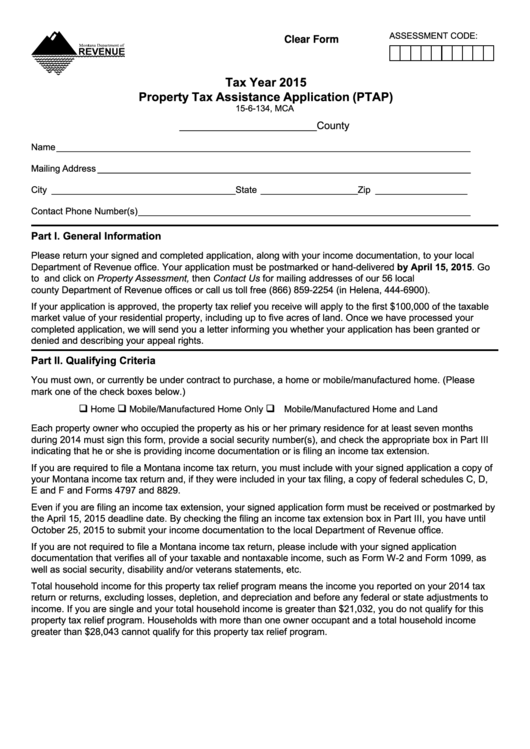

ASSESSMENT CODE:

Clear Form

Tax Year 2015

Property Tax Assistance Application (PTAP)

15-6-134, MCA

________________________County

Name _________________________________________________________________________________

Mailing Address _________________________________________________________________________

City ____________________________________State ___________________ Zip __________________

Contact Phone Number(s) _________________________________________________________________

Part I. General Information

Please return your signed and completed application, along with your income documentation, to your local

Department of Revenue office. Your application must be postmarked or hand-delivered by April 15, 2015. Go

to revenue.mt.gov and click on Property Assessment, then Contact Us for mailing addresses of our 56 local

county Department of Revenue offices or call us toll free (866) 859-2254 (in Helena, 444-6900).

If your application is approved, the property tax relief you receive will apply to the first $100,000 of the taxable

market value of your residential property, including up to five acres of land. Once we have processed your

completed application, we will send you a letter informing you whether your application has been granted or

denied and describing your appeal rights.

Part II. Qualifying Criteria

You must own, or currently be under contract to purchase, a home or mobile/manufactured home. (Please

mark one of the check boxes below.)

q

Home

q

Mobile/Manufactured Home Only

q

Mobile/Manufactured Home and Land

Each property owner who occupied the property as his or her primary residence for at least seven months

during 2014 must sign this form, provide a social security number(s), and check the appropriate box in Part III

indicating that he or she is providing income documentation or is filing an income tax extension.

If you are required to file a Montana income tax return, you must include with your signed application a copy of

your Montana income tax return and, if they were included in your tax filing, a copy of federal schedules C, D,

E and F and Forms 4797 and 8829.

Even if you are filing an income tax extension, your signed application form must be received or postmarked by

the April 15, 2015 deadline date. By checking the filing an income tax extension box in Part III, you have until

October 25, 2015 to submit your income documentation to the local Department of Revenue office.

If you are not required to file a Montana income tax return, please include with your signed application

documentation that verifies all of your taxable and nontaxable income, such as Form W-2 and Form 1099, as

well as social security, disability and/or veterans statements, etc.

Total household income for this property tax relief program means the income you reported on your 2014 tax

return or returns, excluding losses, depletion, and depreciation and before any federal or state adjustments to

income. If you are single and your total household income is greater than $21,032, you do not qualify for this

property tax relief program. Households with more than one owner occupant and a total household income

greater than $28,043 cannot qualify for this property tax relief program.

1

1 2

2