5, fill in 0 . . . . . . . . . . . . . . . . . . . . . . . . .

.00

7

8 Rate of credit is .05 (5%) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.05

x

8

.00

9 Multiply line 7 by line 8 . Fill in here and on line 7 of Form 1X . . . . . . . . . . . . . . . . . . . . . . . . . .

9

Schedule 2

– Married Couple Credit When Both Spouses Are Employed

(Fill in if changed.)

(A) Yourself

(B) Your spouse

1 Wages, salaries, tips, and other employee compensation .

.00

.00

Do NOT enter unearned income . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Net profit or (loss) from self-employment from federal

(Form 1040)

(Form 1065)

Schedules C, C‑EZ, and F

, Schedule K‑1

,

.00

.00

and any other taxable self‑employment or earned income . . . . . . . . 2

.00

.00

3 Combine lines 1 and 2 . This is earned income . . . . . . . . . . . . . . . . 3

4 Add the amounts from federal Form 1040, lines 24, 28 and 32,

plus repayment of supplemental unemployment benefits, and

contributions to secs. 403(b) and 501(c)(18) pension plans

included in line 36, and any Wisconsin disability income

exclusion . Fill in the total of these adjustments that apply to

.00

.00

your or your spouse’s income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Subtract line 4 from line 3. This is qualified earned income.

.00

.00

If less than zero, fill in 0 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

.00

6 Fill in the smaller of column (A) or (B) of line 5. If more than $16,000, fill in $16,000

6

.03

7 Rate of credit is .03 (3.0%) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

x

8 Multiply line 6 by line 7 . Fill in here and on line 17 of Form 1X .

.00

Do not fill in more than $480 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

Return to Page 1

1

1 2

2 3

3 4

4