Alabama Department Of Revenue - Sales And Use Tax Rules

ADVERTISEMENT

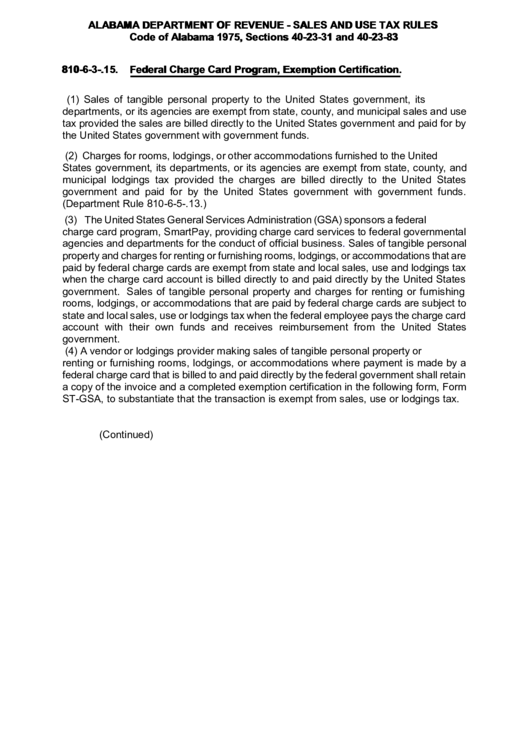

ALABAMA DEPARTMENT OF REVENUE - SALES AND USE TAX RULES

Code of Alabama 1975, Sections 40-23-31 and 40-23-83

810-6-3-.15.

Federal Charge Card Program, Exemption Certification.

(1)

Sales of tangible personal property to the United States government, its

departments, or its agencies are exempt from state, county, and municipal sales and use

tax provided the sales are billed directly to the United States government and paid for by

the United States government with government funds.

(2) Charges for rooms, lodgings, or other accommodations furnished to the United

States government, its departments, or its agencies are exempt from state, county, and

municipal lodgings tax provided the charges are billed directly to the United States

government and paid for by the United States government with government funds.

(Department Rule 810-6-5-.13.)

(3)

The United States General Services Administration (GSA) sponsors a federal

charge card program, SmartPay, providing charge card services to federal governmental

agencies and departments for the conduct of official

business.

Sales of tangible personal

property and charges for renting or furnishing rooms, lodgings, or accommodations that are

paid by federal charge cards are exempt from state and local sales, use and lodgings tax

when the charge card account is billed directly to and paid directly by the United States

government. Sales of tangible personal property and charges for renting or furnishing

rooms, lodgings, or accommodations that are paid by federal charge cards are subject to

state and local sales, use or lodgings tax when the federal employee pays the charge card

account with their own funds and receives reimbursement from the United States

government.

(4)

A vendor or lodgings provider making sales of tangible personal property or

renting or furnishing rooms, lodgings, or accommodations where payment is made by a

federal charge card that is billed to and paid directly by the federal government shall retain

a copy of the invoice and a completed exemption certification in the following form, Form

ST-GSA, to substantiate that the transaction is exempt from sales, use or lodgings tax.

(Continued)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2