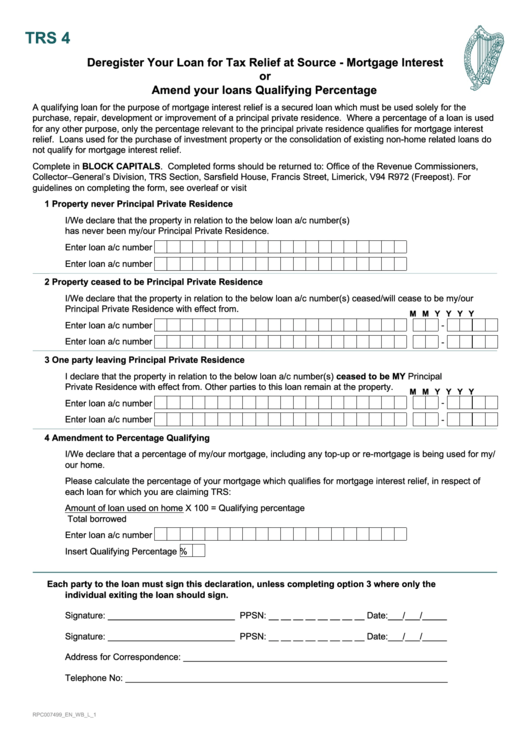

TRS 4

Deregister Your Loan for Tax Relief at Source - Mortgage Interest

or

Amend your loans Qualifying Percentage

A qualifying loan for the purpose of mortgage interest relief is a secured loan which must be used solely for the

purchase, repair, development or improvement of a principal private residence. Where a percentage of a loan is used

for any other purpose, only the percentage relevant to the principal private residence qualifies for mortgage interest

relief. Loans used for the purchase of investment property or the consolidation of existing non-home related loans do

not qualify for mortgage interest relief.

Complete in BLOCK CAPITALS. Completed forms should be returned to: Office of the Revenue Commissioners,

Collector–General’s Division, TRS Section, Sarsfield House, Francis Street, Limerick, V94 R972 (Freepost). For

guidelines on completing the form, see overleaf or visit

1

Property never Principal Private Residence

I/We declare that the property in relation to the below loan a/c number(s)

has never been my/our Principal Private Residence.

Enter loan a/c number

Enter loan a/c number

2

Property ceased to be Principal Private Residence

I/We declare that the property in relation to the below loan a/c number(s) ceased/will cease to be my/our

Principal Private Residence with effect from.

M M

Y Y Y Y

Enter loan a/c number

-

Enter loan a/c number

-

3

One party leaving Principal Private Residence

I declare that the property in relation to the below loan a/c number(s) ceased to be MY Principal

Private Residence with effect from. Other parties to this loan remain at the property.

M M

Y Y Y Y

Enter loan a/c number

-

Enter loan a/c number

-

4

Amendment to Percentage Qualifying

I/We declare that a percentage of my/our mortgage, including any top-up or re-mortgage is being used for my/

our home.

Please calculate the percentage of your mortgage which qualifies for mortgage interest relief, in respect of

each loan for which you are claiming TRS:

Amount of loan used on home

X 100 = Qualifying percentage

Total borrowed

Enter loan a/c number

Insert Qualifying Percentage

%

Each party to the loan must sign this declaration, unless completing option 3 where only the

individual exiting the loan should sign.

Signature: __________________________ PPSN: __ __ __ __ __ __ __ __ Date:___/___/_____

Signature: __________________________ PPSN: __ __ __ __ __ __ __ __ Date:___/___/_____

Address for Correspondence: ______________________________________________________

Telephone No: __________________________________________________________________

RPC007499_EN_WB_L_1

1

1 2

2