Form 1099-R - 2015

ADVERTISEMENT

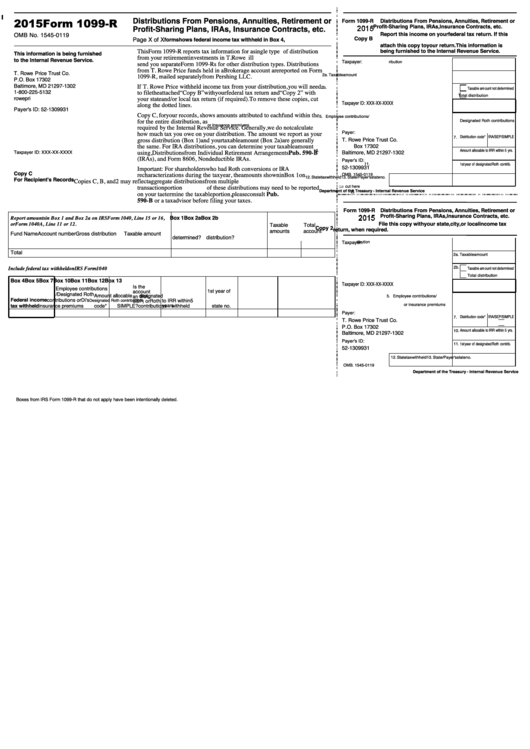

Distributions From Pensions, Annuities, Retirement or

2015 Form 1099-R

Form 1099-R

Distributions From Pensions, Annuities, Retirement or

Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

Report this income on your federal tax return. If this

OMB No. 1545-0119

Copy B

Page X of X

form shows federal income tax withheld in Box 4,

attach this copy to your return. This information is

This Form 1099-R reports tax information for a single type of distribution

being furnished to the Internal Revenue Service.

This information is being furnished

from your retirement investments in T. Rowe Price mutual funds. We will

to the Internal Revenue Service.

send you separate Form 1099-Rs for other distribution types. Distributions

Taxpayer:

1. Gross distribution

from T. Rowe Price funds held in a Brokerage account are reported on Form

T. Rowe Price Trust Co.

1099-R, mailed separately from Pershing LLC.

2a. Taxable amount

P.O. Box 17302

If T. Rowe Price withheld income tax from your distribution, you will need

Baltimore, MD 21297-1302

2b.

Taxable amount not determined

to file the attached “Copy B” with your federal tax return and “Copy 2” with

1-800-225-5132

Total distribution

your state and/or local tax return (if required). To remove these copies, cut

along the dotted lines.

Taxpayer ID: XXX-XX-XXXX

4. Federal income tax withheld

Payer's ID: 52-1309931

Copy C, for your records, shows amounts attributed to each fund within the

5. Employee contributions/

distribution. Copies B and 2 show only totals for the entire distribution, as

Designated Roth contributions

required by the Internal Revenue Service. Generally, we do not calculate

or insurance premiums

how much tax you owe on your distribution. The amount we report as your

Payer:

7.

Distribution code* IRA/SEP/SIMPLE

gross distribution (Box 1) and your taxable amount (Box 2a) are generally

T. Rowe Price Trust Co.

the same. For IRA distributions, you can determine your taxable amount

P.O. Box 17302

using

Pub. 590-B

, Distributions from Individual Retirement Arrangements

10. Amount allocable to IRR within 5 yrs.

Taxpayer ID: XXX-XX-XXXX

Baltimore, MD 21297-1302

(IRAs), and Form 8606, Nondeductible IRAs.

Payer's ID:

11.1st year of designated Roth contrib.

Important: For shareholders who had Roth conversions or IRA

52-1309931

Copy C

recharacterizations during the tax year, the amounts shown in Box 1 on

OMB. 1545-0119

12. State tax withheld

13. State/Payer's state no.

For Recipient's Records

Copies C, B, and 2 may reflect aggregate distributions from multiple

transactions. Only a portion of these distributions may need to be reported

cut here

Department of the Treasury - Internal Revenue Service

on your tax return. To determine the taxable portion, please consult Pub.

590-B or a tax advisor before filing your taxes.

Form 1099-R Distributions From Pensions, Annuities, Retirement or

Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

Report amounts in Box 1 and Box 2a on IRS Form 1040, Line 15 or 16, Box 1

Box 2a

Box 2b

or Form 1040A, Line 11 or 12.

File this copy with your state, city, or local income tax

Taxable

Total

Copy 2 return, when required.

amounts

account

Fund Name

Account number Gross distribution

Taxable amount

determined? distribution?

Taxpayer:

1. Gross distribution

Total

2a. Taxable amount

Include federal tax withheld on IRS Form 1040

2b.

Taxable amount not determined

Total distribution

Box 4

Box 5

Box 7

Box 10

Box 11

Box 12

Box 13

4. Federal income tax withheld

Taxpayer ID: XXX-XX-XXXX

Is the

Employee contributions

1st year of

account

/Designated Roth

Amount allocable

designated

an IRA,

5. Employee contributions/

Federal income

contributions or

Distr.

State tax

State/Payer's

to IRR within 5

Roth

SEP, or

Designated Roth contributions

years

or insurance premiums

tax withheld

insurance premiums

code*

SIMPLE?

contributions withheld

state no.

Payer:

Distribution code* IRA/SEP/SIMPLE

7.

T. Rowe Price Trust Co.

P.O. Box 17302

Amount allocable to IRR within 5 yrs.

10.

Baltimore, MD 21297-1302

Payer's ID:

11.1st year of designated Roth contrib.

52-1309931

12. State tax withheld

13. State/Payer's state no.

OMB. 1545-0119

Department of the Treasury - Internal Revenue Service

Boxes from IRS Form 1099-R that do not apply have been intentionally deleted.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2