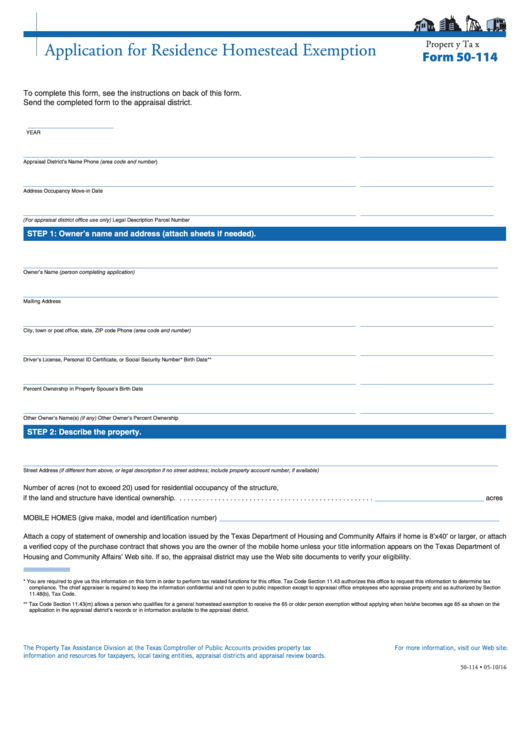

P r o p e r t y T a x

Application for Residence Homestead Exemption

Form 50-114

To complete this form, see the instructions on back of this form.

Send the completed form to the appraisal district.

__________________

YEAR

______________________________________________________________________

____________________________

Appraisal District’s Name

Phone (area code and number)

______________________________________________________________________

____________________________

Address

Occupancy Move-in Date

______________________________________________________________________

____________________________

(For appraisal district office use only) Legal Description

Parcel Number

STEP 1: Owner’s name and address (attach sheets if needed).

____________________________________________________________________________________________________

Owner’s Name (person completing application)

____________________________________________________________________________________________________

Mailing Address

______________________________________________________________________

____________________________

City, town or post office, state, ZIP code

Phone (area code and number)

______________________________________________________________________

____________________________

Driver’s License, Personal ID Certificate, or Social Security Number*

Birth Date**

______________________________________________________________________

____________________________

Percent Ownership in Property

Spouse’s Birth Date

______________________________________________________________________

____________________________

Other Owner’s Name(s) (if any)

Other Owner’s Percent Ownership

STEP 2: Describe the property.

____________________________________________________________________________________________________

Street Address (if different from above, or legal description if no street address; include property account number, if available)

Number of acres (not to exceed 20) used for residential occupancy of the structure,

_______________________

if the land and structure have identical ownership. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

acres

___________________________________________________________

MOBILE HOMES (give make, model and identification number)

Attach a copy of statement of ownership and location issued by the Texas Department of Housing and Community Affairs if home is 8’x40’ or larger, or attach

a verified copy of the purchase contract that shows you are the owner of the mobile home unless your title information appears on the Texas Department of

Housing and Community Affairs’ Web site. If so, the appraisal district may use the Web site documents to verify your eligibility.

* You are required to give us this information on this form in order to perform tax related functions for this office. Tax Code Section 11.43 authorizes this office to request this information to determine tax

compliance. The chief appraiser is required to keep the information confidential and not open to public inspection except to appraisal office employees who appraise property and as authorized by Section

11.48(b), Tax Code.

** Tax Code Section 11.43(m) allows a person who qualifies for a general homestead exemption to receive the 65 or older person exemption without applying when he/she becomes age 65 as shown on the

application in the appraisal district’s records or in information available to the appraisal district.

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our Web site:

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-114 • 05-10/16

1

1 2

2