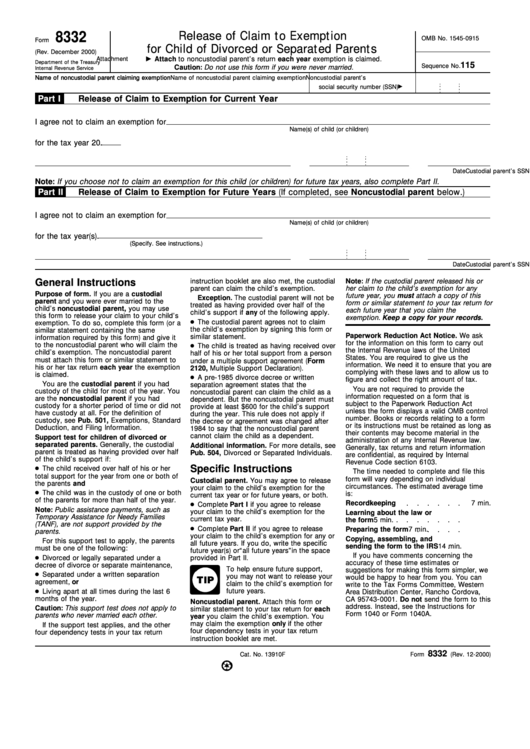

8332

Release of Claim to Exemption

OMB No. 1545-0915

Form

for Child of Divorced or Separated Parents

(Rev. December 2000)

Attach to noncustodial parent’s return each year exemption is claimed.

Attachment

Department of the Treasury

115

Sequence No.

Caution: Do not use this form if you were never married.

Internal Revenue Service

Name of noncustodial parent claiming exemption

Name of noncustodial parent claiming exemption

Name of noncustodial parent claiming exemption

Noncustodial parent’s

social security number (SSN)

Part I

Release of Claim to Exemption for Current Year

I agree not to claim an exemption for

Name(s) of child (or children)

for the tax year 20

.

Signature of custodial parent releasing claim to exemption

Custodial parent’s SSN

Date

Note: If you choose not to claim an exemption for this child (or children) for future tax years, also complete Part II.

Part II

Release of Claim to Exemption for Future Years (If completed, see Noncustodial parent below.)

I agree not to claim an exemption for

Name(s) of child (or children)

for the tax year(s)

.

(Specify. See instructions.)

Signature of custodial parent releasing claim to exemption

Custodial parent’s SSN

Date

General Instructions

instruction booklet are also met, the custodial

Note: If the custodial parent released his or

parent can claim the child’s exemption.

her claim to the child’s exemption for any

Purpose of form. If you are a custodial

future year, you must attach a copy of this

Exception. The custodial parent will not be

parent and you were ever married to the

form or similar statement to your tax return for

treated as having provided over half of the

child’s noncustodial parent, you may use

each future year that you claim the

child’s support if any of the following apply.

this form to release your claim to your child’s

exemption. Keep a copy for your records.

● The custodial parent agrees not to claim

exemption. To do so, complete this form (or a

the child’s exemption by signing this form or

similar statement containing the same

Paperwork Reduction Act Notice. We ask

similar statement.

information required by this form) and give it

for the information on this form to carry out

● The child is treated as having received over

to the noncustodial parent who will claim the

the Internal Revenue laws of the United

child’s exemption. The noncustodial parent

half of his or her total support from a person

States. You are required to give us the

must attach this form or similar statement to

under a multiple support agreement (Form

information. We need it to ensure that you are

his or her tax return each year the exemption

2120, Multiple Support Declaration).

complying with these laws and to allow us to

is claimed.

● A pre-1985 divorce decree or written

figure and collect the right amount of tax.

You are the custodial parent if you had

separation agreement states that the

You are not required to provide the

custody of the child for most of the year. You

noncustodial parent can claim the child as a

information requested on a form that is

are the noncustodial parent if you had

dependent. But the noncustodial parent must

subject to the Paperwork Reduction Act

custody for a shorter period of time or did not

provide at least $600 for the child’s support

unless the form displays a valid OMB control

have custody at all. For the definition of

during the year. This rule does not apply if

number. Books or records relating to a form

custody, see Pub. 501, Exemptions, Standard

the decree or agreement was changed after

or its instructions must be retained as long as

Deduction, and Filing Information.

1984 to say that the noncustodial parent

their contents may become material in the

cannot claim the child as a dependent.

Support test for children of divorced or

administration of any Internal Revenue law.

separated parents. Generally, the custodial

Additional information. For more details, see

Generally, tax returns and return information

parent is treated as having provided over half

Pub. 504, Divorced or Separated Individuals.

are confidential, as required by Internal

of the child’s support if:

Revenue Code section 6103.

● The child received over half of his or her

Specific Instructions

The time needed to complete and file this

total support for the year from one or both of

form will vary depending on individual

Custodial parent. You may agree to release

the parents and

circumstances. The estimated average time

your claim to the child’s exemption for the

● The child was in the custody of one or both

is:

current tax year or for future years, or both.

of the parents for more than half of the year.

● Complete Part I if you agree to release

Recordkeeping

7 min.

Note: Public assistance payments, such as

your claim to the child’s exemption for the

Learning about the law or

Temporary Assistance for Needy Families

current tax year.

the form

5 min.

(TANF), are not support provided by the

● Complete Part II if you agree to release

Preparing the form

7 min.

parents.

your claim to the child’s exemption for any or

Copying, assembling, and

For this support test to apply, the parents

all future years. If you do, write the specific

sending the form to the IRS

14 min.

must be one of the following:

future year(s) or “all future years” in the space

If you have comments concerning the

● Divorced or legally separated under a

provided in Part II.

accuracy of these time estimates or

decree of divorce or separate maintenance,

To help ensure future support,

suggestions for making this form simpler, we

● Separated under a written separation

you may not want to release your

would be happy to hear from you. You can

agreement, or

claim to the child’s exemption for

write to the Tax Forms Committee, Western

● Living apart at all times during the last 6

future years.

Area Distribution Center, Rancho Cordova,

months of the year.

CA 95743-0001. Do not send the form to this

Noncustodial parent. Attach this form or

address. Instead, see the Instructions for

Caution: This support test does not apply to

similar statement to your tax return for each

Form 1040 or Form 1040A.

parents who never married each other.

year you claim the child’s exemption. You

may claim the exemption only if the other

If the support test applies, and the other

four dependency tests in your tax return

four dependency tests in your tax return

instruction booklet are met.

8332

Cat. No. 13910F

Form

(Rev. 12-2000)

1

1