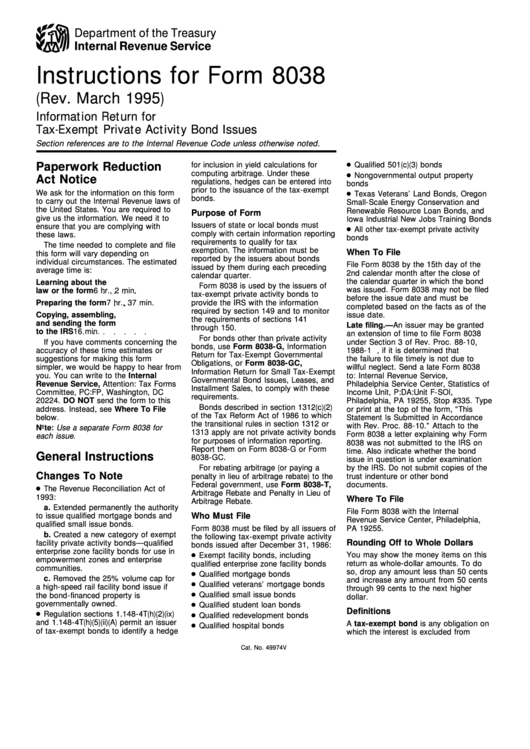

Instructions For Form 8038 (Rev. March 1995) - Information Return For Tax-Exempt Private Activity Bond Issues

ADVERTISEMENT

Department of the Treasury

Internal Revenue Service

Instructions for Form 8038

(Rev. March 1995)

Information Return for

Tax-Exempt Private Activity Bond Issues

Section references are to the Internal Revenue Code unless otherwise noted.

Paperwork Reduction

for inclusion in yield calculations for

Qualified 501(c)(3) bonds

computing arbitrage. Under these

Nongovernmental output property

Act Notice

regulations, hedges can be entered into

bonds

prior to the issuance of the tax-exempt

We ask for the information on this form

Texas Veterans’ Land Bonds, Oregon

bonds.

to carry out the Internal Revenue laws of

Small-Scale Energy Conservation and

the United States. You are required to

Renewable Resource Loan Bonds, and

Purpose of Form

give us the information. We need it to

Iowa Industrial New Jobs Training Bonds

Issuers of state or local bonds must

ensure that you are complying with

All other tax-exempt private activity

comply with certain information reporting

these laws.

bonds

requirements to qualify for tax

The time needed to complete and file

exemption. The information must be

When To File

this form will vary depending on

reported by the issuers about bonds

individual circumstances. The estimated

File Form 8038 by the 15th day of the

issued by them during each preceding

average time is:

2nd calendar month after the close of

calendar quarter.

the calendar quarter in which the bond

Learning about the

Form 8038 is used by the issuers of

was issued. Form 8038 may not be filed

law or the form

6 hr., 2 min.

tax-exempt private activity bonds to

before the issue date and must be

provide the IRS with the information

Preparing the form

7 hr., 37 min.

completed based on the facts as of the

required by section 149 and to monitor

Copying, assembling,

issue date.

the requirements of sections 141

and sending the form

Late filing.—An issuer may be granted

through 150.

to the IRS

16 min.

an extension of time to file Form 8038

For bonds other than private activity

If you have comments concerning the

under Section 3 of Rev. Proc. 88-10,

bonds, use Form 8038-G, Information

accuracy of these time estimates or

1988-1 C.B. 635, if it is determined that

Return for Tax-Exempt Governmental

suggestions for making this form

the failure to file timely is not due to

Obligations, or Form 8038-GC,

simpler, we would be happy to hear from

willful neglect. Send a late Form 8038

Information Return for Small Tax-Exempt

you. You can write to the Internal

to: Internal Revenue Service,

Governmental Bond Issues, Leases, and

Revenue Service, Attention: Tax Forms

Philadelphia Service Center, Statistics of

Installment Sales, to comply with these

Committee, PC:FP, Washington, DC

Income Unit, P:DA:Unit F-SOI,

requirements.

20224. DO NOT send the form to this

Philadelphia, PA 19255, Stop #335. Type

Bonds described in section 1312(c)(2)

address. Instead, see Where To File

or print at the top of the form, “This

of the Tax Reform Act of 1986 to which

below.

Statement Is Submitted in Accordance

the transitional rules in section 1312 or

with Rev. Proc. 88-10.” Attach to the

Note: Use a separate For m 8038 for

1313 apply are not private activity bonds

Form 8038 a letter explaining why Form

each issue.

for purposes of information reporting.

8038 was not submitted to the IRS on

Report them on Form 8038-G or Form

time. Also indicate whether the bond

General Instructions

8038-GC.

issue in question is under examination

For rebating arbitrage (or paying a

by the IRS. Do not submit copies of the

Changes To Note

penalty in lieu of arbitrage rebate) to the

trust indenture or other bond

Federal government, use Form 8038-T,

documents.

The Revenue Reconciliation Act of

Arbitrage Rebate and Penalty in Lieu of

1993:

Where To File

Arbitrage Rebate.

a. Extended permanently the authority

File Form 8038 with the Internal

Who Must File

to issue qualified mortgage bonds and

Revenue Service Center, Philadelphia,

qualified small issue bonds.

Form 8038 must be filed by all issuers of

PA 19255.

b. Created a new category of exempt

the following tax-exempt private activity

Rounding Off to Whole Dollars

facility private activity bonds—qualified

bonds issued after December 31, 1986:

enterprise zone facility bonds for use in

You may show the money items on this

Exempt facility bonds, including

empowerment zones and enterprise

return as whole-dollar amounts. To do

qualified enterprise zone facility bonds

communities.

so, drop any amount less than 50 cents

Qualified mortgage bonds

c. Removed the 25% volume cap for

and increase any amount from 50 cents

Qualified veterans’ mortgage bonds

a high-speed rail facility bond issue if

through 99 cents to the next higher

Qualified small issue bonds

the bond-financed property is

dollar.

governmentally owned.

Qualified student loan bonds

Definitions

Regulation sections 1.148-4T(h)(2)(ix)

Qualified redevelopment bonds

and 1.148-4T(h)(5)(ii)(A) permit an issuer

A tax-exempt bond is any obligation on

Qualified hospital bonds

of tax-exempt bonds to identify a hedge

which the interest is excluded from

Cat. No. 49974V

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4