Tol 2015 City Of Cincinnati Individual Income Tax Return

ADVERTISEMENT

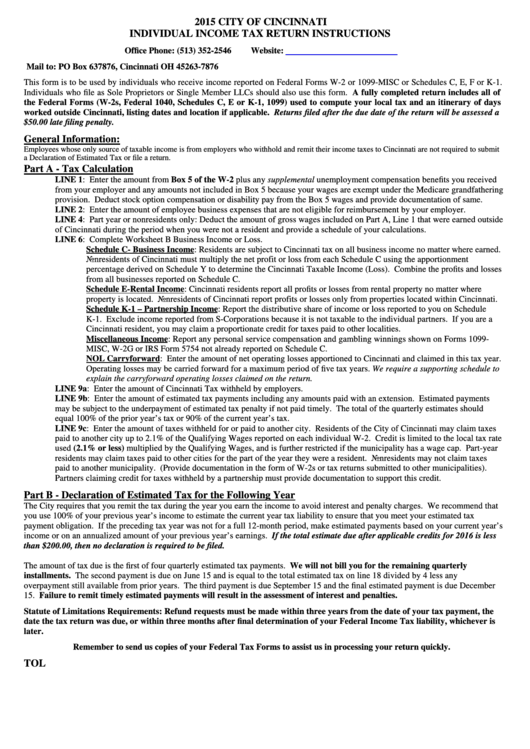

2015 CITY OF CINCINNATI

INDIVIDUAL INCOME TAX RETURN INSTRUCTIONS

Office Phone: (513) 352-2546

Website:

Mail to: PO Box 637876, Cincinnati OH 45263-7876

This form is to be used by individuals who receive income reported on Federal Forms W-2 or 1099-MISC or Schedules C, E, F or K-1.

Individuals who file as Sole Proprietors or Single Member LLCs should also use this form. A fully completed return includes all of

the Federal Forms (W-2s, Federal 1040, Schedules C, E or K-1, 1099) used to compute your local tax and an itinerary of days

worked outside Cincinnati, listing dates and location if applicable. Returns filed after the due date of the return will be assessed a

$50.00 late filing penalty.

General Information:

Employees whose only source of taxable income is from employers who withhold and remit their income taxes to Cincinnati are not required to submit

a Declaration of Estimated Tax or file a return.

Part A - Tax Calculation

LINE 1: Enter the amount from Box 5 of the W-2 plus any supplemental unemployment compensation benefits you received

from your employer and any amounts not included in Box 5 because your wages are exempt under the Medicare grandfathering

provision. Deduct stock option compensation or disability pay from the Box 5 wages and provide documentation of same.

LINE 2: Enter the amount of employee business expenses that are not eligible for reimbursement by your employer.

LINE 4: Part year or nonresidents only: Deduct the amount of gross wages included on Part A, Line 1 that were earned outside

of Cincinnati during the period when you were not a resident and provide a schedule of your calculations.

LINE 6: Complete Worksheet B Business Income or Loss.

Schedule C- Business Income: Residents are subject to Cincinnati tax on all business income no matter where earned.

Nonresidents of Cincinnati must multiply the net profit or loss from each Schedule C using the apportionment

percentage derived on Schedule Y to determine the Cincinnati Taxable Income (Loss). Combine the profits and losses

from all businesses reported on Schedule C.

Schedule E-Rental Income: Cincinnati residents report all profits or losses from rental property no matter where

property is located. Nonresidents of Cincinnati report profits or losses only from properties located within Cincinnati.

Schedule K-1 – Partnership Income: Report the distributive share of income or loss reported to you on Schedule

K-1. Exclude income reported from S-Corporations because it is not taxable to the individual partners. If you are a

Cincinnati resident, you may claim a proportionate credit for taxes paid to other localities.

Miscellaneous Income: Report any personal service compensation and gambling winnings shown on Forms 1099-

MISC, W-2G or IRS Form 5754 not already reported on Schedule C.

NOL Carryforward: Enter the amount of net operating losses apportioned to Cincinnati and claimed in this tax year.

Operating losses may be carried forward for a maximum period of five tax years. We require a supporting schedule to

explain the carryforward operating losses claimed on the return.

LINE 9a: Enter the amount of Cincinnati Tax withheld by employers.

LINE 9b: Enter the amount of estimated tax payments including any amounts paid with an extension. Estimated payments

may be subject to the underpayment of estimated tax penalty if not paid timely. The total of the quarterly estimates should

equal 100% of the prior year’s tax or 90% of the current year’s tax.

LINE 9c: Enter the amount of taxes withheld for or paid to another city. Residents of the City of Cincinnati may claim taxes

paid to another city up to 2.1% of the Qualifying Wages reported on each individual W-2. Credit is limited to the local tax rate

used (2.1% or less) multiplied by the Qualifying Wages, and is further restricted if the municipality has a wage cap. Part-year

residents may claim taxes paid to other cities for the part of the year they were a resident. Nonresidents may not claim taxes

paid to another municipality. (Provide documentation in the form of W-2s or tax returns submitted to other municipalities).

Partners claiming credit for taxes withheld by a partnership must provide documentation to support this credit.

Part B - Declaration of Estimated Tax for the Following Year

The City requires that you remit the tax during the year you earn the income to avoid interest and penalty charges. We recommend that

you use 100% of your previous year’s income to estimate the current year tax liability to ensure that you meet your estimated tax

payment obligation. If the preceding tax year was not for a full 12-month period, make estimated payments based on your current year’s

income or on an annualized amount of your previous year’s earnings. If the total estimate due after applicable credits for 2016 is less

than $200.00, then no declaration is required to be filed.

The amount of tax due is the first of four quarterly estimated tax payments. We will not bill you for the remaining quarterly

installments. The second payment is due on June 15 and is equal to the total estimated tax on line 18 divided by 4 less any

overpayment still available from prior years. The third payment is due September 15 and the final estimated payment is due December

15. Failure to remit timely estimated payments will result in the assessment of interest and penalties.

Statute of Limitations Requirements: Refund requests must be made within three years from the date of your tax payment, the

date the tax return was due, or within three months after final determination of your Federal Income Tax liability, whichever is

later.

Remember to send us copies of your Federal Tax Forms to assist us in processing your return quickly.

TOL

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2