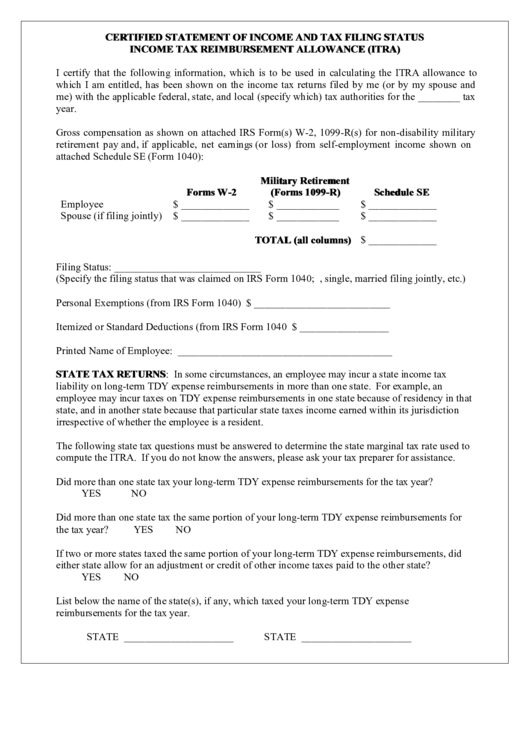

CERTIFIED STATEMENT OF INCOME AND TAX FILING STATUS

INCOME TAX REIMBURSEMENT ALLOWANCE (ITRA)

I certify that the following information, which is to be used in calculating the ITRA allowance to

which I am entitled, has been shown on the income tax returns filed by me (or by my spouse and

me) with the applicable federal, state, and local (specify which) tax authorities for the ________ tax

year.

Gross compensation as shown on attached IRS Form(s) W-2, 1099-R(s) for non-disability military

retirement pay and, if applicable, net earnings (or loss) from self-employment income shown on

attached Schedule SE (Form 1040):

Military Retirement

Forms W-2

(Forms 1099-R)

Schedule SE

Employee

$ _____________

$ ____________

$ _____________

Spouse (if filing jointly)

$ _____________

$ ____________

$ _____________

TOTAL (all columns) $ _____________

Filing Status: ____________________________

(Specify the filing status that was claimed on IRS Form 1040; i.e., single, married filing jointly, etc.)

Personal Exemptions (from IRS Form 1040) $ __________________________

Itemized or Standard Deductions (from IRS Form 1040 $ _________________

Printed Name of Employee: _________________________________________

STATE TAX RETURNS: In some circumstances, an employee may incur a state income tax

liability on long-term TDY expense reimbursements in more than one state. For example, an

employee may incur taxes on TDY expense reimbursements in one state because of residency in that

state, and in another state because that particular state taxes income earned within its jurisdiction

irrespective of whether the employee is a resident.

The following state tax questions must be answered to determine the state marginal tax rate used to

compute the ITRA. If you do not know the answers, please ask your tax preparer for assistance.

Did more than one state tax your long-term TDY expense reimbursements for the tax year?

YES

NO

Did more than one state tax the same portion of your long-term TDY expense reimbursements for

the tax year?

YES

NO

If two or more states taxed the same portion of your long-term TDY expense reimbursements, did

either state allow for an adjustment or credit of other income taxes paid to the other state?

YES

NO

List below the name of the state(s), if any, which taxed your long-term TDY expense

reimbursements for the tax year.

STATE _____________________

STATE _____________________

1

1 2

2