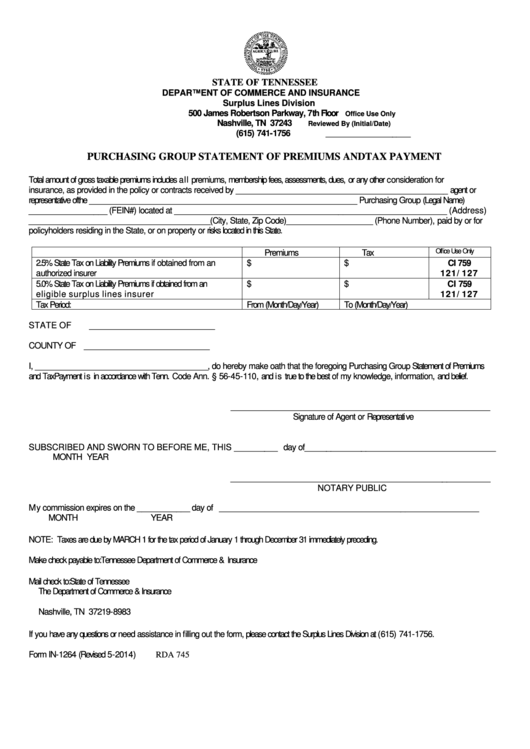

Form In-1264 - Purchasing Group Statement Of Premiums And Tax Payment

ADVERTISEMENT

STATE OF TENNESSEE

DEPARTM ENT OF COM M ERCE AND I NSURANCE

Surplus Lines Division

500 James Robertson Parkway, 7th Floor

Office Use Only

Nashville, TN 37243

Reviewed By (I nitial/Date)

(615) 741-1756

________________________

PURCHASING GROUP STATEMENT OF PREMIUMS AND TAX PAYMENT

Total amount of gross taxable premiums includes all premiums, membership fees, assessments, dues, or any other consideration for

insurance, as provided in the policy or contracts received by _________________________________________________ agent or

representative of the ______________________________________________________________ Purchasing Group (Legal Name)

__________________ (FEIN #) located at _______________________________________________________________ (Address)

__________________________________________(City, State, Zip Code)____________________ (Phone Number), paid by or for

policyholders residing in the State, or on property or risks located in this State.

Office Use Only

Premiums

Tax

2.5% State Tax on Liability Premiums if obtained from an

$

$

CI 759

121/127

authorized insurer

5.0% State Tax on Liability Premiums if obtained from an

$

$

CI 759

121/127

eligible surplus lines insurer

Tax Period:

From (Month/Day/Year)

To (Month/Day/Year)

STATE OF

_____________________________

COUNTY OF _____________________________

I, ________________________________________, do hereby make oath that the foregoing Purchasing Group Statement of Premiums

and Tax Payment is in accordance with Tenn. Code Ann. § 56-45-110, and is true to the best of my knowledge, information, and belief.

____________________________________________________________

Signature of Agent or Representative

SUBSCRIBED AND SWORN TO BEFORE ME, THIS __________ day of ____________________________________________

MONTH

YEAR

____________________________________________________________

NOTARY PUBLIC

My commission expires on the ____________ day of ____________________________________________________________

MONTH

YEAR

NOTE: Taxes are due by MARCH 1 for the tax period of January 1 through December 31 immediately preceding.

Make check payable to:

Tennessee Department of Commerce & Insurance

Mail check to:

State of Tennessee

The Department of Commerce & Insurance

P.O. Box 198983

Nashville, TN 37219-8983

If you have any questions or need assistance in filling out the form, please contact the Surplus Lines Division at (615) 741-1756.

Form IN-1264 (Revised 5-2014)

RDA 745

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1