Instructions For Completing 401(K) Bonus Deferral Election Form

ADVERTISEMENT

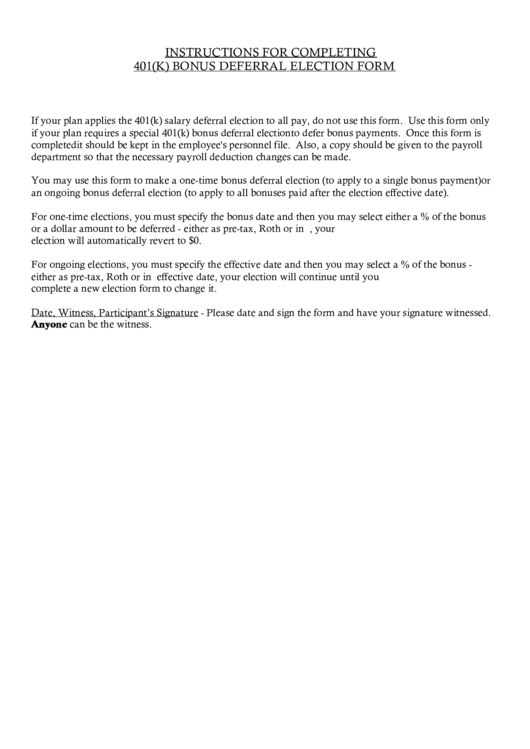

INSTRUCTIONS FOR COMPLETING

401(K) BONUS DEFERRAL ELECTION FORM

If your plan applies the 401(k) salary deferral election to all pay, do not use this form. Use this form only

if your plan requires a special 401(k) bonus deferral election to defer bonus payments. Once this form is

completed it should be kept in the employee's personnel file. Also, a copy should be given to the payroll

department so that the necessary payroll deduction changes can be made.

You may use this form to make a one-time bonus deferral election (to apply to a single bonus payment) or

an ongoing bonus deferral election (to apply to all bonuses paid after the election effective date).

For one-time elections, you must specify the bonus date and then you may select either a % of the bonus

or a dollar amount to be deferred - either as pre-tax, Roth or in combination. After the bonus date, your

election will automatically revert to $0.

For ongoing elections, you must specify the effective date and then you may select a % of the bonus -

either as pre-tax, Roth or in combination. After the effective date, your election will continue until you

complete a new election form to change it.

Date, Witness, Participant’s Signature - Please date and sign the form and have your signature witnessed.

Anyone can be the witness.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2