DEFINITIONS

36 MRSA Section 681. Definitions

As used in this subchapter, unless the context otherwise indicates, the following terms have

the following meanings.

1. Applicant. “Applicant” means an individual who has applied for a homestead property

tax exemption pursuant to this subchapter.

2. Homestead. “Homestead” means any residential property in this State assessed as real

property owned by an applicant or held in a revocable living trust for the benefit of the applicant

and occupied by the applicant as the applicant’s permanent residence. A “homestead” does not

include any real property used solely for commercial purposes.

3. Permanent residence. “Permanent residence” means that place where an individual

has a true, fixed and permanent home and principal establishment to which the individual,

whenever absent, has the intention of returning. An individual may have only one permanent

residence at a time and, once a permanent residence is established, that residence is presumed to

continue until circumstances indicate otherwise.

4. Permanent resident. “Permanent resident” means an individual who has established a

permanent residence.

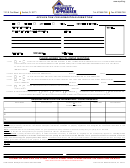

INSTRUCTIONS

Section 1. Check all three boxes indicating your answers. You must answer “Yes” to all three

questions in order to qualify for the Maine homestead exemption. If you have moved during the

year and owned a homestead prior to your move, indicate the name of the municipality you moved

from on line B(1). Your ownership of homestead property must have been continuous for the 12

month period in question B. If you answer “No” to any question in this section you do not qualify

for the homestead exemption.

Section 2. Indicate your full name as shown on your property tax bill, the physical location of your

home and your mailing address.

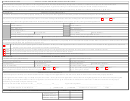

Section 3. This section gives the local assessor information which may be used to determine if you

qualify and should support your answers to the questions in Section 1. Please check the

appropriate answer for each of the statements in this section.

One or more of the owners of the homestead property may sign this document. Please file

the application with your local municipal assessor. If, for any reason you are denied exemption by

the assessor you may wish to appeal the assessor’s decision under the abatement statute. (Title 36

MRSA Section 841)

1

1 2

2