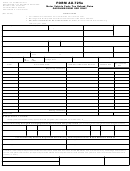

FORM

POWER TAkE OFF REFUND CLAIM

MARYLAND

701

MOTOR FUEL

WORkSHEET

TAX

Complete this worksheet to compute your fuel tax PTO refund amount. Submit the completed form with the original invoices for fuel purchases. You are also required to maintain

a permanent record at your office for verification purposes. Detailed records must be available for audit.

Beginning date

___________

Beginning date

___________

Ending date

___________

Ending date

___________

Gasoline

__________

Special Fuel

_________

1. Gallons purchased per original invoices.

(Licensed users/sellers: Enter only taxable fuel gallons placed in PTO qualified vehicles.)

2. Less gallons used in 100% taxable highway vehicles.

3. Total gallons used in PTO highway vehicles.

4. Multiply by the appropriate tax rate.

X

X

5. Total tax paid in PTO highway vehicles. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

$

6. Enter the applicable percentage rate(s) from the list below.

X

0. ___ ___

X

0. ___ ___

Multiply the amount(s) on line 5 by the applicable rate

7. Refund amount(s). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . SUBTOTALS $

$

8. Add the subtotals to yield your final refund amount.

Transfer this amount to your Motor Fuel Tax Refund Claim – GT-106. . . . . . . . . . . . . . . . . . . . . . . TOTAL

$

Percentage Rates for Motor Fuel Tax Paid

•

Motor fuel delivery vehicle: 10% (0.10)

Gasoline & Special Fuel rates & effective dates

Prior to 06/30/2013

GAS: .235

SF: .2425

•

Concrete mixing vehicle/concrete pumping vehicle: 35% (0.35)

7/1/2013-6/30/2014

GAS: .27

SF: .2775

7/1/2014-12/31/2014

GAS: .274

SF: .2815

•

Solid waste compacting vehicle: 15% (0.15)

1/1/2015-6/30/2015

GAS: .303

SF: .3105

•

Qualifying farm equipment: 55% (0.55)

7/1/2015-12/31/2015

GAS: .321

SF: .3285

1/1/2016-6/30/2016

GAS: .3260 SF: .3335

•

Well-drilling vehicle: 80% (0.80)

7/1/2016-12/31/2016

GAS: .335

SF: .3425

Provisions of Law Pertaining to Refunds - Tax General Article, Title 13

§ 13-1029 Violation of motor fuel tax provisions: A person who violates any provision of Title 9, Subtitle 3 of this article is guilty of a misdemeanor and, on conviction, is

subject to a fine not exceeding $1,000 or imprisonment in the county jail not exceeding six months or both.

§ 13-1030 False or fraudulent claims for refunds of motor fuel tax: False claims: A person who makes or assists another person to make a false claim for refund of

motor fuel tax is guilty of a misdemeanor and, on conviction, is subject to a fine not exceeding $1,000 and imprisonment in the county jail not exceeding six months or

both. Fraudulent Claims: A person who fraudulently obtains or assists another person to fraudulently obtain a refund of motor fuel tax is guilty of a misdemeanor and, on

conviction, is subject to a fine not exceeding $1,000 or imprisonment in the county jail not exceeding six months or both.

COM/RAD-078

(Rev 7/16)

1

1 2

2