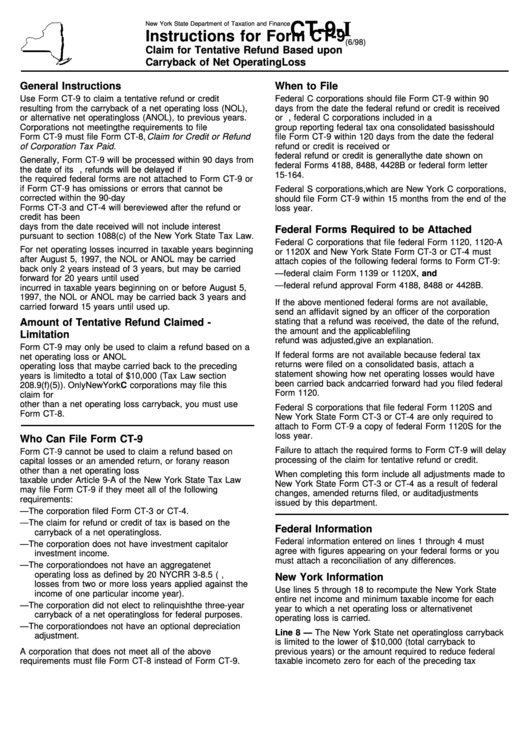

Form Ct-9-I - Instructions For Form Ct-9 - Claim For Tentative Refund Based Upon Carryback Of Net Operating Loss - New York State Department Of Taxation And Finance

ADVERTISEMENT

CT-9-I

New York State Department of Taxation and Finance

Instructions for Form CT-9

(6/98)

Claim for Tentative Refund Based upon

Carryback of Net Operating Loss

General Instructions

When to File

Use Form CT-9 to claim a tentative refund or credit

Federal C corporations should file Form CT-9 within 90

resulting from the carryback of a net operating loss (NOL),

days from the date the federal refund or credit is received

or alternative net operating loss (ANOL), to previous years.

or credited. However, federal C corporations included in a

Corporations not meeting the requirements to file

group reporting federal tax on a consolidated basis should

Form CT-9 must file Form CT-8, Claim for Credit or Refund

file Form CT-9 within 120 days from the date the federal

of Corporation Tax Paid.

refund or credit is received or credited. The date of the

federal refund or credit is generally the date shown on

Generally, Form CT-9 will be processed within 90 days from

federal Forms 4188, 8488, 4428B or federal form letter

the date of its receipt. However, refunds will be delayed if

15-164.

the required federal forms are not attached to Form CT-9 or

if Form CT-9 has omissions or errors that cannot be

Federal S corporations, which are New York C corporations,

corrected within the 90-day period. New York State

should file Form CT-9 within 15 months from the end of the

Forms CT-3 and CT-4 will be reviewed after the refund or

loss year.

credit has been processed. Refunds processed within 90

days from the date received will not include interest

Federal Forms Required to be Attached

pursuant to section 1088(c) of the New York State Tax Law.

Federal C corporations that file federal Form 1120, 1120-A

For net operating losses incurred in taxable years beginning

or 1120X and New York State Form CT-3 or CT-4 must

after August 5, 1997, the NOL or ANOL may be carried

attach copies of the following federal forms to Form CT-9:

back only 2 years instead of 3 years, but may be carried

— federal claim Form 1139 or 1120X, and

forward for 20 years until used up. For net operating losses

— federal refund approval Form 4188, 8488 or 4428B.

incurred in taxable years beginning on or before August 5,

1997, the NOL or ANOL may be carried back 3 years and

If the above mentioned federal forms are not available,

carried forward 15 years until used up.

send an affidavit signed by an officer of the corporation

stating that a refund was received, the date of the refund,

Amount of Tentative Refund Claimed -

the amount and the applicable filing period. If the federal

Limitation

refund was adjusted, give an explanation.

Form CT-9 may only be used to claim a refund based on a

If federal forms are not available because federal tax

net operating loss or ANOL carryback. The amount of net

returns were filed on a consolidated basis, attach a

operating loss that may be carried back to the preceding

statement showing how net operating losses would have

years is limited to a total of $10,000 (Tax Law section

been carried back and carried forward had you filed federal

208.9(f)(5)). Only New York C corporations may file this

Form 1120.

claim for refund. If the refund claim is based upon anything

other than a net operating loss carryback, you must use

Federal S corporations that file federal Form 1120S and

Form CT-8.

New York State Form CT-3 or CT-4 are only required to

attach to Form CT-9 a copy of federal Form 1120S for the

loss year.

Who Can File Form CT-9

Failure to attach the required forms to Form CT-9 will delay

Form CT-9 cannot be used to claim a refund based on

processing of the claim for tentative refund or credit.

capital losses or an amended return, or for any reason

other than a net operating loss carryback. Corporations

When completing this form include all adjustments made to

taxable under Article 9-A of the New York State Tax Law

New York State Form CT-3 or CT-4 as a result of federal

may file Form CT-9 if they meet all of the following

changes, amended returns filed, or audit adjustments

requirements:

issued by this department.

— The corporation filed Form CT-3 or CT-4.

— The claim for refund or credit of tax is based on the

Federal Information

carryback of a net operating loss.

Federal information entered on lines 1 through 4 must

— The corporation does not have investment capital or

agree with figures appearing on your federal forms or you

investment income.

must attach a reconciliation of any differences.

— The corporation does not have an aggregate net

operating loss as defined by 20 NYCRR 3-8.5 (i.e.,

New York Information

losses from two or more loss years applied against the

Use lines 5 through 18 to recompute the New York State

income of one particular income year).

entire net income and minimum taxable income for each

— The corporation did not elect to relinquish the three-year

year to which a net operating loss or alternative net

carryback of a net operating loss for federal purposes.

operating loss is carried.

— The corporation does not have an optional depreciation

Line 8 — The New York State net operating loss carryback

adjustment.

is limited to the lower of $10,000 (total carryback to

A corporation that does not meet all of the above

previous years) or the amount required to reduce federal

requirements must file Form CT-8 instead of Form CT-9.

taxable income to zero for each of the preceding tax

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2