Employee Information Sheet - Checkright

ADVERTISEMENT

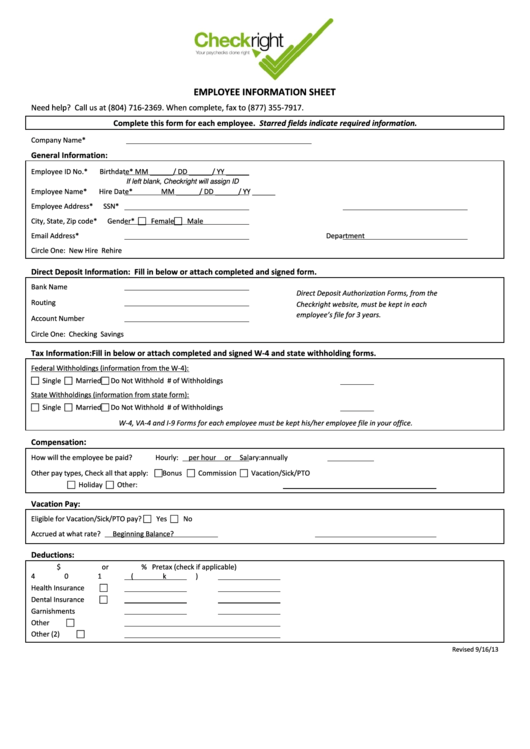

EMPLOYEE INFORMATION SHEET

Need help? Call us at (804) 716-2369.

When complete, fax to (877) 355-7917.

Complete this form for each employee. Starred fields indicate required information.

Company Name*

General Information:

Employee ID No.*

Birthdate*

MM ______/ DD ______/ YY ______

If left blank, Checkright will assign ID

Employee Name*

Hire Date*

MM ______/ DD ______/ YY ______

Employee Address*

SSN*

City, State, Zip code*

Gender*

Female

Male

Email Address*

Department

Circle One:

New Hire

Rehire

Direct Deposit Information: Fill in below or attach completed and signed form.

Bank Name

Direct Deposit Authorization Forms, from the

Routing

Checkright website, must be kept in each

employee’s file for 3 years.

Account Number

Circle One:

Checking

Savings

Tax Information: Fill in below or attach completed and signed W-4 and state withholding forms.

Federal Withholdings (information from the W-4):

Single

Married

Do Not Withhold

# of Withholdings

State Withholdings (information from state form):

Single

Married

Do Not Withhold

# of Withholdings

W-4, VA-4 and I-9 Forms for each employee must be kept his/her employee file in your office.

:

Compensation

How will the employee be paid?

Hourly:

per hour

or

Salary:

annually

Other pay types, Check all that apply: Bonus

Commission

Vacation/Sick/PTO

Holiday

Other:

Vacation Pay:

Eligible for Vacation/Sick/PTO pay?

Yes

No

Accrued at what rate?

Beginning Balance?

Deductions:

$

or

%

Pretax (check if applicable)

401(k)

Health Insurance

Dental Insurance

Garnishments

Other

Other (2)

Revised 9/16/13

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4