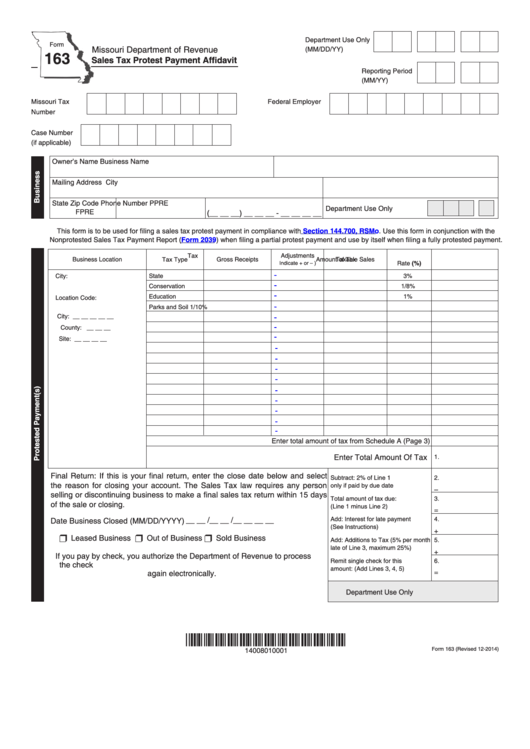

Department Use Only

Form

Missouri Department of Revenue

(MM/DD/YY)

163

Sales Tax Protest Payment Affidavit

Reporting Period

(MM/YY)

Missouri Tax I.D.

Federal Employer

Number

I.D. Number

Case Number

(if applicable)

Owner’s Name

Business Name

Mailing Address

City

State

Zip Code

Phone Number

PPRE

Department Use Only

FPRE

(__ __ __) __ __ __ - __ __ __ __

This form is to be used for filing a sales tax protest payment in compliance with

Section 144.700,

RSMo. Use this form in conjunction with the

Nonprotested Sales Tax Payment Report

(Form

2039) when filing a partial protest payment and use by itself when filing a fully protested payment.

Adjustments

Tax

Business Location

Gross Receipts

Taxable Sales

Tax Type

Amount of Tax

Rate (%)

Indicate + or – )

-

City:

State

3%

-

Conservation

1/8%

-

Education

1%

Location Code:

-

Parks and Soil

1/10%

-

City: __ __ __ __ __

-

County: __ __ __

-

Site: __ __ __ __

-

-

-

-

-

-

-

-

-

Enter total amount of tax from Schedule A (Page 3)

Enter Total Amount Of Tax

1.

Final Return: If this is your final return, enter the close date below and select

Subtract: 2% of Line 1

2.

the reason for closing your account. The Sales Tax law requires any person

only if paid by due date

–

selling or discontinuing business to make a final sales tax return within 15 days

Total amount of tax due:

3.

of the sale or closing.

(Line 1 minus Line 2)

=

__ __ /__ __ /__ __ __ __

Add: Interest for late payment

4.

Date Business Closed (MM/DD/YYYY)

(See Instructions)

+

r Leased Business

r Out of Business r Sold Business

Add: Additions to Tax (5% per month

5.

late of Line 3, maximum 25%)

+

If you pay by check, you authorize the Department of Revenue to process

Remit single check for this

6.

the check electronically. Any check returned unpaid may be presented

amount: (Add Lines 3, 4, 5)

again electronically.

=

Department Use Only

*14008010001*

Form 163 (Revised 12-2014)

14008010001

1

1 2

2 3

3 4

4