Form Ia Franchise 4626f - Iowa Alternative Minimum Tax - 2016

ADVERTISEMENT

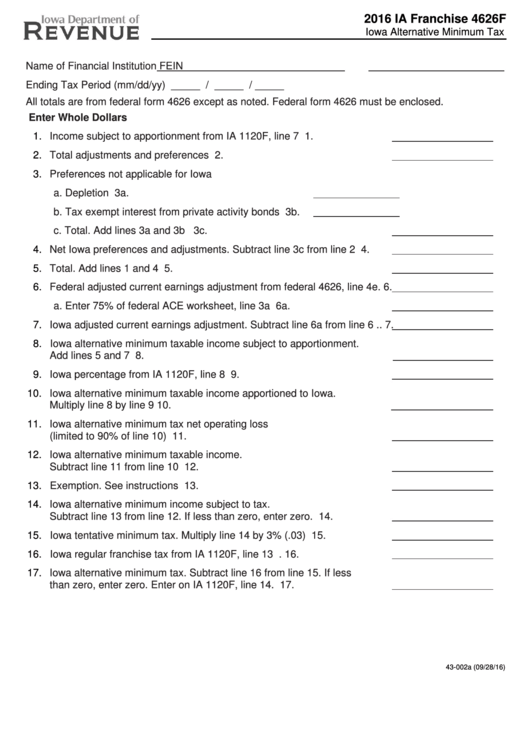

2016 IA Franchise 4626F

Iowa Alternative Minimum Tax

https://tax.iowa.gov

Name of Financial Institution

FEIN

Ending Tax Period (mm/dd/yy) _____ / _____ / _____

All totals are from federal form 4626 except as noted. Federal form 4626 must be enclosed.

Enter Whole Dollars

1.

Income subject to apportionment from IA 1120F, line 7 ............................ 1.

2.

Total adjustments and preferences ........................................................... 2.

3.

Preferences not applicable for Iowa

a. Depletion ............................................................... 3a.

b. Tax exempt interest from private activity bonds .... 3b.

c. Total. Add lines 3a and 3b ............................................................... 3c.

4.

Net Iowa preferences and adjustments. Subtract line 3c from line 2 ........ 4.

5.

Total. Add lines 1 and 4 ............................................................................ 5.

6.

Federal adjusted current earnings adjustment from federal 4626, line 4e. 6.

a. Enter 75% of federal ACE worksheet, line 3a .................................. 6a.

7.

Iowa adjusted current earnings adjustment. Subtract line 6a from line 6 .. 7.

8.

Iowa alternative minimum taxable income subject to apportionment.

Add lines 5 and 7 ....................................................................................... 8.

9.

Iowa percentage from IA 1120F, line 8 ..................................................... 9.

10.

Iowa alternative minimum taxable income apportioned to Iowa.

Multiply line 8 by line 9............................................................................ 10.

11.

Iowa alternative minimum tax net operating loss

(limited to 90% of line 10) ....................................................................... 11.

12.

Iowa alternative minimum taxable income.

Subtract line 11 from line 10 ................................................................... 12.

13.

Exemption. See instructions ................................................................... 13.

14.

Iowa alternative minimum income subject to tax.

Subtract line 13 from line 12. If less than zero, enter zero. ..................... 14.

15.

Iowa tentative minimum tax. Multiply line 14 by 3% (.03) ....................... 15.

16.

Iowa regular franchise tax from IA 1120F, line 13 ................................. 16.

17.

Iowa alternative minimum tax. Subtract line 16 from line 15. If less

than zero, enter zero. Enter on IA 1120F, line 14. .................................. 17.

43-002a (09/28/16)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3