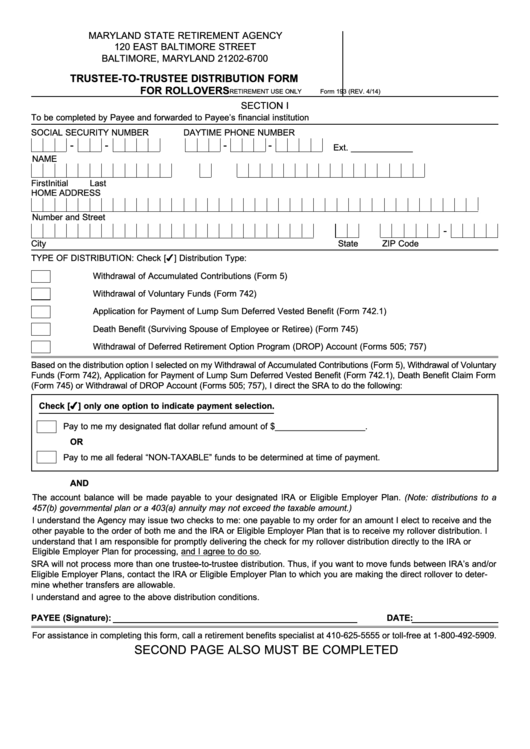

Form 193 - Trustee-To-Trustee Distribution Form For Rollovers

ADVERTISEMENT

MARYLAND STATE RETIREMENT AGENCY

120 EAST BALTIMORE STREET

BALTIMORE, MARYLAND 21202-6700

TRUSTEE-TO-TRUSTEE DISTRIBUTION FORM

FOR ROLLOVERS

RETIREMENT USE ONLY

Form 193 (REV. 4/14)

SECTION I

To be completed by Payee and forwarded to Payee’s financial institution

SOCIAL SECURITY NUMBER

DAYTIME PHONE NUMBER

-

-

-

-

Ext. _____________

NAME

First

Initial

Last

HOME ADDRESS

Number and Street

-

City

State

ZIP Code

TYPE OF DISTRIBUTION: Check [4] Distribution Type:

Withdrawal of Accumulated Contributions (Form 5)

Withdrawal of Voluntary Funds (Form 742)

Application for Payment of Lump Sum Deferred Vested Benefit (Form 742.1)

Death Benefit (Surviving Spouse of Employee or Retiree) (Form 745)

Withdrawal of Deferred Retirement Option Program (DROP) Account (Forms 505; 757)

Based on the distribution option I selected on my Withdrawal of Accumulated Contributions (Form 5), Withdrawal of Voluntary

Funds (Form 742), Application for Payment of Lump Sum Deferred Vested Benefit (Form 742.1), Death Benefit Claim Form

(Form 745) or Withdrawal of DROP Account (Forms 505; 757), I direct the SRA to do the following:

Check [4] only one option to indicate payment selection.

Pay to me my designated flat dollar refund amount of $___________________.

OR

Pay to me all federal “NON-TAXABLE” funds to be determined at time of payment.

AND

The account balance will be made payable to your designated IRA or Eligible Employer Plan. (Note: distributions to a

457(b) governmental plan or a 403(a) annuity may not exceed the taxable amount.)

I understand the Agency may issue two checks to me: one payable to my order for an amount I elect to receive and the

other payable to the order of both me and the IRA or Eligible Employer Plan that is to receive my rollover distribution. I

understand that I am responsible for promptly delivering the check for my rollover distribution directly to the IRA or

Eligible Employer Plan for processing, and I agree to do so.

SRA will not process more than one trustee-to-trustee distribution. Thus, if you want to move funds between IRA’s and/or

Eligible Employer Plans, contact the IRA or Eligible Employer Plan to which you are making the direct rollover to deter-

mine whether transfers are allowable.

I understand and agree to the above distribution conditions.

PAYEE (Signature):

DATE:

For assistance in completing this form, call a retirement benefits specialist at 410-625-5555 or toll-free at 1-800-492-5909.

SECOND PAGE ALSO MUST BE COMPLETED

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2