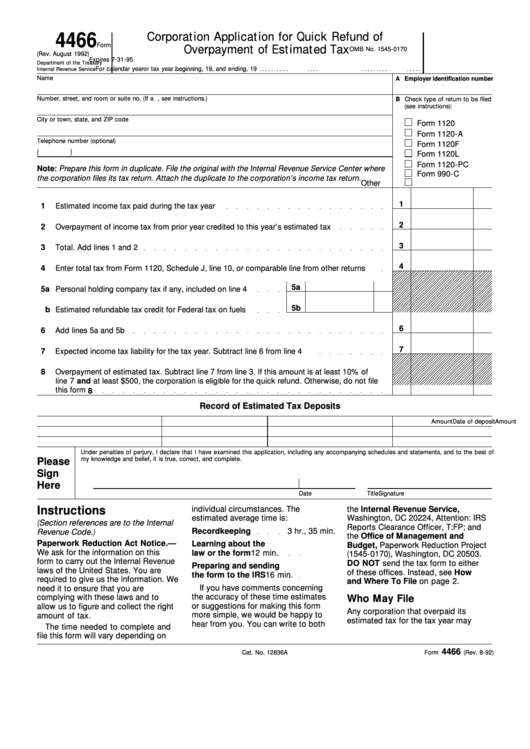

Form 4466 - Corporation Application For Quick Refund Of Overpayment Of Estimated Tax

ADVERTISEMENT

4466

Corporation Application for Quick Refund of

Form

Overpayment of Estimated Tax

OMB No. 1545-0170

(Rev. August 1992)

Expires 7-31-95

Department of the Treasury

For calendar year

or tax year beginning

, 19

, and ending

, 19

Internal Revenue Service

Name

A

Employer identification number

Number, street, and room or suite no. (If a P.O. box, see instructions.)

B Check type of return to be filed

(see instructions):

City or town, state, and ZIP code

Form 1120

Form 1120-A

Telephone number (optional)

Form 1120F

(

)

Form 1120L

Form 1120-PC

Note: Prepare this form in duplicate. File the original with the Internal Revenue Service Center where

Form 990-C

the corporation files its tax return. Attach the duplicate to the corporation’s income tax retur n.

Other

1

1

Estimated income tax paid during the tax year

2

2

Overpayment of income tax from prior year credited to this year’s estimated tax

3

3

Total. Add lines 1 and 2

4

4

Enter total tax from Form 1120, Schedule J, line 10, or comparable line from other returns

5a

5a

Personal holding company tax if any, included on line 4

5b

b

Estimated refundable tax credit for Federal tax on fuels

6

6

Add lines 5a and 5b

7

7

Expected income tax liability for the tax year. Subtract line 6 from line 4

8

Overpayment of estimated tax. Subtract line 7 from line 3. If this amount is at least 10% of

line 7 and at least $500, the corporation is eligible for the quick refund. Otherwise, do not file

this form

8

Record of Estimated Tax Deposits

Date of deposit

Amount

Date of deposit

Amount

Under penalties of perjury, I declare that I have examined this application, including any accompanying schedules and statements, and to the best of

my knowledge and belief, it is true, correct, and complete.

Please

Sign

Here

Signature

Date

Title

Instructions

individual circumstances. The

the Internal Revenue Service,

estimated average time is:

Washington, DC 20224, Attention: IRS

(Section references are to the Inter nal

Reports Clearance Officer, T:FP; and

Recordkeeping

3 hr., 35 min.

Revenue Code. )

the Office of Management and

Paperwork Reduction Act Notice.—

Learning about the

Budget, Paperwork Reduction Project

We ask for the information on this

law or the form

12 min.

(1545-0170), Washington, DC 20503.

form to carry out the Internal Revenue

DO NOT send the tax form to either

Preparing and sending

laws of the United States. You are

of these offices. Instead, see How

the form to the IRS

16 min.

required to give us the information. We

and Where To File on page 2.

If you have comments concerning

need it to ensure that you are

the accuracy of these time estimates

complying with these laws and to

Who May File

or suggestions for making this form

allow us to figure and collect the right

Any corporation that overpaid its

more simple, we would be happy to

amount of tax.

estimated tax for the tax year may

hear from you. You can write to both

The time needed to complete and

file this form will vary depending on

4466

Cat. No. 12836A

Form

(Rev. 8-92)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2