Instructions For Completing The Certificate Of Limited Partnership (Form Lp-1) - California Secretary Of State

ADVERTISEMENT

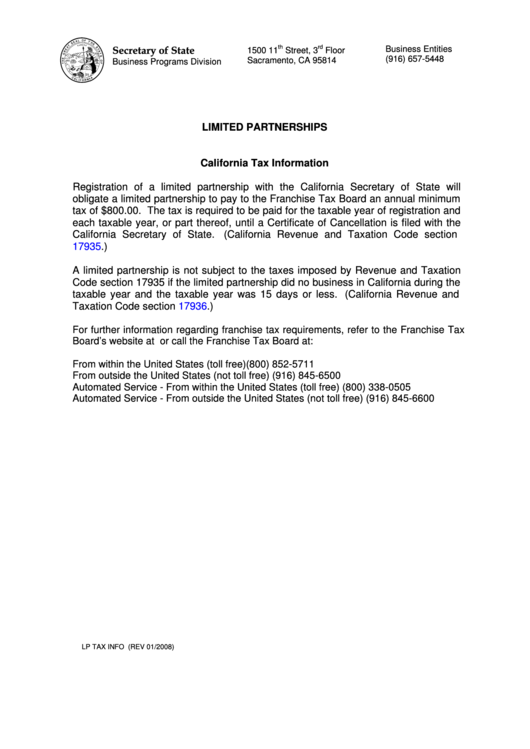

Secretary of State

th

rd

Business Entities

1500 11

Street, 3

Floor

(916) 657-5448

Sacramento, CA 95814

Business Programs Division

LIMITED PARTNERSHIPS

California Tax Information

Registration of a limited partnership with the California Secretary of State will

obligate a limited partnership to pay to the Franchise Tax Board an annual minimum

tax of $800.00. The tax is required to be paid for the taxable year of registration and

each taxable year, or part thereof, until a Certificate of Cancellation is filed with the

California Secretary of State.

(California Revenue and Taxation Code section

17935.)

A limited partnership is not subject to the taxes imposed by Revenue and Taxation

Code section 17935 if the limited partnership did no business in California during the

taxable year and the taxable year was 15 days or less. (California Revenue and

Taxation Code section 17936.)

For further information regarding franchise tax requirements, refer to the Franchise Tax

Board’s website at

or call the Franchise Tax Board at:

From within the United States (toll free) ................................................... (800) 852-5711

From outside the United States (not toll free) ........................................... (916) 845-6500

Automated Service - From within the United States (toll free).................. (800) 338-0505

Automated Service - From outside the United States (not toll free) ......... (916) 845-6600

LP TAX INFO (REV 01/2008)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2