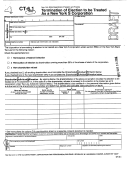

Form Ct-6-I July 2006, Instructions Page 2

ADVERTISEMENT

Page 2 of 2 CT-6-I (7/06)

It is your responsibility to mail the election on time. The date

If a husband and wife have a community interest in the stock or

of the U.S. postmark will be considered the date of delivery.

the income from it, both must consent. Likewise, each tenant in

The date recorded or marked by certain private delivery

common, joint tenant, or tenant by the entirety must also consent.

services, as designated by the U.S. Secretary of the Treasury,

A minor’s consent is made by the minor or the legal guardian. If no

shall be treated as a postmark (Tax Law section 1091). If sent

legal guardian has been appointed, the natural guardian makes

by registered or certified mail, the date of registration or

the consent (even if a custodian holds the minor’s stock under a law

certification will be considered the date of delivery.

patterned after the Uniform Gifts to Minors Act).

Approval of election

An Article 13 taxpayer’s consent is made by an elected officer or

You will be notified whether your election is approved, and if

other authorized person.

approved, the date the election will take effect. Until then, do not file

Where to file

Form CT‑3‑S or CT‑32‑S. If you are now required to file Form CT‑3,

CT‑4, or CT‑32, continue filing it until your election takes effect.

Mail Form CT‑6 to:

NYS TAX DEPARTMENT

CORPORATION TAX REGISTRATION

If you do not receive confirmation of your election before your return

W A HARRIMAN CAMPUS

is due, you should write to: NYS Tax Department, Corporation Tax

ALBANY NY 12227

Registration, W A Harriman Campus, Albany NY 12227.

Note: All information in this election form is subject to review by the

Audit Division in determining whether the corporation meets the

legal requirements for filing as a New York S corporation.

Need help?

Years for which election is effective

The election will be effective for the entire corporate tax year for

Internet access:

which it is made and for all succeeding tax years until terminated.

(for information, forms, and publications)

Termination or revocation of election

Shareholders of a New York S corporation should refer to

Fax-on-demand forms: Forms are

Form CT‑6.1, Termination of Election to be Treated As a New York

available 24 hours a day,

S Corporation, for information and instructions regarding the

7 days a week.

1 800 748‑3676

termination or revocation of a New York S election.

Specific instructions

Telephone assistance is available from 8:00 A.M. to

5:00 P.M. (eastern time), Monday through Friday.

Enter the legal name of the corporation exactly as it appears in

To order forms and publications:

1 800 462‑8100

the records of the New York State Department of State.

Corporation Tax Information Center: 1 888 698‑2908

Enter the DBA or trade name that appears on the Certificate of

From areas outside the U.S. and

Assumed Name filed with the New York State Department of State,

if different from the legal name.

outside Canada:

(518) 485‑6800

Enter the number of shares of stock issued and outstanding

Hotline for the hearing and speech impaired: If you

(from federal Form 2553) — The number of shares of stock

have access to a telecommunications device for the

entered in this box should be the number of shares of stock that

deaf (TDD), contact us at 1 800 634‑2110. If you

have been issued to shareholders and have not been reacquired by

do not own a TDD, check with independent living

the corporation. It should equal the total shares of stock owned by

centers or community action programs to find out

all shareholders, as reported in column C.

where machines are available for public use.

Continuation sheet or separate consent statement — If you

Persons with disabilities: In compliance with the

need a continuation sheet or use a separate consent statement,

Americans with Disabilities Act, we will ensure that

attach it to Form CT‑6. The separate consent statement must

our lobbies, offices, meeting rooms, and other facilities

contain the name, address, and employer identification number

are accessible to persons with disabilities. If you have

of the corporation and the shareholder information requested in

questions about special accommodations for persons

columns A through D.

with disabilities, please call 1 800 972‑1233.

Column A — Enter the name and address of each shareholder.

Column B — Enter the social security number of each shareholder

Privacy notification

who is an individual. Enter the employer identification number (EIN)

The Commissioner of Taxation and Finance may collect and maintain personal

of each shareholder that is an estate, a qualified trust, or an exempt

information pursuant to the New York State Tax Law, including but not limited to,

organization.

sections 5‑a, 171, 171‑a, 287, 308, 429, 475, 505, 697, 1096, 1142, and 1415

of that Law; and may require disclosure of social security numbers pursuant to

Column C — Enter the number of shares of stock each

42 USC 405(c)(2)(C)(i).

shareholder owns and the dates the stock was acquired. Do

This information will be used to determine and administer tax liabilities and, when

not list the shares of stock for those shareholders who sold or

authorized by law, for certain tax offset and exchange of tax information programs as

well as for any other lawful purpose.

transferred all of their stock before the election was made but who

still must consent to the election for it to be effective for the tax year.

Information concerning quarterly wages paid to employees is provided to certain

state agencies for purposes of fraud prevention, support enforcement, evaluation of

For more information, see the instructions for column D below.

the effectiveness of certain employment and training programs and other purposes

authorized by law.

Column D — Each shareholder at the time the election is made

must consent to the election by signing in column D or by signing

Failure to provide the required information may subject you to civil or criminal

penalties, or both, under the Tax Law.

a separate consent statement, described above.

This information is maintained by the Director of Records Management and Data

If the election is made during the corporation’s first tax year for

Entry, NYS Tax Department, W A Harriman Campus, Albany NY 12227; telephone

which it is to be effective, any former shareholder who held stock

1 800 225‑5829. From areas outside the United States and outside Canada, call

(518) 485‑6800.

at any time on or before the fifteenth day of the third month of

the electing year must also consent to the election. If the former

shareholder does not consent, the election will not be effective until

the following tax year.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2