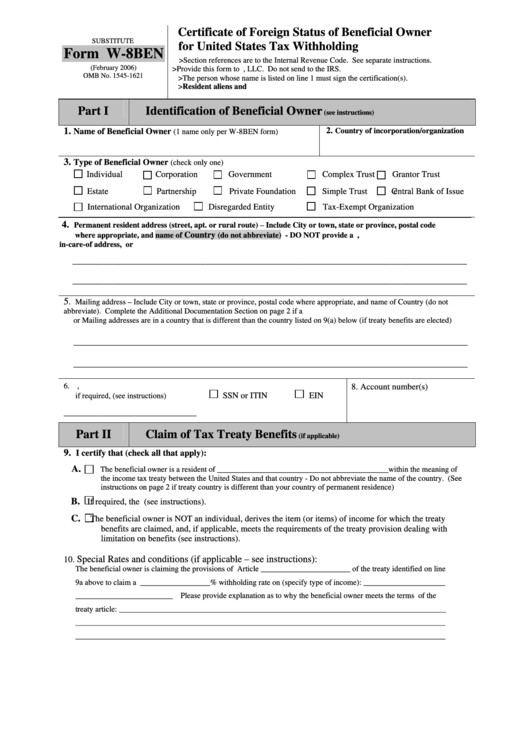

Substitute Form W-8ben - Certificate Of Foreign Status Of Beneficial Owner For United States Tax Withholding

ADVERTISEMENT

Certificate of Foreign Status of Beneficial Owner

SUBSTITUTE

for United States Tax Withholding

Form W-8BEN

>Section references are to the Internal Revenue Code. See separate instructions.

(February 2006)

>Provide this form to U.S. Bancorp Fund Services, LLC. Do not send to the IRS.

OMB No. 1545-1621

>The person whose name is listed on line 1 must sign the certification(s).

>Resident aliens and U.S. citizens should complete Form W-9.

Part I

Identification of Beneficial Owner

(see instructions)

1.

2.

Country of incorporation/organization

Name of Beneficial Owner

(1 name only per W-8BEN form)

3.

Type of Beneficial Owner

(check only one)

Individual

Corporation

Government

Complex Trust

Grantor Trust

Estate

Partnership

Private Foundation

Simple Trust

Central Bank of Issue

International Organization

Disregarded Entity

Tax-Exempt Organization

4.

Permanent resident address (street, apt. or rural route) – Include City or town, state or province, postal code

Country

where appropriate, and name of

(do not abbreviate) - DO NOT provide a P.O. Box address,

in-care-of address, or U.S. address

_________________________________________________________________________________________

_________________________________________________________________________________________

5

.

Mailing address – Include City or town, state or province, postal code where appropriate, and name of Country (do not

abbreviate). Complete the Additional Documentation Section on page 2 if a U.S. mailing address is provided or the Permanent

or Mailing addresses are in a country that is different than the country listed on 9(a) below (if treaty benefits are elected)

_________________________________________________________________________________

_________________________________________________________________________________

6. U.S. taxpayer identification number,

8. Account number(s)

SSN or ITIN

EIN

if required, (see instructions)

______________________________

Part II

Claim of Tax Treaty Benefits

(if applicable)

9.

I certify that (check all that apply):

A.

The beneficial owner is a resident of ____________________________________________within the meaning of

the income tax treaty between the United States and that country - Do not abbreviate the name of the country. (See

instructions on page 2 if treaty country is different than your country of permanent residence)

B.

If required, the U.S. taxpayer identification number is stated on line 6 (see instructions).

C.

The beneficial owner is NOT an individual, derives the item (or items) of income for which the treaty

benefits are claimed, and, if applicable, meets the requirements of the treaty provision dealing with

limitation on benefits (see instructions).

Special Rates and conditions (if applicable – see instructions):

10.

The beneficial owner is claiming the provisions of Article _______________________ of the treaty identified on line

9a above to claim a __________________% withholding rate on (specify type of income): _____________________

_________________________ Please provide explanation as to why the beneficial owner meets the terms of the

treaty article: ____________________________________________________________________________________

_______________________________________________________________________________________________

_______________________________________________________________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2