Form Nj-1040-H 2015 Property Tax Credit Application (Instructions)

ADVERTISEMENT

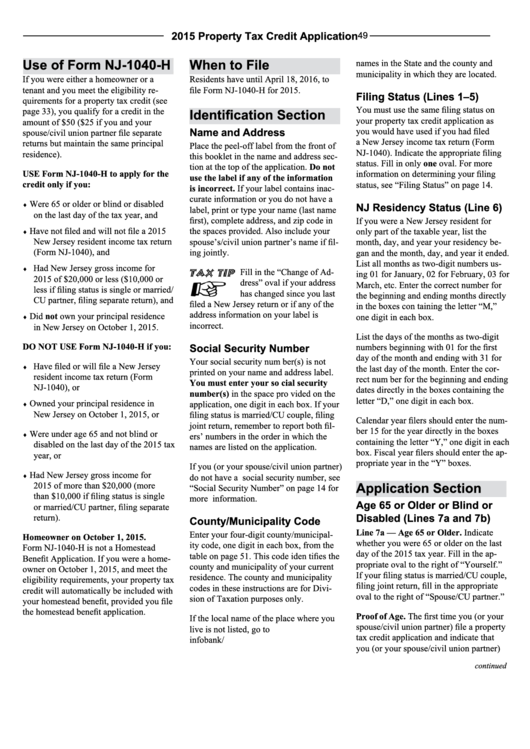

2015 Property Tax Credit Application

49

Use of Form NJ-1040-H

When to File

names in the State and the county and

municipality in which they are located.

If you were either a homeowner or a

Residents have until April 18, 2016, to

tenant and you meet the eligibility re-

file Form NJ-1040-H for 2015.

Filing Status (Lines 1–5)

quirements for a property tax credit (see

You must use the same filing status on

page 33), you qualify for a credit in the

Identification Section

your property tax credit application as

amount of $50 ($25 if you and your

Name and Address

you would have used if you had filed

spouse/civil union partner file separate

a New Jersey income tax return (Form

returns but maintain the same principal

Place the peel-off label from the front of

NJ-1040). Indicate the appropriate filing

residence).

this booklet in the name and address sec-

status. Fill in only one oval. For more

tion at the top of the application. Do not

USE Form NJ-1040-H to apply for the

information on determining your filing

use the label if any of the information

credit only if you:

status, see “Filing Status” on page 14.

is incorrect. If your label contains inac-

curate information or you do not have a

Were 65 or older or blind or disabled

♦

NJ Residency Status (Line 6)

label, print or type your name (last name

on the last day of the tax year, and

first), complete address, and zip code in

If you were a New Jersey resident for

Have not filed and will not file a 2015

the spaces provided. Also include your

only part of the taxable year, list the

♦

New Jersey resident income tax return

spouse’s/civil union partner’s name if fil-

month, day, and year your residency be-

(Form NJ-1040), and

ing jointly.

gan and the month, day, and year it ended.

List all months as two-digit numbers us-

Had New Jersey gross income for

♦

Fill in the “Change of Ad-

ing 01 for January, 02 for February, 03 for

2015 of $20,000 or less ($10,000 or

dress” oval if your address

March, etc. Enter the correct number for

less if filing status is single or married/

has changed since you last

the beginning and ending months directly

CU partner, filing separate return), and

filed a New Jersey return or if any of the

in the boxes con taining the letter “M,”

address information on your label is

Did not own your principal residence

one digit in each box.

♦

incorrect.

in New Jersey on October 1, 2015.

List the days of the months as two-digit

DO NOT USE Form NJ-1040-H if you:

Social Security Number

numbers beginning with 01 for the first

day of the month and ending with 31 for

Your social security num ber(s) is not

Have filed or will file a New Jersey

the last day of the month. Enter the cor-

♦

printed on your name and address label.

resident income tax return (Form

rect num ber for the beginning and ending

You must enter your so cial security

NJ-1040), or

dates directly in the boxes containing the

number(s) in the space pro vided on the

letter “D,” one digit in each box.

Owned your principal residence in

application, one digit in each box. If your

♦

New Jersey on October 1, 2015, or

filing status is married/CU couple, filing

Calendar year filers should enter the num-

joint return, remember to report both fil-

ber 15 for the year directly in the boxes

Were under age 65 and not blind or

ers’ numbers in the order in which the

♦

containing the letter “Y,” one digit in each

disabled on the last day of the 2015 tax

names are listed on the application.

box. Fiscal year filers should enter the ap-

year, or

propriate year in the “Y” boxes.

If you (or your spouse/civil union partner)

Had New Jersey gross income for

do not have a social security number, see

♦

2015 of more than $20,000 (more

Application Section

“Social Security Number” on page 14 for

than $10,000 if filing status is single

more information.

Age 65 or Older or Blind or

or married/CU partner, filing separate

Disabled (Lines 7a and 7b)

return).

County/Municipality Code

Line 7a — Age 65 or Older. Indicate

Enter your four-digit county/municipal-

Homeowner on October 1, 2015.

whether you were 65 or older on the last

ity code, one digit in each box, from the

Form NJ-1040-H is not a Homestead

day of the 2015 tax year. Fill in the ap-

table on page 51. This code iden tifies the

Benefit Application. If you were a home-

propriate oval to the right of “Yourself.”

county and municipality of your current

owner on October 1, 2015, and meet the

If your filing status is married/CU couple,

residence. The county and municipality

eligibility requirements, your property tax

filing joint return, fill in the appropriate

codes in these instructions are for Divi-

credit will automatically be included with

oval to the right of “Spouse/CU partner.”

sion of Taxation purposes only.

your homestead benefit, provided you file

the homestead benefit application.

Proof of Age. The first time you (or your

If the local name of the place where you

spouse/civil union partner) file a property

live is not listed, go to

tax credit application and indicate that

infobank/locality.htm for a listing of local

you (or your spouse/civil union partner)

continued

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2