Instructions For Form 8849 - Claim For Refund Of Excise Taxes

ADVERTISEMENT

Department of the Treasury

Internal Revenue Service

Instructions for Form 8849

(January 1994)

Claim for Refund of Excise Taxes

Section references are to the Internal Revenue Code.

Paperwork Reduction

Generally, you can file more than

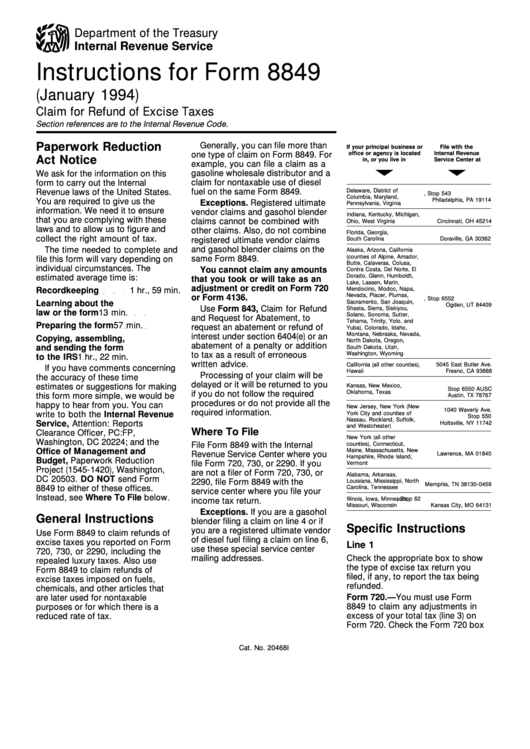

If your principal business or

File with the

one type of claim on Form 8849. For

office or agency is located

Internal Revenue

Act Notice

in, or you live in

Service Center at

example, you can file a claim as a

gasoline wholesale distributor and a

We ask for the information on this

claim for nontaxable use of diesel

form to carry out the Internal

fuel on the same Form 8849.

Delaware, District of

Revenue laws of the United States.

P.O. Box 21135, Stop 543

Columbia, Maryland,

You are required to give us the

Philadelphia, PA 19114

Exceptions. Registered ultimate

Pennsylvania, Virginia

information. We need it to ensure

vendor claims and gasohol blender

Indiana, Kentucky, Michigan,

P.O. Box 145500

that you are complying with these

claims cannot be combined with

Ohio, West Virginia

Cincinnati, OH 45214

laws and to allow us to figure and

other claims. Also, do not combine

Florida, Georgia,

P.O. Box 48549

collect the right amount of tax.

registered ultimate vendor claims

South Carolina

Doraville, GA 30362

and gasohol blender claims on the

The time needed to complete and

Alaska, Arizona, California

(counties of Alpine, Amador,

same Form 8849.

file this form will vary depending on

Butte, Calaveras, Colusa,

individual circumstances. The

You cannot claim any amounts

Contra Costa, Del Norte, El

Dorado, Glenn, Humboldt,

estimated average time is:

that you took or will take as an

Lake, Lassen, Marin,

adjustment or credit on Form 720

Mendocino, Modoc, Napa,

Recordkeeping

1 hr., 59 min.

Nevada, Placer, Plumas,

or Form 4136.

P.O. Box 9941, Stop 6552

Sacramento, San Joaquin,

Learning about the

Ogden, UT 84409

Use Form 843, Claim for Refund

Shasta, Sierra, Siskiyou,

law or the form

13 min.

Solano, Sonoma, Sutter,

and Request for Abatement, to

Tehama, Trinity, Yolo, and

Preparing the form

57 min.

request an abatement or refund of

Yuba), Colorado, Idaho,

Montana, Nebraska, Nevada,

interest under section 6404(e) or an

Copying, assembling,

North Dakota, Oregon,

abatement of a penalty or addition

and sending the form

South Dakota, Utah,

Washington, Wyoming

to tax as a result of erroneous

to the IRS

1 hr., 22 min.

written advice.

California (all other counties),

5045 East Butler Ave.

If you have comments concerning

Hawaii

Fresno, CA 93888

Processing of your claim will be

the accuracy of these time

P.O. Box 934

delayed or it will be returned to you

estimates or suggestions for making

Kansas, New Mexico,

Stop 6550 AUSC

Oklahoma, Texas

if you do not follow the required

this form more simple, we would be

Austin, TX 78767

procedures or do not provide all the

happy to hear from you. You can

New Jersey, New York (New

1040 Waverly Ave.

required information.

write to both the Internal Revenue

York City and counties of

Stop 550

Nassau, Rockland, Suffolk,

Service, Attention: Reports

Holtsville, NY 11742

and Westchester)

Where To File

Clearance Officer, PC:FP,

New York (all other

Washington, DC 20224; and the

File Form 8849 with the Internal

counties), Connecticut,

P.O. Box 628

Office of Management and

Maine, Massachusetts, New

Revenue Service Center where you

Lawrence, MA 01840

Hampshire, Rhode Island,

Budget, Paperwork Reduction

file Form 720, 730, or 2290. If you

Vermont

Project (1545-1420), Washington,

are not a filer of Form 720, 730, or

Alabama, Arkansas,

DC 20503. DO NOT send Form

P.O. Box 30459

2290, file Form 8849 with the

Louisiana, Mississippi, North

Memphis, TN 38130-0459

8849 to either of these offices.

Carolina, Tennessee

service center where you file your

Instead, see Where To File below.

Illinois, Iowa, Minnesota,

P.O. Box 24551, Stop 62

income tax return.

Missouri, Wisconsin

Kansas City, MO 64131

Exceptions. If you are a gasohol

General Instructions

blender filing a claim on line 4 or if

Specific Instructions

you are a registered ultimate vendor

Use Form 8849 to claim refunds of

of diesel fuel filing a claim on line 6,

excise taxes you reported on Form

Line 1

use these special service center

720, 730, or 2290, including the

mailing addresses.

Check the appropriate box to show

repealed luxury taxes. Also use

the type of excise tax return you

Form 8849 to claim refunds of

filed, if any, to report the tax being

excise taxes imposed on fuels,

refunded.

chemicals, and other articles that

Form 720.—You must use Form

are later used for nontaxable

8849 to claim any adjustments in

purposes or for which there is a

excess of your total tax (line 3) on

reduced rate of tax.

Form 720. Check the Form 720 box

Cat. No. 20468I

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4