Form 5472 (Rev. December 2011) Page 2

Download a blank fillable Form 5472 (Rev. December 2011) in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form 5472 (Rev. December 2011) with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

2

Form 5472 (Rev. 12-2011)

Page

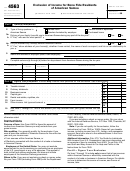

Part IV

Monetary Transactions Between Reporting Corporations and Foreign Related Party

(see instructions)

Caution: Part IV must be completed if the “foreign person” box is checked in the heading for Part III.

If estimates are used, check here

▶

1

Sales of stock in trade (inventory) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

1

2

2

Sales of tangible property other than stock in trade .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3 a

Rents received (for other than intangible property rights)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3a

b

Royalties received (for other than intangible property rights)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3b

4

4

Sales, leases, licenses, etc., of intangible property rights (e.g., patents, trademarks, secret formulas)

.

.

.

5

Consideration received for technical, managerial, engineering, construction, scientific, or like services .

.

.

5

6

Commissions received

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6

7

7b

Amounts borrowed (see instructions)

a Beginning balance

b Ending balance or monthly average

▶

8

8

Interest received .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9

Premiums received for insurance or reinsurance .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9

10

Other amounts received (see instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

10

11

Total. Combine amounts on lines 1 through 10 .

11

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

12

Purchases of stock in trade (inventory) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

12

13

Purchases of tangible property other than stock in trade

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

13

14 a

14a

Rents paid (for other than intangible property rights) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

b

Royalties paid (for other than intangible property rights) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

14b

15

Purchases, leases, licenses, etc., of intangible property rights (e.g., patents, trademarks, secret formulas) .

.

15

16

Consideration paid for technical, managerial, engineering, construction, scientific, or like services

.

.

.

.

16

17

17

Commissions paid

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

18

18b

Amounts loaned (see instructions)

a Beginning balance

b Ending balance or monthly average

▶

19

Interest paid

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

19

20

20

Premiums paid for insurance or reinsurance .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

21

Other amounts paid (see instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

21

22

Total. Combine amounts on lines 12 through 21

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

22

Part V

Nonmonetary and Less-Than-Full Consideration Transactions Between the Reporting Corporation and

the Foreign Related Party

(see instructions)

Describe these transactions on an attached separate sheet and check here.

▶

Part VI

Additional Information

All reporting corporations must complete Part VI.

1

Does the reporting corporation import goods from a foreign related party? .

.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

2 a

If “Yes,” is the basis or inventory cost of the goods valued at greater than the customs value of the imported goods?

Yes

No

If “No,” do not complete b and c below.

b

If “Yes,” attach a statement explaining the reason or reasons for such difference.

c

If the answers to questions 1 and 2a are “Yes,” were the documents used to support this treatment of the imported

goods in existence and available in the United States at the time of filing Form 5472? .

.

.

.

.

.

.

.

.

.

.

Yes

No

General Instructions

• A foreign corporation engaged in a trade or

• Any person who is related (within the

business within the United States.

meaning of section 267(b) or 707(b)(1)) to the

Section references are to the Internal

reporting corporation,

25% foreign owned. A corporation is 25%

Revenue Code unless otherwise noted.

foreign owned if it has at least one direct or

• Any person who is related (within the

indirect 25% foreign shareholder at any time

meaning of section 267(b) or 707(b)(1)) to a

What’s New

during the tax year.

25% foreign shareholder of the reporting

T.D. 9529, 2011-30 I.R.B. 57, removed the

corporation, or

25% foreign shareholder. Generally, a

duplicate filing requirement for Form 5472

foreign person (defined on page 3) is a 25%

• Any other person who is related to the

contained in Regulations sections

foreign shareholder if the person owns,

reporting corporation within the meaning of

1.6038A-2(d) and 1.6038A-2(e). See When

directly or indirectly, at least 25% of either:

section 482 and the related regulations.

and Where To File on page 3 for revised filing

• The total voting power of all classes of

“Related party” does not include any

requirements.

stock entitled to vote or

corporation filing a consolidated Federal

Purpose of Form

income tax return with the reporting

• The total value of all classes of stock of the

corporation.

corporation.

Use Form 5472 to provide information

The rules in section 318 apply to the

The constructive ownership rules of section

required under sections 6038A and 6038C

definition of related party with the

318 apply with the following modifications to

when reportable transactions occur during

modifications listed under the definition of

determine if a corporation is 25% foreign

the tax year of a reporting corporation with a

25% foreign shareholder above.

owned. Substitute “10%” for “50%” in

foreign or domestic related party.

section 318(a)(2)(C). Do not apply sections

Reportable transaction. A reportable

Definitions

318(a)(3)(A), (B), and (C) so as to consider a

transaction is:

U.S. person as owning stock that is owned

• Any type of transaction listed in Part IV (e.g.,

Reporting corporation. A reporting

by a foreign person.

sales, rents, etc.) for which monetary

corporation is either:

Related party. A related party is:

consideration (including U.S. and foreign

• A 25% foreign-owned U.S. corporation or

currency) was the sole consideration paid or

• Any direct or indirect 25% foreign

received during the reporting corporation’s

shareholder of the reporting corporation,

tax year or

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2