Form 65 - Instructions - Partnership/limited Liability Company Return Of Income - 2016

ADVERTISEMENT

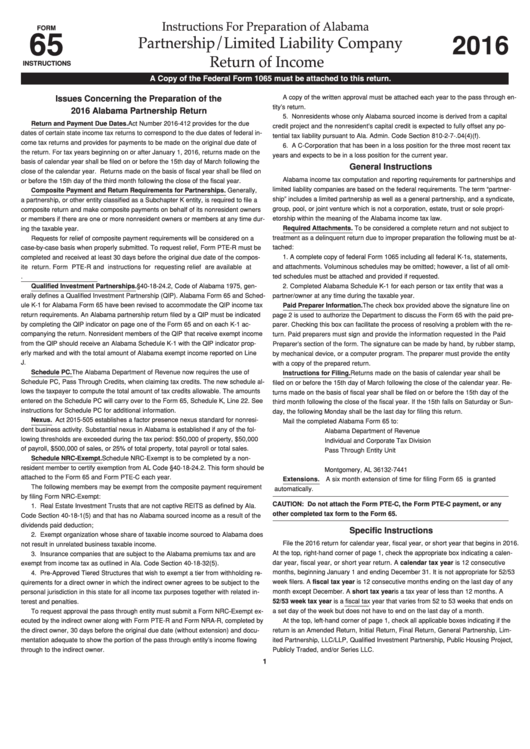

Instructions For Preparation of Alabama

Partnership/Limited Liability Company

FORM

Return of Income

2016

65

INSTRUCTIONS

A Copy of the Federal Form 1065 must be attached to this return.

Issues Concerning the Preparation of the

A copy of the written approval must be attached each year to the pass through en-

tity’s return.

2016 Alabama Partnership Return

5. Nonresidents whose only Alabama sourced income is derived from a capital

Return and Payment Due Dates. Act Number 2016-412 provides for the due

credit project and the nonresident’s capital credit is expected to fully offset any po-

dates of certain state income tax returns to correspond to the due dates of federal in-

tential tax liability pursuant to Ala. Admin. Code Section 810-2-7-.04(4)(f).

come tax returns and provides for payments to be made on the original due date of

6. A C-Corporation that has been in a loss position for the three most recent tax

the return. For tax years beginning on or after January 1, 2016, returns made on the

years and expects to be in a loss position for the current year.

basis of calendar year shall be filed on or before the 15th day of March following the

General Instructions

close of the calendar year. Returns made on the basis of fiscal year shall be filed on

Alabama income tax computation and reporting requirements for partnerships and

or before the 15th day of the third month following the close of the fiscal year.

limited liability companies are based on the federal requirements. The term “partner-

Composite Payment and Return Requirements for Partnerships. Generally,

ship” includes a limited partnership as well as a general partnership, and a syndicate,

a partnership, or other entity classified as a Subchapter K entity, is required to file a

group, pool, or joint venture which is not a corporation, estate, trust or sole propri-

composite return and make composite payments on behalf of its nonresident owners

etorship within the meaning of the Alabama income tax law.

or members if there are one or more nonresident owners or members at any time dur-

Required Attachments. To be considered a complete return and not subject to

ing the taxable year.

treatment as a delinquent return due to improper preparation the following must be at-

Requests for relief of composite payment requirements will be considered on a

case-by-case basis when properly submitted. To request relief, Form PTE-R must be

tached:

1. A complete copy of federal Form 1065 including all federal K-1s, statements,

completed and received at least 30 days before the original due date of the compos-

ite return. Form PTE-R and instructions for requesting relief are available at

and attachments. Voluminous schedules may be omitted; however, a list of all omit-

ted schedules must be attached and provided if requested.

