Form 1310 (Rev. March 1995)

ADVERTISEMENT

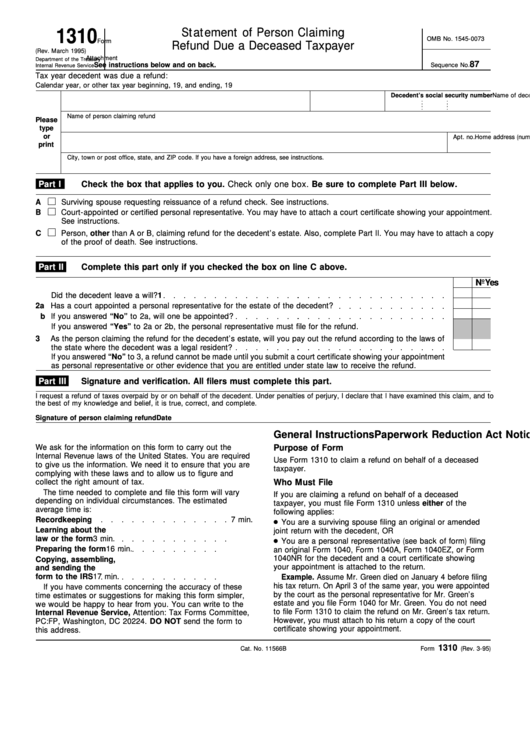

1310

Statement of Person Claiming

OMB No. 1545-0073

Form

Refund Due a Deceased Taxpayer

(Rev. March 1995)

Attachment

Department of the Treasury

87

See instructions below and on back.

Sequence No.

Internal Revenue Service

Tax year decedent was due a refund:

Calendar year

, or other tax year beginning

, 19

, and ending

, 19

Name of decedent

Date of death

Decedent’s social security number

Name of person claiming refund

Please

type

or

Home address (number and street). If you have a P.O. box, see instructions.

Apt. no.

print

City, town or post office, state, and ZIP code. If you have a foreign address, see instructions.

Part I

Check the box that applies to you. Check only one box. Be sure to complete Part III below.

A

Surviving spouse requesting reissuance of a refund check. See instructions.

B

Court-appointed or certified personal representative. You may have to attach a court certificate showing your appointment.

See instructions.

C

Person, other than A or B, claiming refund for the decedent’s estate. Also, complete Part II. You may have to attach a copy

of the proof of death. See instructions.

Part II

Complete this part only if you checked the box on line C above.

Yes

No

1

Did the decedent leave a will?

2a Has a court appointed a personal representative for the estate of the decedent?

b If you answered “No” to 2a, will one be appointed?

If you answered “Yes” to 2a or 2b, the personal representative must file for the refund.

3

As the person claiming the refund for the decedent’s estate, will you pay out the refund according to the laws of

the state where the decedent was a legal resident?

If you answered “No” to 3, a refund cannot be made until you submit a court certificate showing your appointment

as personal representative or other evidence that you are entitled under state law to receive the refund.

Part III

Signature and verification. All filers must complete this part.

I request a refund of taxes overpaid by or on behalf of the decedent. Under penalties of perjury, I declare that I have examined this claim, and to

the best of my knowledge and belief, it is true, correct, and complete.

Signature of person claiming refund

Date

Paperwork Reduction Act Notice

General Instructions

We ask for the information on this form to carry out the

Purpose of Form

Internal Revenue laws of the United States. You are required

Use Form 1310 to claim a refund on behalf of a deceased

to give us the information. We need it to ensure that you are

taxpayer.

complying with these laws and to allow us to figure and

collect the right amount of tax.

Who Must File

The time needed to complete and file this form will vary

If you are claiming a refund on behalf of a deceased

depending on individual circumstances. The estimated

taxpayer, you must file Form 1310 unless either of the

average time is:

following applies:

Recordkeeping

7 min.

You are a surviving spouse filing an original or amended

Learning about the

joint return with the decedent, OR

law or the form

3 min.

You are a personal representative (see back of form) filing

Preparing the form

16 min.

an original Form 1040, Form 1040A, Form 1040EZ, or Form

1040NR for the decedent and a court certificate showing

Copying, assembling,

your appointment is attached to the return.

and sending the

form to the IRS

17 min.

Example. Assume Mr. Green died on January 4 before filing

his tax return. On April 3 of the same year, you were appointed

If you have comments concerning the accuracy of these

by the court as the personal representative for Mr. Green’s

time estimates or suggestions for making this form simpler,

estate and you file Form 1040 for Mr. Green. You do not need

we would be happy to hear from you. You can write to the

to file Form 1310 to claim the refund on Mr. Green’s tax return.

Internal Revenue Service, Attention: Tax Forms Committee,

However, you must attach to his return a copy of the court

PC:FP, Washington, DC 20224. DO NOT send the form to

certificate showing your appointment.

this address.

1310

Cat. No. 11566B

Form

(Rev. 3-95)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2