Application For Residence Homestead Exemption - Harris County Appraisal District

ADVERTISEMENT

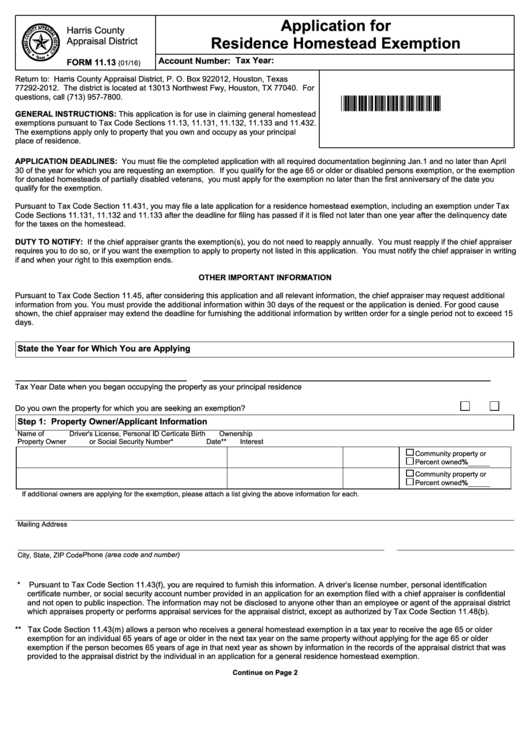

Application for

Harris County

Residence Homestead Exemption

Appraisal District

Tax Year:

Account Number:

FORM 11.13

(01/16)

Return to: Harris County Appraisal District, P. O. Box 922012, Houston, Texas

77292-2012. The district is located at 13013 Northwest Fwy, Houston, TX 77040. For

questions, call (713) 957-7800.

*NEWHS111*

GENERAL INSTRUCTIONS: This application is for use in claiming general homestead

exemptions pursuant to Tax Code Sections 11.13, 11.131, 11.132, 11.133 and 11.432.

The exemptions apply only to property that you own and occupy as your principal

place of residence.

APPLICATION DEADLINES: You must file the completed application with all required documentation beginning Jan.1 and no later than April

30 of the year for which you are requesting an exemption. If you qualify for the age 65 or older or disabled persons exemption, or the exemption

for donated homesteads of partially disabled veterans, you must apply for the exemption no later than the first anniversary of the date you

qualify for the exemption.

Pursuant to Tax Code Section 11.431, you may file a late application for a residence homestead exemption, including an exemption under Tax

Code Sections 11.131, 11.132 and 11.133 after the deadline for filing has passed if it is filed not later than one year after the delinquency date

for the taxes on the homestead.

DUTY TO NOTIFY: If the chief appraiser grants the exemption(s), you do not need to reapply annually. You must reapply if the chief appraiser

requires you to do so, or if you want the exemption to apply to property not listed in this application. You must notify the chief appraiser in writing

if and when your right to this exemption ends.

OTHER IMPORTANT INFORMATION

Pursuant to Tax Code Section 11.45, after considering this application and all relevant information, the chief appraiser may request additional

information from you. You must provide the additional information within 30 days of the request or the application is denied. For good cause

shown, the chief appraiser may extend the deadline for furnishing the additional information by written order for a single period not to exceed 15

days.

State the Year for Which You are Applying

Tax Year

Date when you began occupying the property as your principal residence

Do you own the property for which you are seeking an exemption?

...........................................................

Yes

No

Step 1: Property Owner/Applicant Information

Name of

Driver's License, Personal ID Certicate

Birth

Ownership

Property Owner

or Social Security Number*

Date**

Interest

Community property or

Percent owned

%

Community property or

Percent owned

%

If additional owners are applying for the exemption, please attach a list giving the above information for each.

Mailing Address

Phone (area code and number)

City, State, ZIP Code

*

Pursuant to Tax Code Section 11.43(f), you are required to furnish this information. A driver’s license number, personal identification

certificate number, or social security account number provided in an application for an exemption filed with a chief appraiser is confidential

and not open to public inspection. The information may not be disclosed to anyone other than an employee or agent of the appraisal district

which appraises property or performs appraisal services for the appraisal district, except as authorized by Tax Code Section 11.48(b).

** Tax Code Section 11.43(m) allows a person who receives a general homestead exemption in a tax year to receive the age 65 or older

exemption for an individual 65 years of age or older in the next tax year on the same property without applying for the age 65 or older

exemption if the person becomes 65 years of age in that next year as shown by information in the records of the appraisal district that was

provided to the appraisal district by the individual in an application for a general residence homestead exemption.

Continue on Page 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4