Qualified Investment Partnerships. §40-18-24.2, Code of Alabama 1975, gen-

2. Completed Alabama Schedule K-1 for each person or tax entity that was a

erally defines a Qualified Investment Partnership (QIP). Alabama Form 65 and Sched-

partner/owner at any time during the taxable year.

ule K-1 for Alabama Form 65 have been revised to accommodate the QIP income tax

Paid Preparer Information. The check box provided above the signature line on

return requirements. An Alabama partnership return filed by a QIP must be indicated

page 2 is used to authorize the Department to discuss the Form 65 with the paid pre-

by completing the QIP indicator on page one of the Form 65 and on each K-1 ac-

parer. Checking this box can facilitate the process of resolving a problem with the re-

companying the return. Nonresident members of the QIP that receive exempt income

turn. Paid preparers must sign and provide the information requested in the Paid

from the QIP should receive an Alabama Schedule K-1 with the QIP indicator prop-

Preparer’s section of the form. The signature can be made by hand, by rubber stamp,

erly marked and with the total amount of Alabama exempt income reported on Line

by mechanical device, or a computer program. The preparer must provide the entity

J.

with a copy of the prepared return.

Schedule PC. The Alabama Department of Revenue now requires the use of

Instructions for Filing. Returns made on the basis of calendar year shall be

Schedule PC, Pass Through Credits, when claiming tax credits. The new schedule al-

filed on or before the 15th day of March following the close of the calendar year. Re-

lows the taxpayer to compute the total amount of tax credits allowable. The amounts

turns made on the basis of fiscal year shall be filed on or before the 15th day of the

entered on the Schedule PC will carry over to the Form 65, Schedule K, Line 22. See

third month following the close of the fiscal year. If the 15th falls on Saturday or Sun-

instructions for Schedule PC for additional information.

day, the following Monday shall be the last day for filing this return.

Nexus. Act 2015-505 establishes a factor presence nexus standard for nonresi-

Mail the completed Alabama Form 65 to:

dent business activity. Substantial nexus in Alabama is established if any of the fol-

Alabama Department of Revenue

lowing thresholds are exceeded during the tax period: $50,000 of property, $50,000

Individual and Corporate Tax Division

of payroll, $500,000 of sales, or 25% of total property, total payroll or total sales.

Pass Through Entity Unit

Schedule NRC-Exempt. Schedule NRC-Exempt is to be completed by a non-

P.O. Box 327441

resident member to certify exemption from AL Code §40-18-24.2. This form should be

Montgomery, AL 36132-7441

attached to the Form 65 and Form PTE-C each year.

Extensions. A six month extension of time for filing Form 65 is granted

The following members may be exempt from the composite payment requirement

automatically.

by filing Form NRC-Exempt:

CAUTION: Do not attach the Form PTE-C, the Form PTE-C payment, or any

1. Real Estate Investment Trusts that are not captive REITS as defined by Ala.

other completed tax form to the Form 65.

Code Section 40-18-1(5) and that has no Alabama sourced income as a result of the

dividends paid deduction;

Specific Instructions

2. Exempt organization whose share of taxable income sourced to Alabama does

File the 2016 return for calendar year, fiscal year, or short year that begins in 2016.

not result in unrelated business taxable income.

At the top, right-hand corner of page 1, check the appropriate box indicating a calen-

3. Insurance companies that are subject to the Alabama premiums tax and are

dar year, fiscal year, or short year return. A calendar tax year is 12 consecutive

exempt from income tax as outlined in Ala. Code Section 40-18-32(5).

months, beginning January 1 and ending December 31. It is not appropriate for 52/53

4. Pre-Approved Tiered Structures that wish to exempt a tier from withholding re-

week filers. A fiscal tax year is 12 consecutive months ending on the last day of any

quirements for a direct owner in which the indirect owner agrees to be subject to the

month except December. A short tax year is a tax year of less than 12 months. A

personal jurisdiction in this state for all income tax purposes together with related in-

terest and penalties.

52/53 week tax year is a fiscal tax year that varies from 52 to 53 weeks that ends on

a set day of the week but does not have to end on the last day of a month.

To request approval the pass through entity must submit a Form NRC-Exempt ex-

At the top, left-hand corner of page 1, check all applicable boxes indicating if the

ecuted by the indirect owner along with Form PTE-R and Form NRA-R, completed by

the direct owner, 30 days before the original due date (without extension) and docu-

return is an Amended Return, Initial Return, Final Return, General Partnership, Lim-

ited Partnership, LLC/LLP, Qualified Investment Partnership, Public Housing Project,

mentation adequate to show the portion of the pass through entity’s income flowing

through to the indirect owner.

Publicly Traded, and/or Series LLC.

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4