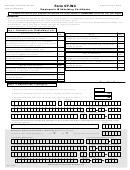

Form Ct-W4 - Employee'S Withholding Certificate Page 4

ADVERTISEMENT

Supplemental Table for Qualifying Widow(er) With Dependent Child and

Married Couples Filing Jointly - Effective January 1, 2013

For married couples who both select Withholding Code “A” on Form CT-W4 (combined income is $100,500 or less).

28,000

30,000

32,000

34,000

36,000

38,000

40,000 42,000

44,000

46,000

48,000

50,000

52,000

Annual Salary

3,000

(647)

(752)

(866)

(1,007)

(1,148)

(1,148)

(1,136) (1,158)

(1,163)

(1,125)

(1,023)

(992)

(1,031)

6,000

(525)

(666)

(807)

(948)

(981)

(1,020)

(1,025) (1,030)

(950)

(822)

(720)

(722)

(761)

9,000

(467)

(608)

(698)

(776)

(888)

(893)

(855)

(753)

(630)

(540)

(450)

(452)

(491)

12,000

(408)

(441)

(570)

(665)

(760)

(680)

(552)

(450)

(360)

(270)

(180)

(182)

(221)

15,000

(258)

(370)

(465)

(518)

(506)

(383)

(293)

(203)

(113)

(23)

68

66

26

18,000

(224)

(319)

(329)

(291)

(279)

(189)

(99)

(9)

81

171

261

259

220

21,000

(158)

(146)

(113)

(113)

(113)

(23)

68

158

248

338

428

426

341

24,000

8

20

20

20

20

110

200

290

380

470

560

468

339

27,000

7

7

7

7

7

97

187

277

367

412

412

320

191

30,000

0

0

0

0

0

90

180

270

270

270

270

178

49

33,000

0

0

0

0

0

90

135

135

135

135

135

43

(86)

36,000

0

0

0

0

0

0

0

0

0

0

0

(92)

(221)

39,000

135

135

135

90

0

0

0

0

0

0

0

(92)

(221)

42,000

270

270

180

90

0

0

0

0

0

0

0

(92)

(221)

45,000

360

270

180

90

0

0

0

0

0

0

0

(92)

(132)

48,000

360

270

180

90

0

0

0

0

0

0

0

88

147

51,000

195

105

15

(75)

(165)

(165)

(165)

(165)

(165)

(76)

108

253

54,000

50

(40)

(130)

(220)

(310)

(310)

(310)

(310)

(130)

58

210

57,000

0

(90)

(180)

(270)

(360)

(360)

(271)

(87)

150

60,000

(50)

(140)

(230)

(320)

(410)

(230)

(42)

110

63,000

(120)

(210)

(300)

(301)

(207)

30

66,000

(170)

(260)

(170)

(72)

(10)

69,000

(131)

(37)

110

This table joins the table on Page 3.

72,000

98

160

(Rev.

)

11/12

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4