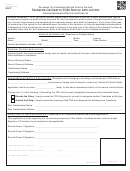

Simple Revocable Transfer On Death (Tod) Deed Page 3

ADVERTISEMENT

COMMON QUESTIONS ABOUT THE USE OF THIS FORM

WHAT DOES THE TOD DEED DO? When you die, the identified property will transfer to your named

beneficiary without probate. The TOD deed has no effect until you die. You can revoke it at any time.

CAN I USE THIS DEED TO TRANSFER BUSINESS PROPERTY? This deed can only be used to transfer (1) a

parcel of property that contains one to four residential dwelling units, (2) a condominium unit, or (3) a

parcel of agricultural land of 40 acres or less, which contains a single-family residence.

HOW DO I USE THE TOD DEED? Complete this form. Have it notarized. RECORD the form in the county

where the property is located. The form MUST be recorded on or before 60 days after the date you sign

it or the deed has no effect.

IS THE “LEGAL DESCRIPTION” OF THE PROPERTY NECESSARY? Yes.

HOW DO I FIND THE “LEGAL DESCRIPTION” OF THE PROPERTY? This information may be on the deed

you received when you became an owner of the property. This information may also be available in the

office of the county recorder for the county where the property is located. If you are not absolutely sure,

consult an attorney.

HOW DO I “RECORD” THE FORM? Take the completed and notarized form to the county recorder for the

county in which the property is located. Follow the instructions given by the county recorder to make the

form part of the official property records.

WHAT IF I SHARE OWNERSHIP OF THE PROPERTY? This form only transfers YOUR share of the

property. If a co-owner also wants to name a TOD beneficiary, that co-owner must complete and

RECORD a separate form.

CAN I REVOKE THE TOD DEED IF I CHANGE MY MIND? Yes. You may revoke the TOD deed at any time.

No one, including your beneficiary, can prevent you from revoking the deed.

HOW DO I REVOKE THE TOD DEED? There are three ways to revoke a recorded TOD deed: (1)

Complete, have notarized, and RECORD a revocation form. (2) Create, have notarized, and RECORD a

new TOD deed. (3) Sell or give away the property, or transfer it to a trust, before your death and

RECORD the deed. A TOD deed can only affect property that you own when you die. A TOD deed cannot

be revoked by will.

CAN I REVOKE A TOD DEED BY CREATING A NEW DOCUMENT THAT DISPOSES OF THE PROPERTY (FOR

EXAMPLE, BY CREATING A NEW TOD DEED OR BY ASSIGNING THE PROPERTY TO A TRUST)? Yes, but

only if the new document is RECORDED. To avoid any doubt, you may wish to RECORD a TOD deed

revocation form before creating the new instrument. A TOD deed cannot be revoked by will, or by

purporting to leave the subject property to anyone via will.

IF I SELL OR GIVE AWAY THE PROPERTY DESCRIBED IN A TOD DEED, WHAT HAPPENS WHEN I DIE? If

the deed or other document used to transfer your property is RECORDED before your death, the TOD

deed will have no effect. If the transfer document is not RECORDED before your death, the TOD deed

will take effect.

I AM BEING PRESSURED TO COMPLETE THIS FORM. WHAT SHOULD I DO? Do NOT complete this form

unless you freely choose to do so. If you are being pressured to dispose of your property in a way that

you do not want, you may want to alert a family member, friend, the district attorney, or a senior service

agency.

DO I NEED TO TELL MY BENEFICIARY ABOUT THE TOD DEED? No. But secrecy can cause later

complications and might make it easier for others to commit fraud.

WHAT DOES MY BENEFICIARY NEED TO DO WHEN I DIE? Your beneficiary must RECORD evidence of

your death (Prob. Code § 210), and file a change in ownership notice (Rev. & Tax. Code § 480). If you

received Medi-Cal benefits, your beneficiary must notify the State Department of Health Care Services of

your death and provide a copy of your death certificate (Prob. Code § 215).

WHAT IF I NAME MORE THAN ONE BENEFICIARY? Your beneficiaries will become co-owners in equal

shares as tenants in common. If you want a different result, you should not use this form.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4