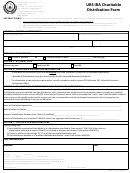

PART 6. SIGNATURES

I certify that I am authorized to receive payments from this HSA and that all information provided by me is true and accurate. No tax advice has

been given to me by the trustee or custodian. All decisions regarding this withdrawal are my own, and I expressly assume responsibility for any

consequences that may arise from this withdrawal. I agree that the trustee or custodian is not responsible for any consequences that may arise

from processing this withdrawal authorization.

Date (mm/dd/yyyy)

Signature of Recipient

Notary Public/Signature Guarantee (If required by the trustee or custodian)

Date (mm/dd/yyyy)

Date (mm/dd/yyyy)

Authorized Signature of Trustee or Custodian

REPORTING INFORMATION APPLICABLE TO HSA WITHDRAWALS

You must supply all requested information for the withdrawal so the trustee or custodian can properly report the withdrawal.

If you have any questions regarding a withdrawal, please consult a competent tax professional or refer to IRS Publication 969, Health Savings

Accounts and Other Tax-Favored Health Plans, for more information. This publication is available on the IRS website at or by calling

1800TAXFORM.

WITHDRAWAL REASON

HSA assets can be withdrawn at any time. Most HSA withdrawals are reported to the IRS. IRS rules specify the distribution code that must be used

to report each withdrawal on IRS Form 1099-SA, Distributions From an HSA, Archer MSA, or Medicare Advantage MSA.

Transfer to Another HSA. Transfers are not reported on Form 1099-SA. Transfers may be made by an HSA owner or former spouse under a transfer

due to a divorce.

Normal Withdrawal. Normal withdrawals are reported on Form 1099-SA using code 1. Also use code 1 if no other code applies to the withdrawal.

Disability. Disability withdrawals are reported on Form 1099-SA using code 3.

Prohibited Transaction. Prohibited transactions as defined in Internal Revenue Code Section 4975(c) are reported on Form 1099-SA using code 5.

Excess Contribution Removal. Excess contributions removed before the excess removal deadline (your tax filing deadline, including extensions)

must include the net income attributable to the excess. A removal of an excess contribution is reported on Form 1099-SA using code 2.

Death Withdrawal by a Beneficiary Taken in the Year of Death. If the financial organization is notified of the HSA owner’s death and the withdraw-

al is made to the beneficiary in a year of death, the Form 1099-SA reporting code depends on the type of beneficiary.

• If the beneficiary is a spouse, the withdrawal is reported on Form 1099-SA using code 1.

• If the beneficiary is an estate or other, the withdrawal is reported on Form 1099-SA using code 4.

Death Withdrawal by a Beneficiary Taken After the Year of Death. If the financial organization is notified of the HSA owner’s death and the with-

drawal is made to the beneficiary in a year after the year of death, the Form 1099-SA reporting code depends on the type of beneficiary.

• If the beneficiary is a spouse, the withdrawal is reported on Form 1099-SA using code 1.

• If the beneficiary is an estate, the withdrawal is reported on Form 1099-SA using code 4.

• If the beneficiary is other, the withdrawal is reported on Form 1099-SA using code 6.

1

1 2

2