Dtf-803 - New York State, Claim For Sales And Use Tax Exemption

ADVERTISEMENT

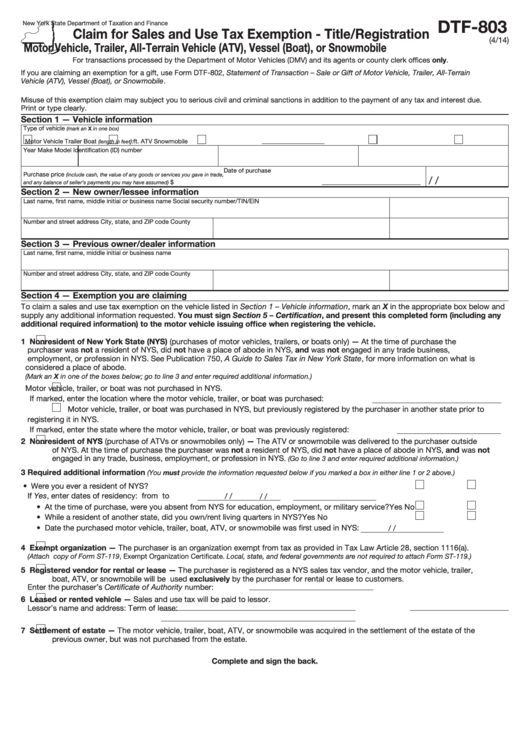

DTF-803

New York State Department of Taxation and Finance

Claim for Sales and Use Tax Exemption - Title/Registration

(4/14)

Motor Vehicle, Trailer, All-Terrain Vehicle (ATV), Vessel (Boat), or Snowmobile

For transactions processed by the Department of Motor Vehicles (DMV) and its agents or county clerk offices only.

If you are claiming an exemption for a gift, use Form DTF-802, Statement of Transaction – Sale or Gift of Motor Vehicle, Trailer, All-Terrain

Vehicle (ATV), Vessel (Boat), or Snowmobile.

Misuse of this exemption claim may subject you to serious civil and criminal sanctions in addition to the payment of any tax and interest due.

Print or type clearly.

Section 1 — Vehicle information

Type of vehicle

(mark an X in one box)

Motor Vehicle

Trailer

Boat

)

ft.

ATV

Snowmobile

(length in feet

:

Year

Make

Model

Identification (ID) number

Date of purchase

Purchase price

(include cash, the value of any goods or services you gave in trade,

/

/

........................................................................................ $

and any balance of seller’s payments you may have assumed)

Section 2 — New owner/lessee information

Last name, first name, middle initial or business name

Social security number/TIN/EIN

Number and street address

City, state, and ZIP code

County

Section 3 — Previous owner/dealer information

Last name, first name, middle initial or business name

Number and street address

City, state, and ZIP code

County

Section 4 — Exemption you are claiming

To claim a sales and use tax exemption on the vehicle listed in Section 1 – Vehicle information, mark an X in the appropriate box below and

supply any additional information requested. You must sign Section 5 – Certification, and present this completed form (including any

additional required information) to the motor vehicle issuing office when registering the vehicle.

1

Nonresident of New York State (NYS) (purchases of motor vehicles, trailers, or boats only) — At the time of purchase the

purchaser was not a resident of NYS, did not have a place of abode in NYS, and was not engaged in any trade business,

employment, or profession in NYS. See Publication 750, A Guide to Sales Tax in New York State, for more information on what is

considered a place of abode.

(Mark an X in one of the boxes below; go to line 3 and enter required additional information.)

Motor vehicle, trailer, or boat was not purchased in NYS.

If marked, enter the location where the motor vehicle, trailer, or boat was purchased:

Motor vehicle, trailer, or boat was purchased in NYS, but previously registered by the purchaser in another state prior to

registering it in NYS.

If marked, enter the state where the motor vehicle, trailer, or boat was previously registered:

2

Nonresident of NYS (purchase of ATVs or snowmobiles only) — The ATV or snowmobile was delivered to the purchaser outside

of NYS. At the time of purchase the purchaser was not a resident of NYS, did not have a place of abode in NYS, and was not

engaged in any trade, business, employment, or profession in NYS.

(Go to line 3 and enter required additional information.)

3

Required additional information

(You must provide the information requested below if you marked a box in either line 1 or 2 above.)

• Were you ever a resident of NYS? ....................................................................................................................

Yes

No

If Yes, enter dates of residency:

from

to

/

/

/

/

• At the time of purchase, were you absent from NYS for education, employment, or military service? ...........

Yes

No

• While a resident of another state, did you own/rent living quarters in NYS? ...................................................

Yes

No

• Date the purchased motor vehicle, trailer, boat, ATV, or snowmobile was first used in NYS:

/

/

4

Exempt organization — The purchaser is an organization exempt from tax as provided in Tax Law Article 28, section 1116(a).

(Attach copy of Form ST-119, Exempt Organization Certificate. Local, state, and federal governments are not required to attach Form ST-119.)

5

Registered vendor for rental or lease — The purchaser is registered as a NYS sales tax vendor, and the motor vehicle, trailer,

boat, ATV, or snowmobile will be used exclusively by the purchaser for rental or lease to customers.

Enter the purchaser’s Certificate of Authority number:

6

Leased or rented vehicle — Sales and use tax will be paid to lessor.

Lessor’s name and address:

Term of lease:

7

Settlement of estate — The motor vehicle, trailer, boat, ATV, or snowmobile was acquired in the settlement of the estate of the

previous owner, but was not purchased from the estate.

Complete and sign the back.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2