Sales Tax Exemption Form

ADVERTISEMENT

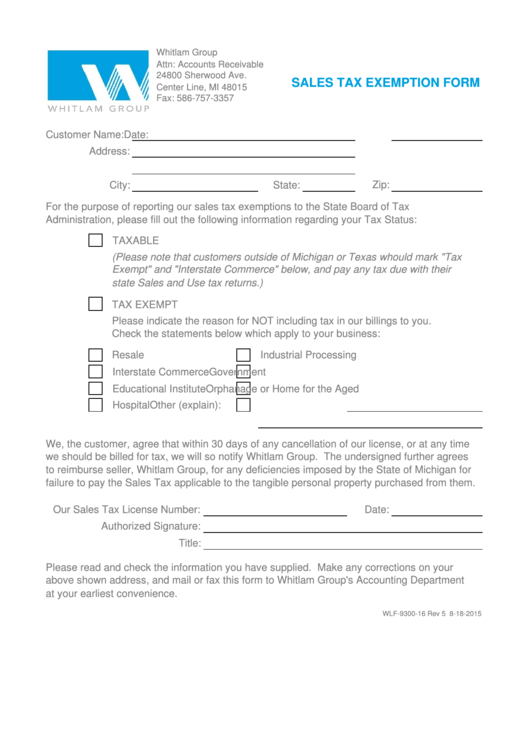

Whitlam Group

Attn: Accounts Receivable

24800 Sherwood Ave.

SALES TAX EXEMPTION FORM

Center Line, MI 48015

Fax: 586-757-3357

Customer Name:

Date:

Address:

City:

State:

Zip:

For the purpose of reporting our sales tax exemptions to the State Board of Tax

Administration, please fill out the following information regarding your Tax Status:

TAXABLE

(Please note that customers outside of Michigan or Texas whould mark "Tax

Exempt" and "Interstate Commerce" below, and pay any tax due with their

state Sales and Use tax returns.)

TAX EXEMPT

Please indicate the reason for NOT including tax in our billings to you.

Check the statements below which apply to your business:

Resale

Industrial Processing

Interstate Commerce

Government

Educational Institute

Orphanage or Home for the Aged

Hospital

Other (explain):

We, the customer, agree that within 30 days of any cancellation of our license, or at any time

we should be billed for tax, we will so notify Whitlam Group. The undersigned further agrees

to reimburse seller, Whitlam Group, for any deficiencies imposed by the State of Michigan for

failure to pay the Sales Tax applicable to the tangible personal property purchased from them.

Our Sales Tax License Number:

Date:

Authorized Signature:

Title:

Please read and check the information you have supplied. Make any corrections on your

above shown address, and mail or fax this form to Whitlam Group's Accounting Department

at your earliest convenience.

WLF-9300-16 Rev 5 8-18-2015

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1