General Instructions For Form 500-Nold

ADVERTISEMENT

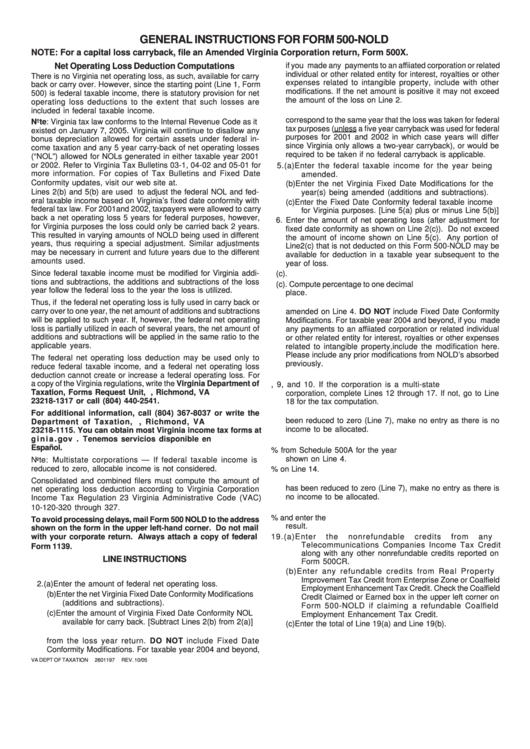

GENERAL INSTRUCTIONS FOR FORM 500-NOLD

NOTE: For a capital loss carryback, file an Amended Virginia Corporation return, Form 500X.

Net Operating Loss Deduction Computations

if you made any payments to an affiiated corporation or related

individual or other related entity for interest, royalties or other

There is no Virginia net operating loss, as such, available for carry

expenses related to intangible property, include with other

back or carry over. However, since the starting point (Line 1, Form

modifications. If the net amount is positive it may not exceed

500) is federal taxable income, there is statutory provision for net

the amount of the loss on Line 2.

operating loss deductions to the extent that such losses are

included in federal taxable income.

4. Enter the taxable year to which the loss was taken. This must

correspond to the same year that the loss was taken for federal

Note: Virginia tax law conforms to the Internal Revenue Code as it

tax purposes (unless a five year carryback was used for federal

existed on January 7, 2005. Virginia will continue to disallow any

purposes for 2001 and 2002 in which case years will differ

bonus depreciation allowed for certain assets under federal in-

since Virginia only allows a two-year carryback), or would be

come taxation and any 5 year carry-back of net operating losses

required to be taken if no federal carryback is applicable.

(“NOL”) allowed for NOLs generated in either taxable year 2001

or 2002. Refer to Virginia Tax Bulletins 03-1, 04-02 and 05-01 for

5. (a) Enter the federal taxable income for the year being

more information. For copies of Tax Bulletins and Fixed Date

amended.

Conformity updates, visit our web site at

(b) Enter the net Virginia Fixed Date Modifications for the

Lines 2(b) and 5(b) are used to adjust the federal NOL and fed-

year(s) being amended (additions and subtractions).

eral taxable income based on Virginia’s fixed date conformity with

(c) Enter the Fixed Date Conformity federal taxable income

federal tax law. For 2001and 2002, taxpayers were allowed to carry

for Virginia purposes. [Line 5(a) plus or minus Line 5(b)]

back a net operating loss 5 years for federal purposes, however,

6. Enter the amount of net operating loss (after adjustment for

for Virginia purposes the loss could only be carried back 2 years.

fixed date conformity as shown on Line 2(c)). Do not exceed

This resulted in varying amounts of NOLD being used in different

the amount of income shown on Line 5(c). Any portion of

years, thus requiring a special adjustment. Similar adjustments

Line2(c) that is not deducted on this Form 500-NOLD may be

may be necessary in current and future years due to the different

available for deduction in a taxable year subsequent to the

amounts used.

year of loss.

