Substitute W-8ben Form - Certificate Of Foreign Status Of Beneficial Owner For United States Tax Withholding

ADVERTISEMENT

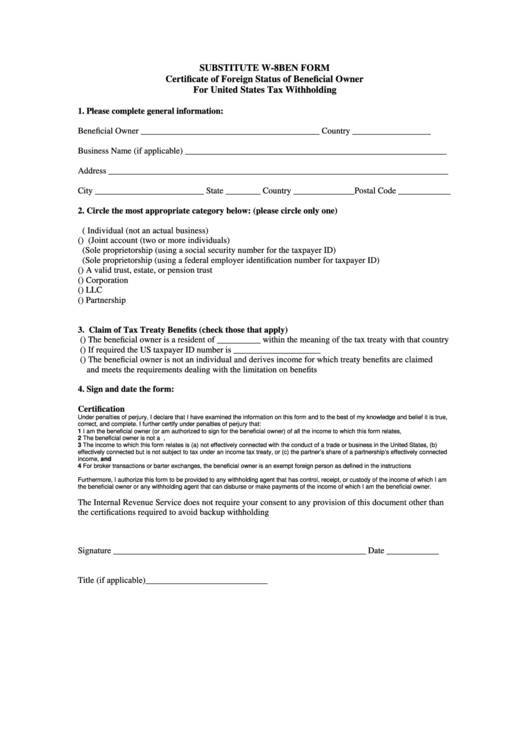

SUBSTITUTE W-8BEN FORM

Certificate of Foreign Status of Beneficial Owner

For United States Tax Withholding

1. Please complete general information:

Beneficial Owner _________________________________________ Country __________________

Business Name (if applicable) ____________________________________________________________

Address ______________________________________________________________________________

City _________________________ State ________ Country ______________Postal Code ____________

2. Circle the most appropriate category below: (please circle only one)

( Individual (not an actual business)

() (Joint account (two or more individuals)

(Sole proprietorship (using a social security number for the taxpayer ID)

(Sole proprietorship (using a federal employer identification number for taxpayer ID)

() A valid trust, estate, or pension trust

() Corporation

() LLC

() Partnership

3. Claim of Tax Treaty Benefits (check those that apply)

() The beneficial owner is a resident of __________ within the meaning of the tax treaty with that country

() If required the US taxpayer ID number is ____________________

() The beneficial owner is not an individual and derives income for which treaty benefits are claimed

and meets the requirements dealing with the limitation on benefits

4. Sign and date the form:

Certification

Under penalties of perjury, I declare that I have examined the information on this form and to the best of my knowledge and belief it is true,

correct, and complete. I further certify under penalties of perjury that:

1 I am the beneficial owner (or am authorized to sign for the beneficial owner) of all the income to which this form relates,

2 The beneficial owner is not a U.S. person,

3 The income to which this form relates is (a) not effectively connected with the conduct of a trade or business in the United States, (b)

effectively connected but is not subject to tax under an income tax treaty, or (c) the partner’s share of a partnership’s effectively connected

income, and

4 For broker transactions or barter exchanges, the beneficial owner is an exempt foreign person as defined in the instructions

Furthermore, I authorize this form to be provided to any withholding agent that has control, receipt, or custody of the income of which I am

the beneficial owner or any withholding agent that can disburse or make payments of the income of which I am the beneficial owner.

The Internal Revenue Service does not require your consent to any provision of this document other than

the certifications required to avoid backup withholding

Signature __________________________________________________________ Date ____________

Title (if applicable)____________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1