Instructions For Form 8275 (1992)- Disclosure Statement

ADVERTISEMENT

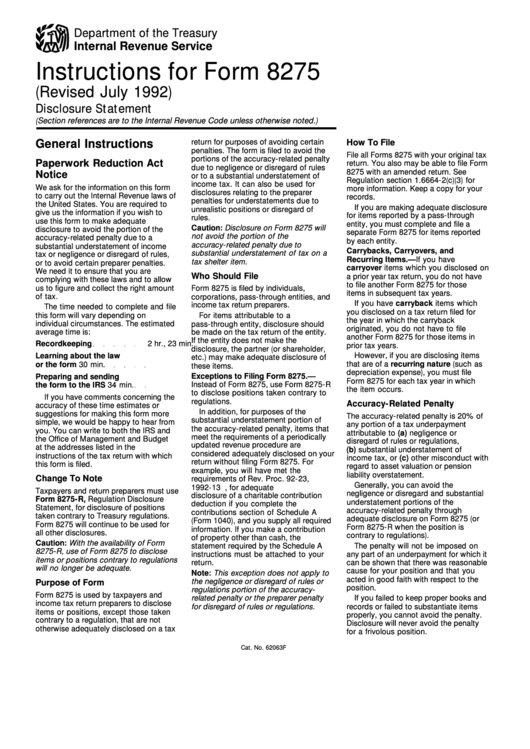

Department of the Treasury

Internal Revenue Service

Instructions for Form 8275

(Revised July 1992)

Disclosure Statement

(Section references are to the Internal Revenue Code unless otherwise noted. )

General Instructions

return for purposes of avoiding certain

How To File

penalties. The form is filed to avoid the

File all Forms 8275 with your original tax

portions of the accuracy-related penalty

Paperwork Reduction Act

return. You also may be able to file Form

due to negligence or disregard of rules

8275 with an amended return. See

Notice

or to a substantial understatement of

Regulation section 1.6664-2(c)(3) for

income tax. It can also be used for

We ask for the information on this form

more information. Keep a copy for your

disclosures relating to the preparer

to carry out the Internal Revenue laws of

records.

penalties for understatements due to

the United States. You are required to

If you are making adequate disclosure

unrealistic positions or disregard of

give us the information if you wish to

for items reported by a pass-through

rules.

use this form to make adequate

entity, you must complete and file a

Caution: Disclosure on For m 8275 will

disclosure to avoid the portion of the

separate Form 8275 for items reported

not avoid the portion of the

accuracy-related penalty due to a

by each entity.

accuracy-related penalty due to

substantial understatement of income

Carrybacks, Carryovers, and

substantial understatement of tax on a

tax or negligence or disregard of rules,

Recurring Items.—If you have

tax shelter item.

or to avoid certain preparer penalties.

carryover items which you disclosed on

We need it to ensure that you are

Who Should File

a prior year tax return, you do not have

complying with these laws and to allow

to file another Form 8275 for those

us to figure and collect the right amount

Form 8275 is filed by individuals,

items in subsequent tax years.

of tax.

corporations, pass-through entities, and

If you have carryback items which

income tax return preparers.

The time needed to complete and file

you disclosed on a tax return filed for

this form will vary depending on

For items attributable to a

the year in which the carryback

individual circumstances. The estimated

pass-through entity, disclosure should

originated, you do not have to file

average time is:

be made on the tax return of the entity.

another Form 8275 for those items in

If the entity does not make the

Recordkeeping

2 hr., 23 min.

prior tax years.

disclosure, the partner (or shareholder,

Learning about the law

However, if you are disclosing items

etc.) may make adequate disclosure of

or the form

30 min.

that are of a recurring nature (such as

these items.

depreciation expense), you must file

Exceptions to Filing Form 8275.—

Preparing and sending

Form 8275 for each tax year in which

Instead of Form 8275, use Form 8275-R

the form to the IRS

34 min.

the item occurs.

to disclose positions taken contrary to

If you have comments concerning the

regulations.

Accuracy-Related Penalty

accuracy of these time estimates or

In addition, for purposes of the

suggestions for making this form more

The accuracy-related penalty is 20% of

substantial understatement portion of

simple, we would be happy to hear from

any portion of a tax underpayment

the accuracy-related penalty, items that

you. You can write to both the IRS and

attributable to (a) negligence or

meet the requirements of a periodically

the Office of Management and Budget

disregard of rules or regulations,

updated revenue procedure are

at the addresses listed in the

(b) substantial understatement of

considered adequately disclosed on your

instructions of the tax return with which

income tax, or (c) other misconduct with

return without filing Form 8275. For

this form is filed.

regard to asset valuation or pension

example, you will have met the

liability overstatement.

Change To Note

requirements of Rev. Proc. 92-23,

Generally, you can avoid the

1992-13 I.R.B. 21, for adequate

Taxpayers and return preparers must use

negligence or disregard and substantial

disclosure of a charitable contribution

Form 8275-R, Regulation Disclosure

understatement portions of the

deduction if you complete the

Statement, for disclosure of positions

accuracy-related penalty through

contributions section of Schedule A

taken contrary to Treasury regulations.

adequate disclosure on Form 8275 (or

(Form 1040), and you supply all required

Form 8275 will continue to be used for

Form 8275-R when the position is

information. If you make a contribution

all other disclosures.

contrary to regulations).

of property other than cash, the

Caution: With the availability of Form

statement required by the Schedule A

The penalty will not be imposed on

8275-R, use of For m 8275 to disclose

instructions must be attached to your

any part of an underpayment for which it

items or positions contrary to regulations

return.

can be shown that there was reasonable

will no longer be adequate.

cause for your position and that you

Note: This exception does not apply to

acted in good faith with respect to the

the negligence or disregard of rules or

Purpose of Form

position.

regulations portion of the accuracy-

Form 8275 is used by taxpayers and

related penalty or the preparer penalty

If you failed to keep proper books and

income tax return preparers to disclose

for disregard of rules or regulations.

records or failed to substantiate items

items or positions, except those taken

properly, you cannot avoid the penalty.

contrary to a regulation, that are not

Disclosure will never avoid the penalty

otherwise adequately disclosed on a tax

for a frivolous position.

Cat. No. 62063F

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2