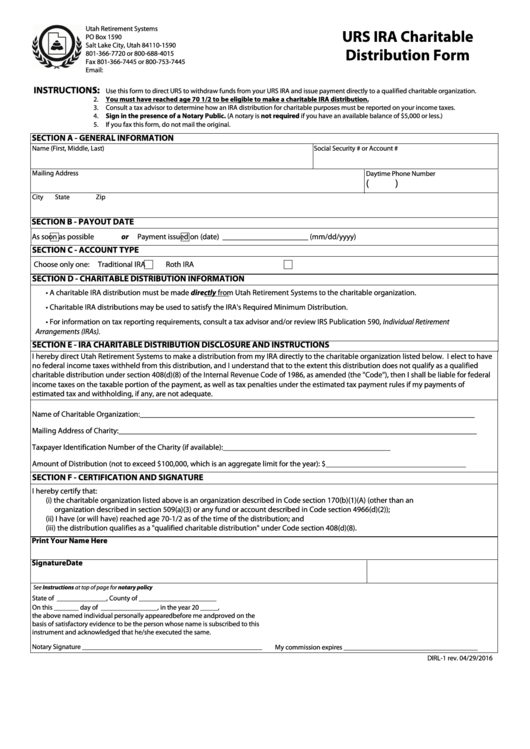

Form Dirl-1 - Ira Charitable Distribution Form

ADVERTISEMENT

Utah Retirement Systems

URS IRA Charitable

PO Box 1590

Salt Lake City, Utah 84110-1590

Distribution Form

801-366-7720 or 800-688-4015

Fax 801-366-7445 or 800-753-7445

Email:

INSTRUCTIONS:

1.

Use this form to direct URS to withdraw funds from your URS IRA and issue payment directly to a qualified charitable organization.

2.

You must have reached age 70 1/2 to be eligible to make a charitable IRA distribution.

3.

Consult a tax advisor to determine how an IRA distribution for charitable purposes must be reported on your income taxes.

Sign in the presence of a Notary Public. (A notary is not required if you have an available balance of $5,000 or less.)

4.

5.

If you fax this form, do not mail the original.

SECTION A - GENERAL INFORMATION

Name (First, Middle, Last)

Social Security # or Account #

Mailing Address

Daytime Phone Number

(

)

City

State

Zip

SECTION B - PAYOUT DATE

or

Payment issued on (date) ______________________ (mm/dd/yyyy)

As soon as possible

SECTION C - ACCOUNT TYPE

Choose only one:

Traditional IRA

Roth IRA

SECTION D - CHARITABLE DISTRIBUTION INFORMATION

A charitable IRA distribution must be made directly from Utah Retirement Systems to the charitable organization.

•

•

Charitable IRA distributions may be used to satisfy the IRA's Required Minimum Distribution.

•

For information on tax reporting requirements, consult a tax advisor and/or review IRS Publication 590, Individual Retirement

Arrangements (IRAs).

SECTION E - IRA CHARITABLE DISTRIBUTION DISCLOSURE AND INSTRUCTIONS

I hereby direct Utah Retirement Systems to make a distribution from my IRA directly to the charitable organization listed below. I elect to have

no federal income taxes withheld from this distribution, and I understand that to the extent this distribution does not qualify as a qualified

charitable distribution under section 408(d)(8) of the Internal Revenue Code of 1986, as amended (the "Code"), then I shall be liable for federal

income taxes on the taxable portion of the payment, as well as tax penalties under the estimated tax payment rules if my payments of

estimated tax and withholding, if any, are not adequate.

Name of Charitable Organization:______________________________________________________________________________________

Mailing Address of Charity:____________________________________________________________________________________________

Taxpayer Identification Number of the Charity (if available):___________________________________________

Amount of Distribution (not to exceed $100,000, which is an aggregate limit for the year): $____________________________________

SECTION F - CERTIFICATION AND SIGNATURE

I hereby certify that:

(i) the charitable organization listed above is an organization described in Code section 170(b)(1)(A) (other than an

organization described in section 509(a)(3) or any fund or account described in Code section 4966(d)(2));

(ii) I have (or will have) reached age 70-1/2 as of the time of the distribution; and

(iii) the distribution qualifies as a "qualified charitable distribution" under Code section 408(d)(8).

Print Your Name Here

Signature

Date

See Instructions at top of page for notary policy

State of ______________, County of ______________________

On this _______ day of ________________, in the year 20 _____,

the above named individual personally appeared before me and proved on the

basis of satisfactory evidence to be the person whose name is subscribed to this

instrument and acknowledged that he/she executed the same.

Notary Signature ___________________________________________________

My commission expires ______________________________________

DIRL-1 rev. 04/29/2016

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1