Montgomery County Unforeseen Emergency Withdrawal Form

ADVERTISEMENT

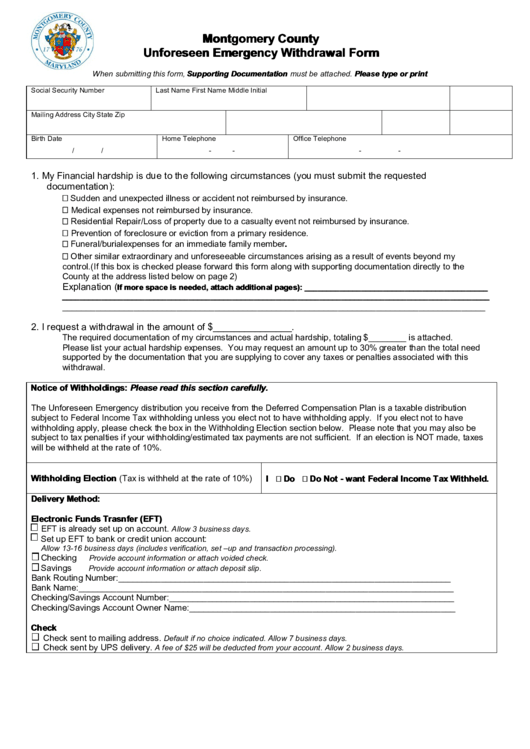

Montgomery County

Unforeseen Emergency Withdrawal Form

When submitting this form, Supporting Documentation must be attached. Please type or print

Social Security Number

Last Name

First Name

Middle Initial

Mailing Address

City

State

Zip

Birth Date

Home Telephone

Office Telephone

/

/

-

-

-

-

1. My Financial hardship is due to the following circumstances (you must submit the requested

documentation):

Sudden and unexpected illness or accident not reimbursed by insurance.

Medical expenses not reimbursed by insurance.

Residential Repair/Loss of property due to a casualty event not reimbursed by insurance.

Prevention of foreclosure or eviction from a primary residence.

Funeral/burial expenses for an immediate family member.

Other similar extraordinary and unforeseeable circumstances arising as a result of events beyond my

control.(If this box is checked please forward this form along with supporting documentation directly to the

County at the address listed below on page 2)

Explanation (

If more space is needed, attach additional pages): __________________________________________

__________________________________________________________________________________________________

_________________________________________________________________________________________

2. I request a withdrawal in the amount of $_______________.

The required documentation of my circumstances and actual hardship, totaling $________ is attached.

Please list your actual hardship expenses. You may request an amount up to 30% greater than the total need

supported by the documentation that you are supplying to cover any taxes or penalties associated with this

withdrawal.

Notice of Withholdings: Please read this section carefully.

The Unforeseen Emergency distribution you receive from the Deferred Compensation Plan is a taxable distribution

subject to Federal Income Tax withholding unless you elect not to have withholding apply. If you elect not to have

withholding apply, please check the box in the Withholding Election section below. Please note that you may also be

subject to tax penalties if your withholding/estimated tax payments are not sufficient. If an election is NOT made, taxes

will be withheld at the rate of 10%.

Withholding Election (Tax is withheld at the rate of 10%)

I

Do

Do Not - want Federal Income Tax Withheld.

Delivery Method:

Electronic Funds Trasnfer (EFT)

EFT is already set up on account.

Allow 3 business days.

Set up EFT to bank or credit union account:

Allow 13-16 business days (includes verification, set –up and transaction processing).

Checking

Provide account information or attach voided check.

Savings

Provide account information or attach deposit slip.

Bank Routing Number:______________________________________________________________________

Bank Name:_______________________________________________________________________________

Checking/Savings Account Number:____________________________________________________________

Checking/Savings Account Owner Name:________________________________________________________

Check

Check sent to mailing address.

Default if no choice indicated. Allow 7 business days.

Check sent by UPS delivery.

A fee of $25 will be deducted from your account. Allow 2 business days.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5