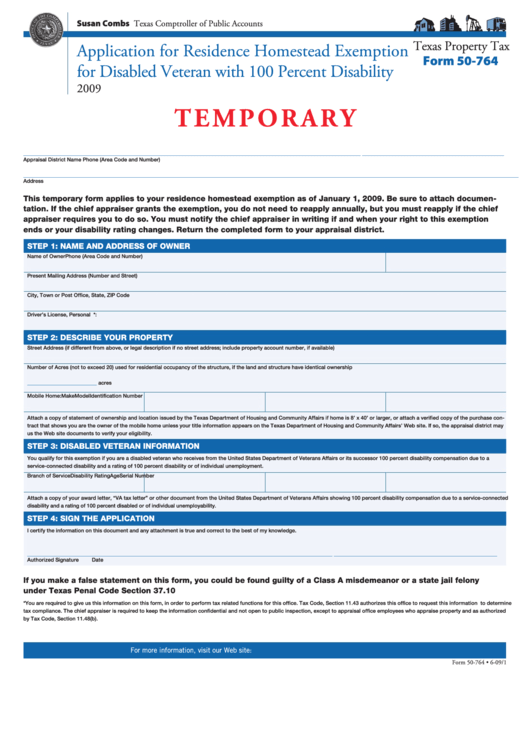

Susan Combs Texas Comptroller of Public Accounts

Texas Property Tax

Application for Residence Homestead Exemption

Form 50-764

for Disabled Veteran with 100 Percent Disability

2009

T E M POR A RY

______________________________________________________________________________________________________________________________

_____________________________________________________

Appraisal District Name

Phone (Area Code and Number)

_________________________________________________________________________________________________________________________________________________________________________________________

Address

This temporary form applies to your residence homestead exemption as of January 1, 2009. Be sure to attach documen-

tation. If the chief appraiser grants the exemption, you do not need to reapply annually, but you must reapply if the chief

appraiser requires you to do so. You must notify the chief appraiser in writing if and when your right to this exemption

ends or your disability rating changes. Return the completed form to your appraisal district.

STEP 1: NAME AND ADDRESS OF OWNER

Name of Owner

Phone (Area Code and Number)

Present Mailing Address (Number and Street)

City, Town or Post Office, State, ZIP Code

Driver’s License, Personal I.D. Certificate or Social Security Number*:

STEP 2: DESCRIBE YOUR PROPERTY

Street Address (if different from above, or legal description if no street address; include property account number, if available)

Number of Acres (not to exceed 20) used for residential occupancy of the structure, if the land and structure have identical ownership

__________________________

acres

Mobile Home:

Make

Model

Identification Number

Attach a copy of statement of ownership and location issued by the Texas Department of Housing and Community Affairs if home is 8’ x 40’ or larger, or attach a verified copy of the purchase con-

tract that shows you are the owner of the mobile home unless your title information appears on the Texas Department of Housing and Community Affairs’ Web site. If so, the appraisal district may

us the Web site documents to verify your eligibility.

STEP 3: DISABLED VETERAN INFORMATION

You qualify for this exemption if you are a disabled veteran who receives from the United States Department of Veterans Affairs or its successor 100 percent disability compensation due to a

service-connected disability and a rating of 100 percent disability or of individual unemployment.

Branch of Service

Disability Rating

Age

Serial Number

Attach a copy of your award letter, “VA tax letter” or other document from the United States Department of Veterans Affairs showing 100 percent disability compensation due to a service-connected

disability and a rating of 100 percent disabled or of individual unemployability.

STEP 4: SIGN THE APPLICATION

I certify the information on this document and any attachment is true and correct to the best of my knowledge.

__________________________________________________________________________________________________________________

_____________________________________________________________

Authorized Signature

Date

If you make a false statement on this form, you could be found guilty of a Class A misdemeanor or a state jail felony

under Texas Penal Code Section 37.10

*You are required to give us this information on this form, in order to perform tax related functions for this office. Tax Code, Section 11.43 authorizes this office to request this information to determine

tax compliance. The chief appraiser is required to keep the information confidential and not open to public inspection, except to appraisal office employees who appraise property and as authorized

by Tax Code, Section 11.48(b).

For more information, visit our Web site:

Form 50-764 • 6-09/1

1

1