Since federal taxable income must be modified for Virginia addi-

7. Subtract Line 6 from Line 5(c).

tions and subtractions, the additions and subtractions of the loss

8. Divide Line 6 by Line 2(c). Compute percentage to one decimal

year follow the federal loss to the year the loss is utilized.

place.

Thus, if the federal net operating loss is fully used in carry back or

9. Enter the net additions and subtractions from the year being

carry over to one year, the net amount of additions and subtractions

amended on Line 4. DO NOT include Fixed Date Conformity

will be applied to such year. If, however, the federal net operating

Modifications. For taxable year 2004 and beyond, if you made

loss is partially utilized in each of several years, the net amount of

any payments to an affiiated corporation or related individual

additions and subtractions will be applied in the same ratio to the

or other related entity for interest, royalties or other expenses

applicable years.

related to intangible property,include the modification here.

Please include any prior modifications from NOLD’s absorbed

The federal net operating loss deduction may be used only to

previously.

reduce federal taxable income, and a federal net operating loss

10. Multiply Line 3 by the percentage on Line 8.

deduction cannot create or increase a federal operating loss. For

a copy of the Virginia regulations, write the Virginia Department of

11. Add Lines 7, 9, and 10. If the corporation is a multi-state

Taxation, Forms Request Unit, P.O. Box 1317, Richmond, VA

corporation, complete Lines 12 through 17. If not, go to Line

23218-1317 or call (804) 440-2541.

18 for the tax computation.

12. Enter the total allocable income. If federal taxable income has

For additional information, call (804) 367-8037 or write the

been reduced to zero (Line 7), make no entry as there is no

Department of Taxation, P.O. Box 1115, Richmond, VA

income to be allocated.

23218-1115. You can obtain most Virginia income tax forms at

i n i a. gov . Tenemos servicios disponible en

13. Subtract Line 12 from Line 11.

Español.

14. Enter the apportionment % from Schedule 500A for the year

shown on Line 4.

Note: Multistate corporations — If federal taxable income is

reduced to zero, allocable income is not considered.

15. Multiply the amount on Line 13 by the % on Line 14.

16. Enter the income allocated to Virginia. If federal taxable income

Consolidated and combined filers must compute the amount of

has been reduced to zero (Line 7), make no entry as there is

net operating loss deduction according to Virginia Corporation

no income to be allocated.

Income Tax Regulation 23 Virginia Administrative Code (VAC)

10-120-320 through 327.

17. Add Lines 15 and 16.

18. Multiply the amount on Line 11 or Line 17 by 6% and enter the

To avoid processing delays, mail Form 500 NOLD to the address

result.

shown on the form in the upper left-hand corner. Do not mail

with your corporate return. Always attach a copy of federal

19. (a) Enter

the

nonrefundable

credits

from

any

Telecommunications Companies Income Tax Credit

Form 1139.

along with any other nonrefundable credits reported on

LINE INSTRUCTIONS

Form 500CR.

(b) Enter any refundable credits from Real Property

1. Enter the taxable year for which the loss was sustained.

Improvement Tax Credit from Enterprise Zone or Coalfield

2. (a) Enter the amount of federal net operating loss.

Employment Enhancement Tax Credit. Check the Coalfield

(b) Enter the net Virginia Fixed Date Conformity Modifications

Credit Claimed or Earned box in the upper left corner on

(additions and subtractions).

Form 500-NOLD if claiming a refundable Coalfield

(c) Enter the amount of Virginia Fixed Date Conformity NOL

Employment Enhancement Tax Credit.

available for carry back. [Subtract Lines 2(b) from 2(a)]

(c) Enter the total of Line 19(a) and Line 19(b).

3. Enter the net amount of the Virginia additions and subtractions

20. Subtract Line 19 from Line 18 and enter the result.

from the loss year return. DO NOT include Fixed Date

21. Enter the tax paid for the year shown on Line 4.

Conformity Modifications. For taxable year 2004 and beyond,

22. Subtract Line 20 from Line 21. This is the refund amount.

VA DEPT OF TAXATION 2601197 REV. 10/05

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1